Лучшие видеоролики

Welcome to Real Estate Marketing Sin #2. In today's video, you'll learn the importance of planning. Studies show that small businesses that create -- and consistently use --marketing plans experience an average of 30% higher sales than those who don't. Wouldn't you like to increase your sales by 30%? For more information, Please call us at (416) 342-1480 or visit www.suppafinancial.com

How would you like to attract more sizzling, red-hot referrals from your past clients? Well, you'll be glad to know I just put together a brand new 6-part video series for you titled, "6 Deadly Mistakes That Kill Your Referrals"t hat teaches how to do exactly that -- become a referral magnet. By avoiding these six costly mistakes and implementing effective "referral systems" you can literally skyrocket your referrals almost overnight. OK, enough prelude already. Here's the very first Referral Mistake to avoid... For more information call us at (714) 293-7860 or visit

www.newamericanagent.com/StephenPaliska

Ok, today we are going to talk about how to manage your finances during a recession… Nobody welcomes a recession. But if you’re among the fortunate majority that still has an income and a home, a recession can actually be a time of valuable learning and growth. Here are 5 ways to manage your finances during a recession… If you are looking for a top-notch loan originator in Henderson call us at, 626-437-2929

Ok, today we are going to talk about three easy, but crucial repairs you must make before selling your home. Making your house as presentable as possible is the best way to achieve a quick and profitable sale. However, you don’t have to make expensive repairs that will force you to raise your asking price. Often, inexpensive but highly-noticeable improvements—combined with good staging—will get you the buyers and sale you want. Here are the 3 most important things to fix before listing your home. If you're looking for a top-notch mortgage agent in Mississauga, call us at (416) 300-3540.

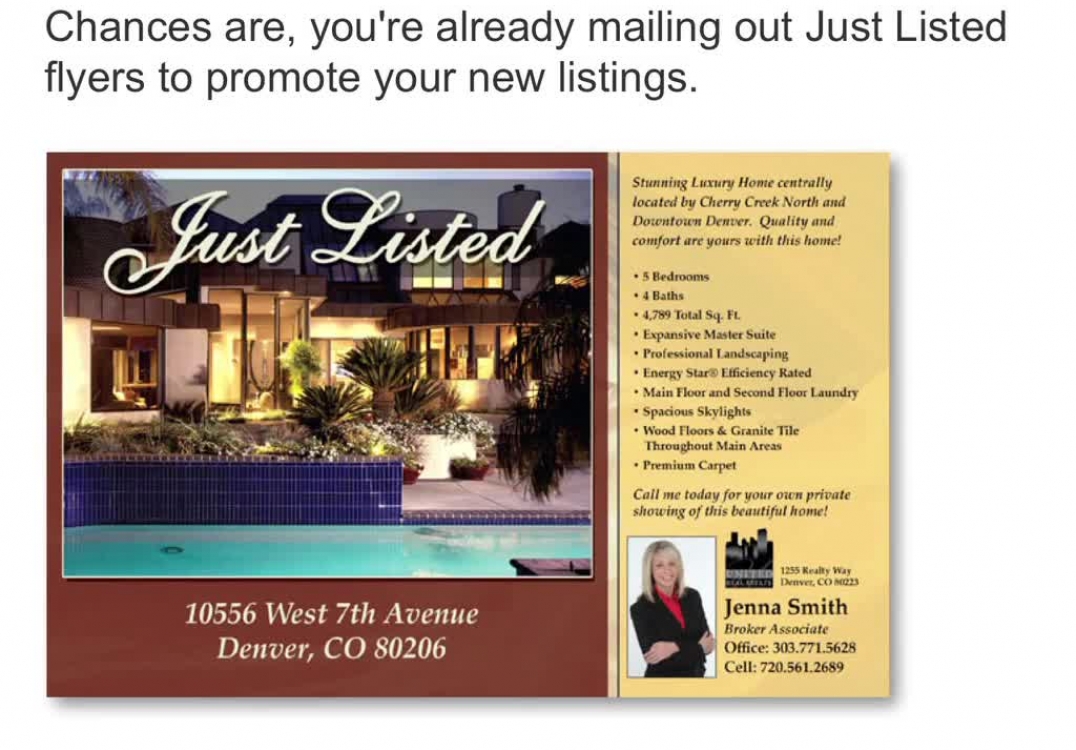

Chances are, you're already mailing out Just Listed flyers to promote your new listings. With that in mind, here are a few tips to help you attract more qualified buyer leads and boost your ROI... For more information, please call us at (831) 535-3954 or visit www.conceptmortgage.com

Ok, today we are going to talk about 10 factors that determine your home’s value… Coming up with the right price for your home is a science. It’s not based on how much you love your home or how much money you need to get out of it. It’s based on what a potential buyer is willing to pay for a home like yours in the current market. Here are 10 factors that determine your home’s worth… If you are looking for a top-notch mortgage advisor in Chesterfield call us at, 314-761-5491

Why do some Realtors® have all the clients they can handle,

while others seem to struggle? Is it because they are smarter

than all the other Realtors® or is it because they simply

work harder? Perhaps neither.

After analyzing the habits, attributes and character traits of

hundreds of real estate professionals over the years, we've

identified the "secrets" that separate the Top 1%

highest-income-earning Realtors® from all the rest.

And for your benefit, we've decided to distill all these traits

down into 21 specific things that create superstar Realtors®

and allow them to pick and choose who they work with, and

have all the clients they can handle.

Are you ready for the 1st secret of Superstar Realtors®?

Here it is...

For more information, please call us at (708) 857-1897) or visit http://crownmortgagecompany.mymortgage-online.com.

Welcome to Realtor Referral Mistake #2. In today's video tip, you're going to learn why most Realtors are unwittingly sabotaging their "referrability" and therfore, leaving thousands of dollars on the table. It also explains why most Realtors get WAY less referrals than they'd like or even feel like they deserve. HINT: It's not because of bad B.O. or halitosis. :) Here's why "great service" doesn't get you referrals... For more information call us at, 801-602-3550

How many times have you said to yourself, "I wish I knew

how to get the best bang for my buck on my

advertising dollars?"

Well today you're going to learn the advertising secrets

that Superstar Realtors use to get at least 200% higher

response rates than the average Realtor.

Here exactly how they do it:

In next week's 15th secret, you'll learn a powerful

marketing strategy that Superstar Realtors use to get

huge floods of leads with little time or effort!

Stay tuned...

For more information, please call us at (416) 300-3540.

Welcome to Realtor Referral Mistake #5. In today's tip, you'll learn how to focus your marketing efforts on the your highest-profit activities so you can make earn more, while working less. It all comes down to working smarter, not harder. Here's a 12-month marketing calendar for massive success...For More Information call us at, 513-238-0999

Welcome to the 4th secret of Superstar Realtors.

In today's secret I unlock the mystery to creating

a constant stream of qualified leads that come to

you instead of the other way around.

All the Superstar Realtors I know use this tactic

and you should too.

Click here to listen to the fourth secret...

In the upcoming 5th secret you'll learn why

Superstar Realtors can charge higher fees than

all their competitors and still have clients lined

up around the block to use their services.

Stay tuned...

For more information, please call us at (518) 852-5650 or visit www.ontariolending.ca.

Welcome to video #4 in our brand new 5-part video series titled, "TRUST: How to Earn it, Grow It and Use It to Skyrocket Your Sales." Last week, I revealed the #1 secret for boosting your sales. Today I’m going to show you how to create your own testimonial capture page, so you can automate the entire process of collecting testimonials. Remember: more trust = more sales! Here's how to capture testimonials on autopilot...For More Information call us at, 647-992-8390

Welcome to Real Estate Marketing Sin #3.

Ever wondered how fast food franchises like

McDonalds or Wendy's run like finely-oiled

cash machines?

Notice how they do the same things, the same

way, every single time.

Unfortunately, most Realtors never take the time

to "systematize" their business, which results in

duplication, waste, chaos and ultimately, lost sales.

Here are 4 types of "systems" to implement in your biz...

In next week's tip, you'll learn the secret for maximizing

your repeat and referral business.

Stay tuned...

For more information please call us at (407) 275-5112 or visit www.thefloridamortgageteam.com.

Ok, today we are going to talk about 4 risks of home equity loans… A home equity loan lets you borrow some of the equity you’ve built up in your home. For most people home equity loans are a convenient, affordable way to access extra cash. But they’re not without risk. Here are 4 things to consider before applying for a home equity loan… If you are looking for a top-notch loan officer in Mason call us at, 513-238-0999

Emergencies come in all shapes and sizes, from a hurricane to furnace failure. But no matter how big the emergency, they’re always expensive because they’re serious and rarely happen during regular business hours. Here are 5 ways to help pay for emergency home repairs… If you are looking for a top-notch mortgage professional in Toronto call us at, (866) 492-4024.

I once heard a statistic that 90% of all failure comes from quitting. Thomas Edison affirmed this when he said, “Many of life's failures are people who did not realize how close they were to success when they gave up.” If it weren't for Mr. Edison's dogged determination to keep going, after thousands of failed attempts, at creating the incandescent light bulb, who knows we might still be lighting our homes with candles! In other words, persistence beats resistance. Quitters never win and winners never quit. If you want to increase your chances of success you must have a dream worth fighting for and then resolve to never, never, never give up! Here's How to Activate the Power of Persistence... For More Information call us at, 573-881-9325

As any good real estate professional will tell you,setting the right price for a home is a mix of technical knowledge and intuition. Realtors have to rely on their experience, knowledge and feel for the market. But there’s more to it than that. Here are 4 factors that smart Realtors rely on to set the right listing price. If you're looking for a top-notch loan officer in Sandy, call us at (801) 851-5399.

Ok, today we are going to talk about how to create or update your home office space… The COVID pandemic introduced many of us to working from home. And regardless of being in a pandemic or not, many of us will continue to and have been working from home already. So now’s the time to make your home office as efficient, comfortable and uplifting as possible. Here are 6 ways to make your home office work better…If you are looking for a top-notch mortgage agent in Mississauga call us at, 647-992-8390

It’s important to know what type of interest you’re paying when you take out a mortgage. There are basically two types, but each of them is sometimes known by more than one name. Here's what you need to know... If you are looking for a top-notch mortgage professional in Toronto call us at, (866) 492-4024.

Ok, today we are going to talk about the most common questions homebuyers ask about mortgages. For most of us, shopping for our dream home is the fun part. So what’s the not-so-fun part? It’s usually when things get complicated trying to arrange financing. (After all, it can be confusing!) Here are answers to 5 of the most common mortgage questions. If you're looking for a top-notch loan officer in Lynwood, call us at (520) 245-2366.