Лучшие видеоролики

Eagan Senior Mortgage Consultant reveals When is it smart to pay off your mortgage early? Here’s 7 t

Ok, today we are going to talk about when it is smart to pay off your mortgage early… Being mortgage-free sounds wonderful. But as with most financial choices, there are pros and cons. Before using an inheritance, a raise or savings to pay off your mortgage early, there are some important things to consider. Here’s 7 things to consider if you want to pay your mortgage off early… If you are looking for a top-notch mortgage consultant in Eagan, call us at 651-271-4413.

Ok, today we are going to talk about how you can save time and money paying your utility bills on your home… Monthly bills are inevitable and predictable. But for some people, bills come as a surprise just when they can least afford them. Here’s 6 tips to save you time and money paying your utility bills… If you are looking for a top-notch mortgage agent in Haileybury call us at, (905) 809-9160.

Ok, today we are going to talk about basic home maintenance you should be doing yearly, every 5-10 years and onward… Ongoing expenses like mortgage payments, property taxes and insurance are an expected part of homeownership. But there’s an additional ongoing expense you also need to budget for… And that is regular homeownership maintenance expenditures. On average, annual maintenance will cost 1% - 3% of your home’s purchase price. However, this can be reduced by maintaining regular preventative maintenance. Here’s your complete maintenance checklist…If you are looking for a top-notch mortgage agent in Haileybury call us at, (905) 809-9160.

Welcome to the 4th secret of Superstar Realtors. In today's secret I unlock the mystery to creating a constant stream of qualified leads that come to you instead of the other way around. All the Superstar Realtors I know use this tactic and you should too. Click here to listen to the fourth secret... For more information call us at, (905) 809-9160.

Ok, today we are going to talk about how to save money on home insurance… Insurance is absolutely essential to home ownership. You have to be confident that your investment and your family are adequately protected. However, there’s no reason to pay more for home insurance than you have to. Here are 7 ways to save money on home insurance…If you are looking for looking for a top-notch senior loan originator in Weston call us at, 305-335-6155

Ok, today we are going to talk about how to save money renovating your home… Renovating can add comfort, convenience and value to your home. But renovations are often pricey. Here are 5 tips for updating your home without blowing your budget…If you are looking for looking for a top-notch senior loan originator in Weston call us at, 305-335-6155

Weston Senior Loan Originator reveals7 tips for using a budget tracking app to manage your finances…

Today we are going to talk about how to use budget tracking apps but stay safe doing it… Budget tracking apps like Quicken and mint.com can be a great way to manage household finances. But considering all the personal financial information you enter into these apps, are they safe to use? Most experts agree the apps are generally safe; it’s the people using them who pose the greatest risk. Here are 7 tips for using a budget tracking app (while keeping your info safe)…If you are looking for looking for a top-notch senior loan originator in Weston call us at, 305-335-6155

Ok, today we are going to talk about basic home maintenance you should be doing yearly, every 5-10 years and onward… Ongoing expenses like mortgage payments, property taxes and insurance are an expected part of homeownership. But there’s an additional ongoing expense you also need to budget for… And that is regular homeownership maintenance expenditures. On average, annual maintenance will cost 1% - 3% of your home’s purchase price. However, this can be reduced by maintaining regular preventative maintenance. Here’s your complete maintenance checklist…If you are looking for looking for a top-notch senior loan originator in Weston call us at, 305-335-6155

Have you ever wondered why you see the names of Superstar Realtors everywhere? It seems every time you turn around, their name is staring at you. Click here to find out how they do it....For more information call us at 305-335-6155

Ok, today we are going to talk about three things you need to know before you borrow from your home equity… Accessing your home equity through a home equity line of credit (HELOC) or cash-out refinance can be an affordable way to pay for renovations or education. Here are 3 things you need to know before applying for a HELOC…If you are looking for a top-notch loan consultant in Carlsbad call us at, 760-224-5510

Today we are going to talk about how to buy a house that’s not on the market… In a competitive real estate market, it may be difficult to find the house you’re looking for. And when you finally find it, you could be outbid by another buyer. That’s why many buyers are looking for homes BEFORE they’re listed. Here’s how to buy a house that’s not yet listed on the market…If you are looking for a top-notch loan consultant in Carlsbad call us at, 760-224-5510

Ok, today we are going to talk about how to pay off your credit card so you can live a stress-free future… If you’re like most people, emergencies, illnesses, job losses or more can put a dent in your credit cards. To make matters worse, most credit cards have high interest rates that make them difficult to pay off. But paying off your cards is exactly what you need to do to achieve a secure and stress-free financial future. Here are 6 tips for paying off your credit cards… If you are looking for a top-notch mortgage advisor in Greenwood Village call us at, 303-307-7580

Ok, today we are going to talk about how to save money on home insurance… Insurance is absolutely essential to home ownership. You have to be confident that your investment and your family are adequately protected. However, there’s no reason to pay more for home insurance than you have to. Here are 7 ways to save money on home insurance…If you are looking for a top-notch mortgage advisor in Greenwood Village call us at, 303-307-7580

Ok, today we are going to cover 5 tips for buying a condo… Millions of people have either decided that condo living suits their budget and lifestyle better than single-family homeownership, or they purchase condos as an investment, second home, or vacation property. There are important differences between buying a home and buying a condo. So, before you make an offer… Here are 5 tips for buying a condo…If you are looking for a top-notch mortgage advisor in Greenwood Village call us at, 303-307-7580

Welcome to Real Estate Marketing Sin #6. Studies have shown that 81% of all sales happen on or after the fifth contact. If you're a Realtor and you're only following up on your leads a few times before giving up, just imagine how much business you're leaving on the table! Spending money on advertising but while not having a system in place that continuously and regularly follows up on your prospects, clients and referral partners is like filling up your bathtub without first putting the stopper in the drain -- it's a complete waste. Here are 3 keys for creating an effective follow-up system...For more information call us at, 303-307-7580

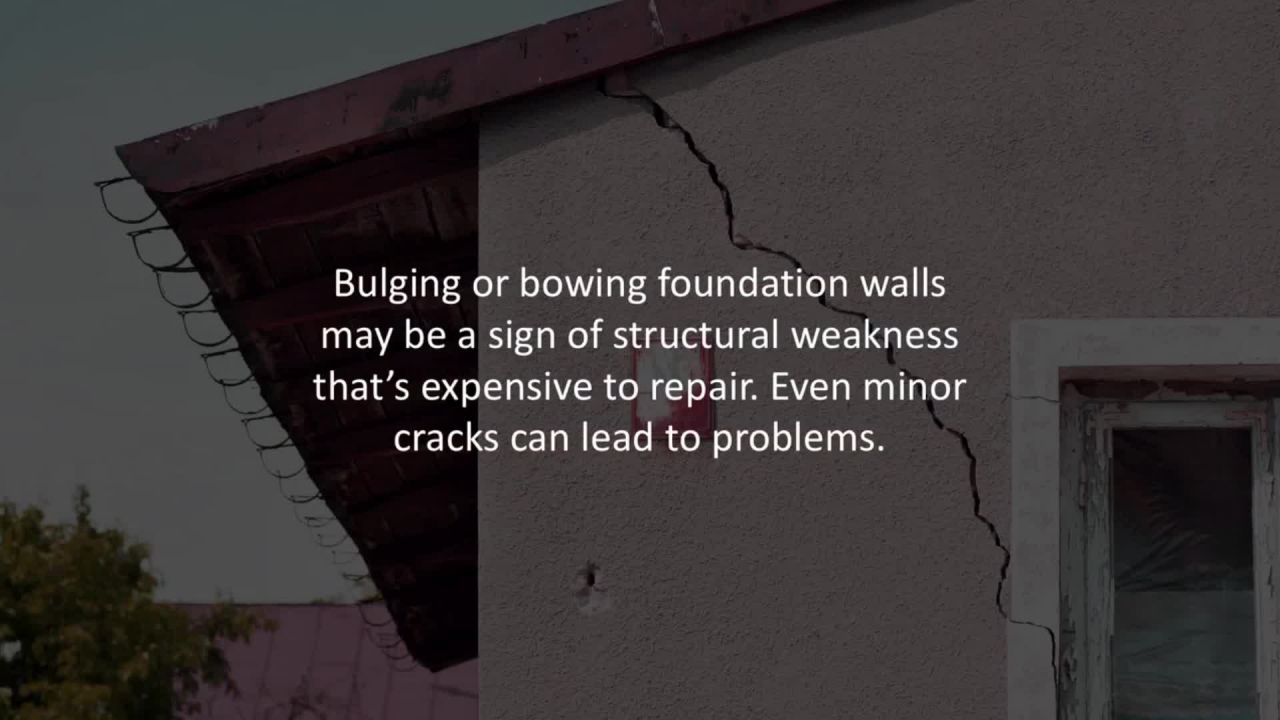

Ok, today we are going to talk about 5 things to look for and be aware of if they get noted in your home inspection… As any good Realtor will advise you, don’t even think about buying a house without a home inspection. Before you get emotionally attached to a home, invest a few hundred dollars in a thorough, professional home inspection. And if your report includes any of the following issues, consider walking away. Here are 5 home inspection red flags… If you are looking for a top-notch mortgage loan advisor in Miami call us at, 786-338-3844

Ok, today we are going to talk about a decade-by-decade retirement plan… Saving for retirement is a challenging but essential goal. Government pensions likely won’t be enough to live on, so it’s up to you to provide a comfortable retirement income. Here is a retirement plan broken down for you, decade by decade…If you are looking for a top-notch loan consultant in California call us at, 925-628-8002

Today we're going to talk about buyer lead CONVERSION. This is one of the easiest ways to increase your income without putting in more hours. The pregnant question is... HOW can you boost your conversion ratio? Here are a few tips to get you started... For more information call us at, 925-628-8002

What’s the single, most important question every smart home seller wants you to answer at their listing presentation? HINT: it's probably not what you think. Here's the shocking truth... For more information call us at, 925-628-8002

Welcome to Realtor Referral Mistake #3. In today's video tip, you'll discover the critical "X" factor that has the power to instantly transform "happy clients" into "raving fans" and "evangelists". It's a game-changer. You'll also learn the the guarded secret Top Producers use to stimulate referral frenzies, almost at will. Here's why "happy clients" still don't send you referrals...Welcome to Realtor Referral Mistake #3. In today's video tip, you'll discover the critical "X" factor that has the power to instantly transform "happy clients" into "raving fans" and "evangelists". It's a game-changer. You'll also learn the the guarded secret Top Producers use to stimulate referral frenzies, almost at will. Here's why "happy clients" still don't send you referrals... For more information call us at, 309-453-2234