Top videos

With few exceptions, some of the first words we learn as kids are “Please” and “Thank you”. As parents, we're constantly reminding our kids to say these words because as a culture, we tend to be repelled by people who lack social graces. If showing appreciation is such an integral part of human interaction, how might you use appreciation to differentiate yourself and improve your marketing results? Here's how... For more information call us at, 415-717-9252

Ok, today we are going to talk about 5 simple things you can do to your home to instantly boost the price when it hits the market… You don’t have to hire a professional stager to prepare sell your home. With a little guidance from a Realtor and a few simple touches, your home’s value can increase instantly. Here are 5 things you can do that can help you boost your asking price… If you are looking for a top-notch producing branch manager in Dallas call us at, 972-922-3742

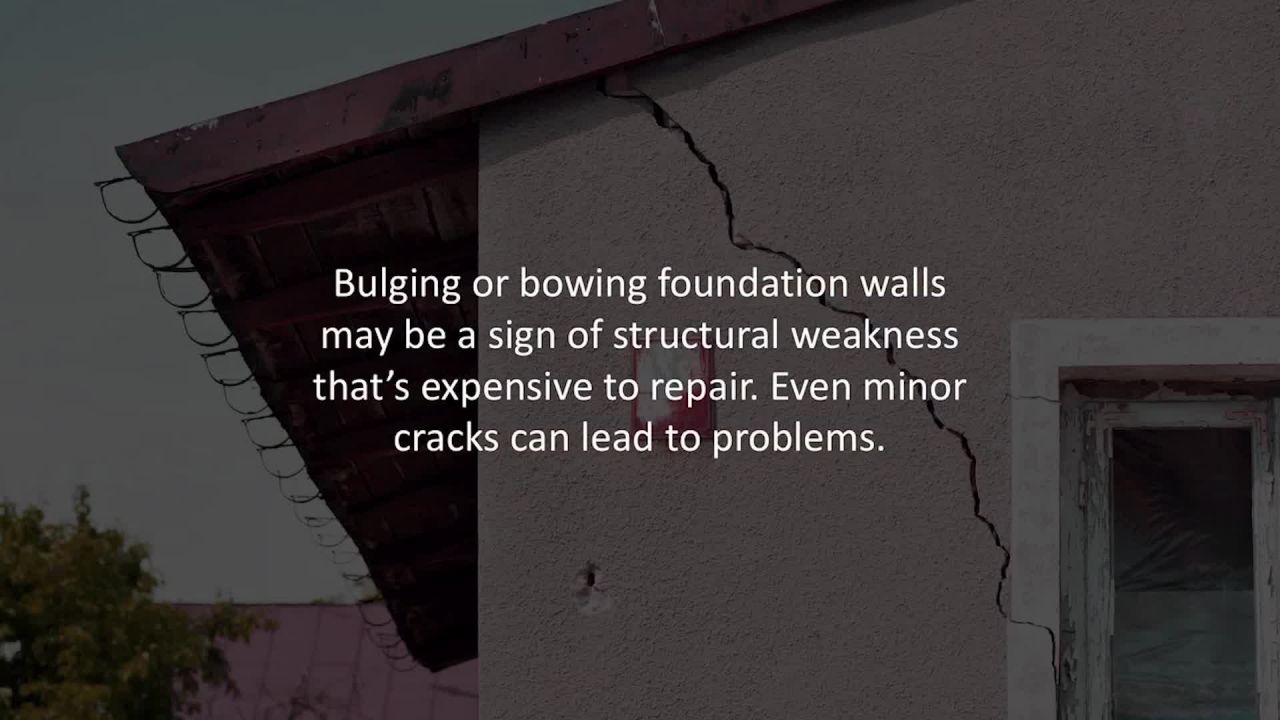

Ok, today we are going to talk about 5 things to look for and be aware of if they get noted in your home inspection… As any good Realtor will advise you, don’t even think about buying a house without a home inspection. Before you get emotionally attached to a home, invest a few hundred dollars in a thorough, professional home inspection. And if your report includes any of the following issues, consider walking away. Here are 5 home inspection red flags… If you are looking for a top-notch mortgage professional in Greenville call us at, (864) 214-6386

Welcome to Real Estate Marketing Sin #3. Ever wondered how fast food franchises like McDonalds or Wendy's run like finely-oiled cash machines? Notice how they do the same things, the same way, every single time. Unfortunately, most Realtors never take the time to "systematize" their business, which results in duplication, waste, chaos and ultimately, lost sales. Here are 4 types of "systems" to implement in your biz...For more information call us at, 203-648-0320

Welcome to Realtor Referral Mistake #5. In today's tip, you'll learn how to focus your marketing efforts on the your highest-profit activities so you can make earn more, while working less. It all comes down to working smarter, not harder. Here's a 12-month marketing calendar for massive success... For more information call us at, 502-291-1795

As you know, BUYER LEADS are the critical ingredient necessary for selling your listings FAST and for TOP DOLLAR... Now, the question is, HOW can you attract MORE of 'em, with the least amount of time, energy and money? Well, to help you in this, here are two proven strategies for ATTRACTING more quality buyer leads and gaining an UNFAIR ADVANTAGE over your competitors... For more information call us at, 502-291-1795

Today we're going to talk about buyer lead CONVERSION. This is one of the easiest ways to increase your income without putting in more hours. The pregnant question is... HOW can you boost your conversion ratio? Here are a few tips to get you started... For more information call us at, 502-291-1795

OK, so you get a phone call from a homebuyer asking for more info on a listing... now what??? What most Realtors® do is simply answer the prospect's question and that's it. No email follow-up. No phone follow-up. No nothin'. It's no wonder they're having such a hard time selling homes – just look at their follow-up! In contrast, here's how top producing Realtors® capture leads and convert more leads into closed deals...For more information call us at, 502-291-1795

Ok, today we are going to talk about what a force majeure clause is and where or not it applies to your mortgage… “Force majeure” is French for superior force. It’s a term used in legal documents that can sometimes let a person or business get out of a contract. Here’s what you need to know and when it could apply to you… If you are looking for a top-notch Mortgage Adviser in La Grange, call us at 502-291-1795

Welcome to Real Estate Marketing Sin #7. When it comes to effective Realtor marketing, there are 3 keys to success: 1. The right market - the people who are most likely to need, want and pay for your services 2. The right message - that hits the hot buttons of your target market and elicits response 3. The right media - that delivers your message to the highest concentration of your target message If any one of these 3 critical components is missing from your marketing plan, your results will suffer. Here's how you can supercharge your results... For more information call us at, 603-637-4110

With few exceptions, some of the first words we learn as kids are “Please” and “Thank you”. As parents, we're constantly reminding our kids to say these words because as a culture, we tend to be repelled by people who lack social graces. If showing appreciation is such an integral part of human interaction, how might you use appreciation to differentiate yourself and improve your marketing results? Here's how... For more information call us at, 603-637-4110

Ok, today we are going to talk about an important thing you should do before you buy in an area… test drive the neighbourhood! You wouldn’t think of buying a car without driving it first. And buying new shoes usually involves wearing them around the store a couple of times. So how do you know you’ll actually like the neighbourhood you’re considering, unless you try it out? Here are 4 ways to test drive a neighbourhood… If you are looking for a top-notch mortgage advisor in Austin call us at, 512-653-2836

Ok, today we are going to talk about the top three green features buyers look for in a house… Are you looking to make upgrades to your home to make it more energy efficient? Wondering what to invest in that will help with resale? As concern for the environment continues to grow, today’s homebuyers are increasingly looking for green options. Here are the top 3 green features buyers are looking for… If you are looking for a top-notch mortgage advisor in Holland call us at, 480-550-0820

Ok, today we are going to talk about how to convert a construction loan into a traditional mortgage… If you’re planning to build a house or do a major renovation, you usually can’t qualify for a traditional mortgage because there’s no existing home to use as collateral. What you need is a construction loan, which is based on the projected future value of the completed property. Generally, construction loans are interest-only while the house is being built. Then when construction is complete, you refinance into a regular mortgage. Here’s how the process works…If you are looking for a top-notch mortgage advisor in Holland call us at, 480-550-0820

Ok, today we are going to talk about the expense of hiring a real estate agent and if it’s really worth it to you… When you’re selling a home, so much money is at stake, you can’t afford to make a mistake. That’s why over 90% of buyers and sellers work with a Realtor. But let’s face it, Real estate commissions are expensive. Are Realtors really worth it? Here’s what good Realtors do to earn every penny of their commissions…If you are looking for a top-notch mortgage advisor in Holland call us at, 480-550-0820

Holland Mortgage Advisor reveals4 ways to prepare your finances for a natural disaster or pandemic….

Ok, today we are going to talk about how to prepare your finances for a natural disaster or pandemic… The thing about crisis situations is that you never know when to expect them. The only way to cope is by being prepared. Here are 4 ways to prepare your finances to help you make it through challenging times…If you are looking for a top-notch mortgage advisor in Holland call us at, 480-550-0820

Ok, today we are going to talk about how you can save time and money paying your utility bills on your home… Monthly bills are inevitable and predictable. But for some people, bills come as a surprise just when they can least afford them. Here’s 6 tips to save you time and money paying your utility bills…If you are looking for a top-notch mortgage advisor in Holland call us at, 480-550-0820

Ok, today we are going to talk about how to maximize the sale price of your home… Selling your home isn’t as simple as putting up a For Sale sign. There are many things to do in advance to prepare yourself financially and make sure your home sells for top dollar. Here are 5 ways to maximize the sale price of your home…If you are looking for a top-notch mortgage advisor in Holland call us at, 480-550-0820

Ok, today we are going to talk about 10 factors that determine your home’s value… Coming up with the right price for your home is a science. It’s not based on how much you love your home or how much money you need to get out of it. It’s based on what a potential buyer is willing to pay for a home like yours in the current market. Here are 10 factors that determine your home’s worth…If you are looking for a top-notch mortgage advisor in Holland call us at, 480-550-0820

Ok, today we are going to talk ways to access the home equity… If you’re equity rich and cash poor, it might make sense to draw equity from your home. Here are 3 ways to access the equity in your home…If you are looking for a top-notch mortgage advisor in Austin call us at, 512-653-2836