Top videos

Ok, today we are going to talk about 3 things you need to do before house hunting… Finding for your dream home is a lot easier if you get your finances in shape before you start looking. If you’re thinking about buying within the next year, now’s the perfect time to start preparing. Here are the first 3 steps to take before house hunting… If you are looking for a top-notch loan officer in Austin call us at, 512-965-5720

Ok, today we are going to talk about how to save money on home insurance… Insurance is absolutely essential to home ownership. You have to be confident that your investment and your family are adequately protected. However, there’s no reason to pay more for home insurance than you have to. Here are 7 ways to save money on home insurance…If you are looking for a top-notch mortgage advisor in Rogers call us at, 479-283-7151

What’s the single, most important question every smart home seller wants you to answer at their listing presentation? HINT: it's probably not what you think. Here's the shocking truth...For more information call us at, (407) 718-5588

Ok, today we are going to talk about how to start investing… Obviously, there are several things to take care of before you can start investing. You need to cover rent or mortgage payments, monthly bills, groceries, etc., and you also need some money set aside for emergencies. But once you’ve accomplished that, it’s time to start investing for the future. Here are 5 steps to help you start investing…If you are looking for a top-notch mortgage agent level 2 in Barrie call us at, 705-716-2875

Ok, today we are going to talk about 4 risks of home equity loans… A home equity loan lets you borrow some of the equity you’ve built up in your home. For most people home equity loans are a convenient, affordable way to access extra cash. But they’re not without risk. Here are 4 things to consider before applying for a home equity loan…If you are looking for a top-notch mortgage originator in Flintstone call us at, (423) 316-4176

Ok, today we are going to talk about how to rebuild your finances if you’ve suffered from financial abuse… Being in an unhealthy relationship could be emotionally, physically, or even financially damaging. And according to recent statistics, 99% of domestic violence also includes financial abuse. Here’s what to do if you’re in a financially abusive situation, or if you’re recovering from one…If you are looking for a top-notch loan originator in Greenville call us at, 864-477-5700

Ok, today we are going to talk about how to create or update your home office space… The COVID pandemic introduced many of us to working from home. And regardless of being in a pandemic or not, many of us will continue to and have been working from home already. So now’s the time to make your home office as efficient, comfortable and uplifting as possible. Here are 6 ways to make your home office work better…If you are looking for a top-notch mortgage agent in Oakville call us at, (416) 723-5144

Ok, today we are going to talk about how to maximize the sale price of your home… Selling your home isn’t as simple as putting up a For Sale sign. There are many things to do in advance to prepare yourself financially and make sure your home sells for top dollar. Here are 5 ways to maximize the sale price of your home… If you are looking for a top-notch mortgage expert in Burnaby call us at, 604-343-8686

San Antonio Mortgage Advisor reveals 4 ways to prepare your finances for a natural disaster or pande

Ok, today we are going to talk about how to prepare your finances for a natural disaster or pandemic… The thing about crisis situations is that you never know when to expect them. The only way to cope is by being prepared. Here are 4 ways to prepare your finances to help you make it through challenging times…If you are looking for a top-notch mortgage advisor in San Antonio call us at, (210) 422-7613

Have you ever wondered why some Realtors® quickly skyrocket to success while the majority continues to struggle just to eke out a meager existence? We all know everyone has access to the same MLS marketing tools, so why such a disparity in results? Is the difference found in their education, intelligence, skills, timing, work habits, contacts or luck? The answer to this mystery is actually no mystery at all. If you dig down to the root cause of their success, you’ll invariably find that the common denominator of success in each and every Top Producer lies in their MINDSET or their UNIQUE WAY OF THINKING. Here are ten ways Top-Producers think differently than all the rest… For more information call us at, (210) 422-7613

Ok, today we are going to talk about three things you need to know before you borrow from your home equity… Accessing your home equity through a home equity line of credit (HELOC) or cash-out refinance can be an affordable way to pay for renovations or education. Here are 3 things you need to know before applying for a HELOC…If you are looking for a top-notch Mortgage Consultant in Puyallup call us at, 253-592-4924

Ok, today we are going to talk about when the best time to do certain updates on your home is… Timing renovations can be tricky. The sooner you remodel, the longer you have to enjoy your beautiful new home. But if you remodel too far in advance of selling, everything’s going to look outdated by the time you list your home. Here’s a yearly schedule broken down that will help you know when to update what… If you are looking for a top-notch mortgage broker in Kingston call us at, 613-328-4481

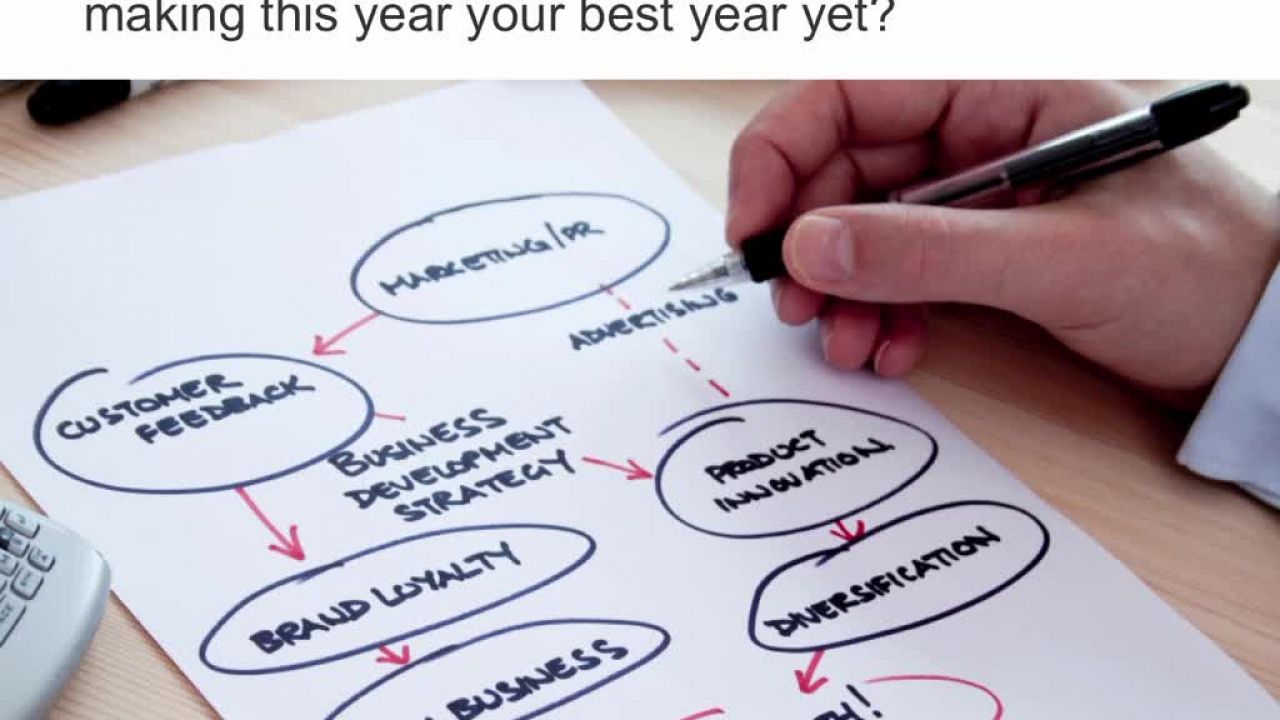

Welcome to Real Estate Marketing Sin #2. In today's video, you'll learn the importance of planning. Studies show that small businesses that create -- and consistently use --marketing plans experience an average of 30% higher sales than those who don't. Wouldn't you like to increase your sales by 30%? Here are 4 Simple Steps for Creating an Effective Marketing Plan... For more information call us at, (587) 222-9221.

Ok, today we are going to talk about 3 things you need to do before house hunting… Finding for your dream home is a lot easier if you get your finances in shape before you start looking. If you’re thinking about buying within the next year, now’s the perfect time to start preparing. Here are the first 3 steps to take before house hunting… If you are looking for a top-notch mortgage broker in Burnaby call us at, 778-875-0926

Welcome to Realtor Referral Mistake #6. This is our final installment in this series. In today's video tip, you'll learn how Top-Producing Realtors engineer their business to consistently cultivate "raving fan" clients who send them loads of red-hot referrals... without begging or asking. You see, they understand a key psychological trigger, that hardly anyone utilizes, that can literally DOUBLE the number of referrals you generate. Learn the secret to more repeat & referral business here... For more call us at, 403-991-5363

Quick question for you... Do you have a clear, concise marketing plan for making this year your best year yet? Chances are, if you're like most Realtors®, you have room for improvement. Here are a few powerful questions to help you take your business to the next level... For more information call us at, 513-266-3160

Ok, today we are going to talk about how to manage your finances during a recession… Nobody welcomes a recession. But if you’re among the fortunate majority that still has an income and a home, a recession can actually be a time of valuable learning and growth. Here are 5 ways to manage your finances during a recession…If you are looking for a top-notch mortgage broker in Burnaby call us at, 778-875-0926

Ok, today we are going to talk about 3 things you need to do before house hunting… Finding for your dream home is a lot easier if you get your finances in shape before you start looking. If you’re thinking about buying within the next year, now’s the perfect time to start preparing. Here are the first 3 steps to take before house hunting… If you are looking for a top-notch mortgage consultant in Fulshear call us at, 832-725-2630

Ok, today we are going to talk about 5 things to look for and be aware of if they get noted in your home inspection… As any good Realtor will advise you, don’t even think about buying a house without a home inspection. Before you get emotionally attached to a home, invest a few hundred dollars in a thorough, professional home inspection. And if your report includes any of the following issues, consider walking away. Here are 5 home inspection red flags… If you are looking for a top-notch mortgage loan officer in Las Vegas call us at, 661-992-7005

OK, Today we're going to talk about how to save for a down payment.Back in the day, you could buy a big house for $100,000. But now it seems like that’s just the price for the down payment.Most of the time, your down payment will be 20%.So on a $500,000 house, that’s $100,000 down! Even a $300,000 condo would require a $60,000 down payment. Here are 5 ways to save for a down payment. If you're looking for top-notch Mortgage Advisor in Concord, call us at (416) 342-1480.