Top Videos

Ok, today we are going to talk about 6 things to do before you list your house… If you’re thinking of selling soon, you’ve probably already started working on enhancements like painting, replacing appliances, installing new flooring or re-grouting bathrooms. But there are lots of little maintenance items you need to take care of too. Here are 6 things to do before you list your house…If you are looking for looking for a top-notch senior loan originator in Weston call us at, 305-335-6155

Welcome to Real Estate Marketing Sin #8. Did you know that your prospect receives, on average, over 3,000 marketing impressions a day? With all the "marketing clutter" bombarding your prospects' on a daily basis, it's becoming more and more difficult to capture people's attention, let alone get a response! So, how do you differentiate your business in a way that separates you from the competition and makes you STAND OUT? Here's exactly how you do it...For more information call us at 305-335-6155

As you know, BUYER LEADS are the critical ingredient necessary for selling your listings FAST and for TOP DOLLAR... Now, the question is, HOW can you attract MORE of 'em, with the least amount of time, energy and money? Well, to help you in this, here are two proven strategies for ATTRACTING more quality buyer leads and gaining an UNFAIR ADVANTAGE over your competitors...For more information call us at 305-335-6155

Ok, today we are going to talk about real estate planning and why it’s necessary… You don’t have to be wealthy to have an estate plan. No matter who you are, you probably have possessions you’d like your children to have once you’re gone. And you definitely want to have a say in who will take care of your kids if you die before your time. Here are 4 reasons why you should start thinking about estate planning today…If you are looking for a top-notch loan consultant in Carlsbad call us at, 760-224-5510

Ok, today we are going to talk about how to build your savings up FAST! Have an unexpected financial need? Rather than borrowing or putting it on your credit card—which just makes your financial situation worse—consider accelerated saving. Here are 7 ways to accelerate your savings…If you are looking for a top-notch mortgage advisor in Greenwood Village call us at, 303-307-7580

Hi [name], Ok, today we are going to talk about how you can buy a home without visiting it in person… Today, more buyers are making offers on homes sight unseen. Reasons for this could include: • Being too busy for physical shopping • Living on the other side of the country • Feeling totally comfortable with online purchases • Preferring the safety of physical distance Here are 6 tips for buying a house sight unseen…If you are looking for a top-notch mortgage advisor in Greenwood Village call us at, 303-307-7580

Ok, today we are going to talk about how to convert a construction loan into a traditional mortgage… If you’re planning to build a house or do a major renovation, you usually can’t qualify for a traditional mortgage because there’s no existing home to use as collateral. What you need is a construction loan, which is based on the projected future value of the completed property. Generally, construction loans are interest-only while the house is being built. Then when construction is complete, you refinance into a regular mortgage. Here’s how the process works…If you are looking for a top-notch mortgage advisor in Greenwood Village call us at, 303-307-7580

Ok, today we are going to talk about 10 factors that determine your home’s value… Coming up with the right price for your home is a science. It’s not based on how much you love your home or how much money you need to get out of it. It’s based on what a potential buyer is willing to pay for a home like yours in the current market. Here are 10 factors that determine your home’s worth…If you are looking for a top-notch mortgage advisor in Greenwood Village call us at, 303-307-7580

Have you ever wondered why some Realtors® quickly skyrocket to success while the majority continues to struggle just to eke out a meager existence? Little things make a big difference. That's true in marriage, parenting, and in marketing yourself as a Realtor. Too often as business owners we get caught up in the "thick" of "thin things" and we lose touch with what really drives success in our business. In this new 8-part video series, I'm going to highlight 8 deadly real estate marketing sins that could be crippling your business growth. Here's Real Estate Marketing Sin #1...For more information call us at, 541-207-5474

Welcome to Real Estate Marketing Sin #3. Ever wondered how fast food franchises like McDonalds or Wendy's run like finely-oiled cash machines? Notice how they do the same things, the same way, every single time. Unfortunately, most Realtors never take the time to "systematize" their business, which results in duplication, waste, chaos and ultimately, lost sales. Here are 4 types of "systems" to implement in your biz...For more information call us at, 541-207-5474

Did you know that there are literally thousands of people every month in your market area who are searching for real estate information online? In today's video tip, you'll discover how you can attract a steady stream of qualified prospects using a LEAD GENERATION WEBSITE (even if you don't have time, money or technical know-how). Here's how you do it...For more information call us at, 303-307-7580

Welcome to the final 21st secret in our video series titled, 21 Secrets of Superstar Realtors. Today's secret is by far the most important and critical secret of all 21 secrets. I've saved this secret for last message because it's the last impression that I want to emblaze on the screen of your mind. ALL SUPERSTAR MORTGAGE REALTORS DO THIS! And if you want to become a Superstar Realtor yourself, you MUST do this too. If you haven't watched any of the last 20 video tips, today's is the one you need to tune in to. Here's the final secret of Superstar Realtors...For more information call us at, 303-307-7580

Ok, today we are going to talk about 3 things you need to do before house hunting… Finding for your dream home is a lot easier if you get your finances in shape before you start looking. If you’re thinking about buying within the next year, now’s the perfect time to start preparing. Here are the first 3 steps to take before house hunting… If you are looking for a top-notch mortgage loan originator in Rocklin call us at, 916-316-2386

Welcome to Real Estate Marketing Sin #3. Ever wondered how fast food franchises like McDonalds or Wendy's run like finely-oiled cash machines? Notice how they do the same things, the same way, every single time. Unfortunately, most Realtors never take the time to "systematize" their business, which results in duplication, waste, chaos and ultimately, lost sales. Here are 4 types of "systems" to implement in your biz... For more information call us at, 925-628-8002

With few exceptions, some of the first words we learn as kids are “Please” and “Thank you”. As parents, we're constantly reminding our kids to say these words because as a culture, we tend to be repelled by people who lack social graces. If showing appreciation is such an integral part of human interaction, how might you use appreciation to differentiate yourself and improve your marketing results? Here's how... For more information call us at, 951-235-2752

Welcome to video #4 in our brand new 5-part video series titled, "TRUST: How to Earn it, Grow It and Use It to Skyrocket Your Sales." Last week, I revealed the #1 secret for boosting your sales. Today I’m going to show you how to create your own testimonial capture page, so you can automate the entire process of collecting testimonials. Remember: more trust = more sales! Here's how to capture testimonials on autopilot... For more information call us at, 916-316-2386

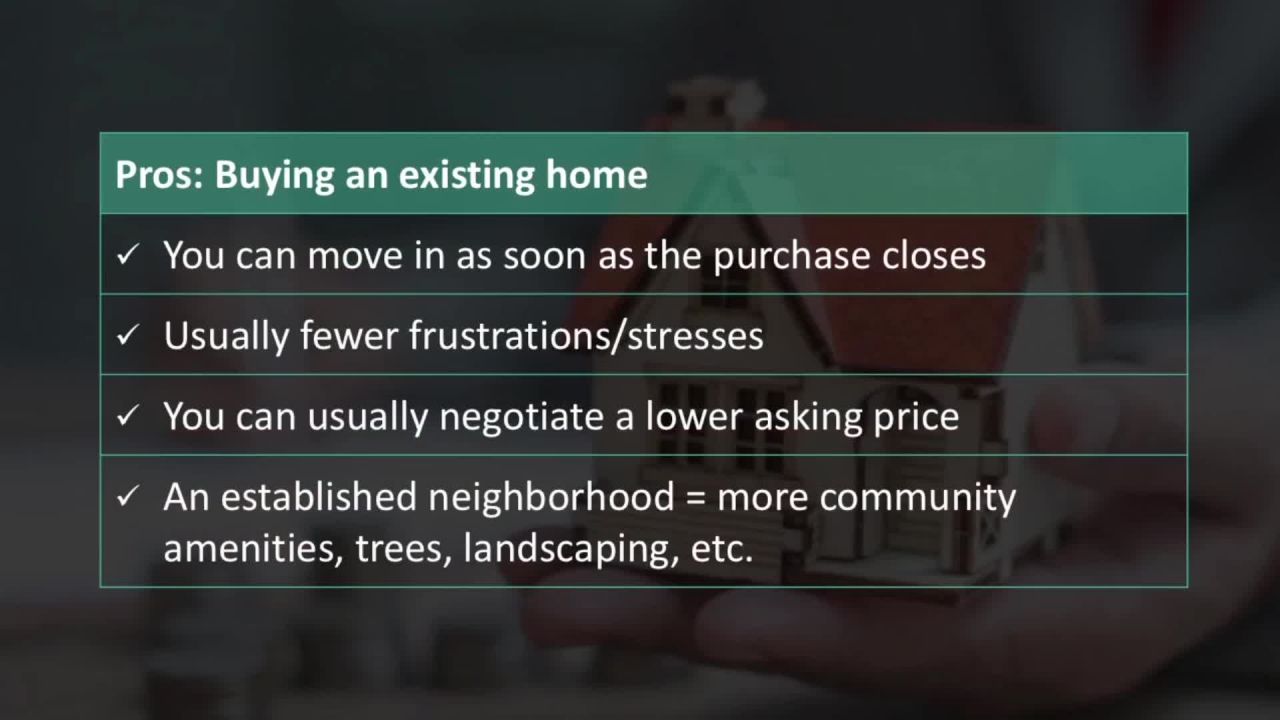

Ok, today we are going to talk about the pros and cons for buying a house verses building new… Deciding whether to buy an existing house or build a brand new one can be complicated. There are so many factors to consider. Here’s a list of pros and cons for both building new and buying an existing home… If you are looking for a top-notch mortgage loan advisor in Miami call us at, 786-338-3844

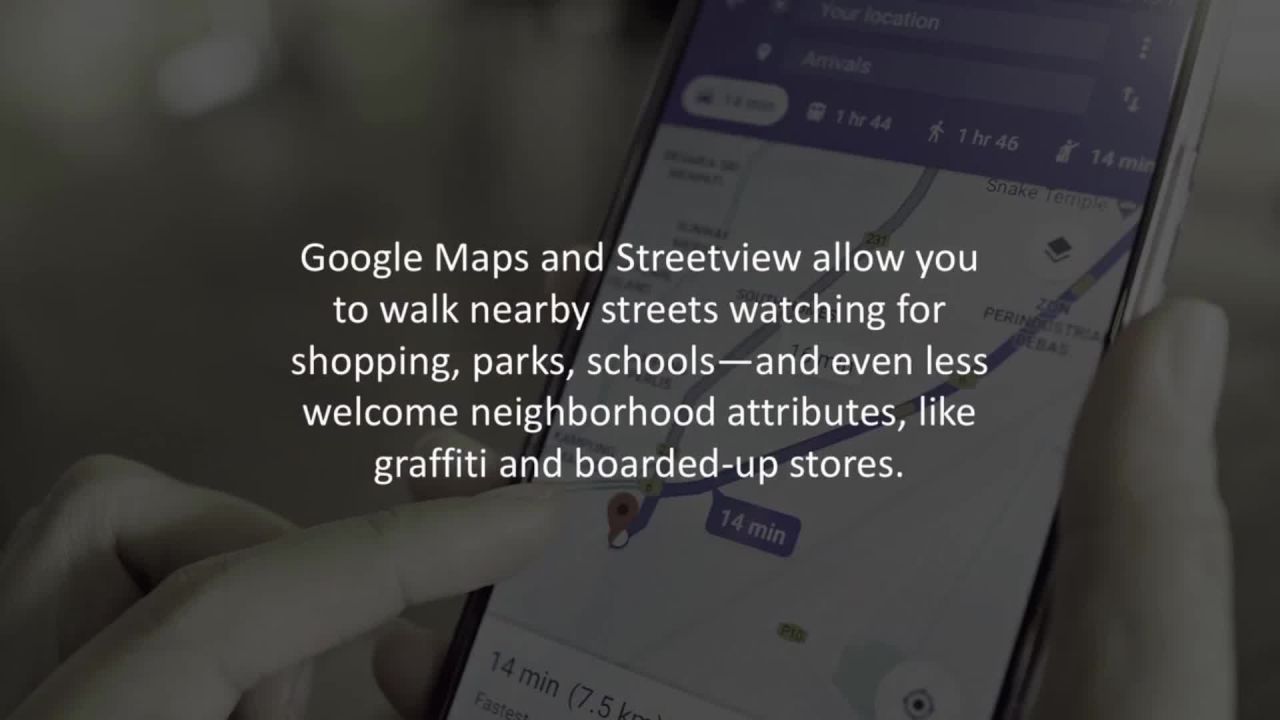

Ok, today we are going to talk about how you can buy a home without visiting it in person… Today, more buyers are making offers on homes sight unseen. Reasons for this could include: • Being too busy for physical shopping • Living on the other side of the country • Feeling totally comfortable with online purchases • Preferring the safety of physical distance Here are 6 tips for buying a house sight unseen… If you are looking for a top-notch mortgage loan advisor in Miami call us at, 786-338-3844

Ok, today we are going to talk about what a force majeure clause is and where or not it applies to your mortgage… “Force majeure” is French for superior force. It’s a term used in legal documents that can sometimes let a person or business get out of a contract. Here’s what you need to know and when it could apply to you… If you are looking for a top-notch Mortgage Broker at Rancho Cucamonga call us at, 951-235-2752

Ok, today we are going to talk about 6 things you need to examine closely in a home inspection… Buying a home is a huge investment, and unfortunately, we’re not all qualified to judge whether a home is worth the money. That’s why it’s essential to hire a professional home inspector. Here are 6 things to pay extra attention to in any home inspection…If you are looking for a top-notch Mortgage Broker at Rancho Cucamonga call us at, 951-235-2752