Top videos

Ok, today we are going to talk about how to shop for a house during a crazy time like a pandemic… Whether you’re house hunting during flu season or a pandemic, here are 5 tips for successful and safe house hunting during a pandemic… If you are looking for a top-notch mortgage banker in Temecula call us at, (310) 767-6289.

Ok, today we are going to talk about 3 things you need to do before house hunting… Finding for your dream home is a lot easier if you get your finances in shape before you start looking. If you’re thinking about buying within the next year, now’s the perfect time to start preparing. Here are the first 3 steps to take before house hunting… If you are looking for a top-notch loan officer in Duluth call us at, 770-633-6617

Ok, today we are going to talk about how to prepare your finances for a natural disaster or pandemic… The thing about crisis situations is that you never know when to expect them. The only way to cope is by being prepared. Here are 4 ways to prepare your finances to help you make it through challenging times… If you are looking for a top-notch loan officer in Duluth call us at, 770-633-6617

Ok, today we are going to talk about how to save money renovating your home… Renovating can add comfort, convenience and value to your home. But renovations are often pricey. Here are 5 tips for updating your home without blowing your budget… If you are looking for a top-notch mortgage banker in Temecula call us at, 310-767-6289

Ok, today we are going to talk about the pros and cons for buying a house verses building new… Deciding whether to buy an existing house or build a brand new one can be complicated. There are so many factors to consider. Here’s a list of pros and cons for both building new and buying an existing home… If you are looking for a top-notch mortgage advisor in Austin call us at, 512-803-3908

Ok, today we are going to talk about rent to own deals… If you can’t qualify for a mortgage, or maybe don’t have funds for a down payment, there’s another way to achieve home ownership. Instead of buying, consider renting to own. Before entering into a rent to own deal, here are some questions to ask… If you are looking for a top-notch loan advisor in Little Rock call us at, 501-912-02.

Ok, today we are going to talk about what a stratified market is and what it means to you… If you’re planning to buy or sell a house, you’re probably already familiar with the terms “buyer’s market” and “seller’s market.” In a buyer’s market, there are more homes than buyers, so prices drop and buyers get better deals. In a seller’s market there are more buyers than homes, so prices rise and sellers make more money. But there’s a third type of market, and it’s called a stratified market. Here’s what you need to know… If you are looking for a top-notch loan originator in Providence call us at, 401-932-8899

Ok, today we are going to talk about 5 things to look for and be aware of if they get noted in your home inspection… As any good Realtor will advise you, don’t even think about buying a house without a home inspection. Before you get emotionally attached to a home, invest a few hundred dollars in a thorough, professional home inspection. And if your report includes any of the following issues, consider walking away. Here are 5 home inspection red flags… If you are looking for a top-notch mortgage consultant in Sherman Oaks call us at, 818-334-7374

Ok, today we are going to talk about how to start investing… Obviously, there are several things to take care of before you can start investing. You need to cover rent or mortgage payments, monthly bills, groceries, etc., and you also need some money set aside for emergencies. But once you’ve accomplished that, it’s time to start investing for the future. Here are 5 steps to help you start investing… If you are looking for a top-notch mortgage consultant in Sherman Oaks call us at, 818-383-5000

Ok, today we are going to talk about what cash reserves are and why you need them to buy a home… When buying a house, most people only think about saving enough to cover a down payment and closing costs. But lenders like to see more than that. Borrowers who have additional “cash reserves” are considered lower risk and are more likely to be approved for financing at the lowest possible rate. So, what are “cash reserves” and how can they benefit you? Take a look… If you are looking for a top-notch mortgage consultant in Sherman Oaks call us at, 818-383-5000

Ok, today we are going to talk about how you can buy a home without visiting it in person… Today, more buyers are making offers on homes sight unseen. Reasons for this could include: • Being too busy for physical shopping • Living on the other side of the country • Feeling totally comfortable with online purchases • Preferring the safety of physical distance Here are 6 tips for buying a house sight unseen… If you are looking for a top-notch mortgage agent in Whitby call us at, 647-895-0201

Ok, today we are going to talk about a decade-by-decade retirement plan… Saving for retirement is a challenging but essential goal. Government pensions likely won’t be enough to live on, so it’s up to you to provide a comfortable retirement income. Here is a retirement plan broken down for you, decade by decade… If you are looking for a top-notch mortgage broker in El Dorado Hills call us at, 925-640-8521

Ok, today we are going to talk about three things you need to know before you borrow from your home equity… Accessing your home equity through a home equity line of credit (HELOC) or cash-out refinance can be an affordable way to pay for renovations or education. Here are 3 things you need to know before applying for a HELOC…If you are looking

for a top-notch mortgage agent in Toronto call us at, 647-688-9449

Ok, today we are going to talk about a decade-by-decade retirement plan… Saving for retirement is a challenging but essential goal. Government pensions likely won’t be enough to live on, so it’s up to you to provide a comfortable retirement income. Here is a retirement plan broken down for you, decade by decade… If you are looking

for a top-notch loan officer in Canonsburg call us at, 412-203-3379

Ok, today we are going to talk about 3 things you need to do before house hunting… Finding for your dream home is a lot easier if you get your finances in shape before you start looking. If you’re thinking about buying within the next year, now’s the perfect time to start preparing. Here are the first 3 steps to take before house hunting… If you're looking for a top-notch Mortgage Broker in Melbourne, call us at (2019) 513.755

Ok, today we are going to talk about when the best time to do certain updates on your home is… Timing renovations can be tricky. The sooner you remodel, the longer you have to enjoy your beautiful new home. But if you remodel too far in advance of selling, everything’s going to look outdated by the time you list your home. Here’s a yearly schedule broken down that will help you know when to update what… If you are looking

for a top-notch loan officer in Kennewick call us at, 503-358-1687

Ok, today we are going to talk about an important thing you should do before you buy in an area… test drive the neighbourhood! You wouldn’t think of buying a car without driving it first. And buying new shoes usually involves wearing them around the store a couple of times. So how do you know you’ll actually like the neighbourhood you’re considering, unless you try it out? Here are 4 ways to test drive a neighbourhood… If you are looking

for a top-notch mortgage agent in Toronto call us at, 905-392-6595

Ok, today we are going to talk about how to manage your finances during a recession… Nobody welcomes a recession. But if you’re among the fortunate majority that still has an income and a home, a recession can actually be a time of valuable learning and growth. Here are 5 ways to manage your finances during a recession… If you are looking

for a top-notch mortgage agent in Toronto call us at, 905-392-6595

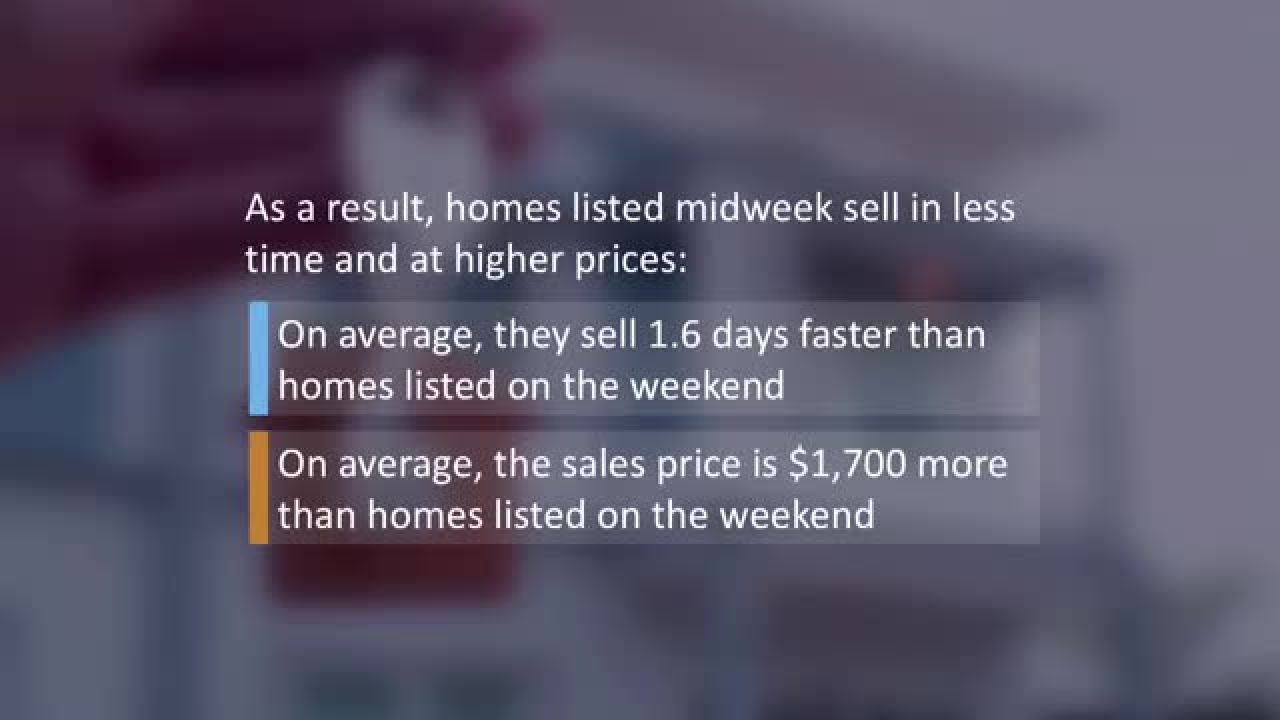

Ok, today we are going to talk about the benefits of listing your home midweek…When you list your home, you want it to sell as quickly as possibleat the highest possible price. Given that goal, a new survey of by Redfinsuggests the best time to list is midweek. If you are looking for a top-notch mortgage broker in Mississauga call us at, 416-451-4158.

Ok, today we are going to cover 5 tips for buying a condo… Millions of people have either decided that condo living suits their budget and lifestyle better than single-family homeownership, or they purchase condos as an investment, second home, or vacation property. There are important differences between buying a home and buying a condo. So, before you make an offer… Here are 5 tips for buying a condo… If you are looking for a top-notch mortgage broker in Vaughan call us at, 416-474-7466