Danny's Money Moment

|Подписчики

Последние видео

Ok, today we are going to talk about how amortization works. Mortgage term and amortization are two different things. Mortgage term is the number of years you’re locked into a specific contract and interest rate with your lender, while the amortization is how long it takes to pay off your mortgage. Here’s what you need to know about amortization … If you are looking for a top-notch mortgage broker in Mississauga call us at, 416-451-4158.

Ok, today we are going to talk about 4 tips to successfully flip a house… If you’re a fan of house-flipping TV shows, you know how tempting this can be. Any time you buy a house with the intention of quickly reselling at a profit, you’re flipping. But it’s not as easy as it sounds. Here are 4 tips for flipping a house for profit… If you are looking for a top-notch mortgage broker in Mississauga call us at, 416-451-4158.

Ok, today we are going to talk about what iBuying is and how it works… One of the advantages of today’s real estate marketplace is the number of choices you have of ways to sell your house. You can sell your house yourself, use a traditional Realtor, use a discount broker, sell online, etc. And now, there’s an even newer choice: using an iBuyer. The “i” in iBuyer stands for “instant.” Here’s what iBuying is and how it works… If you are looking for a top-notch mortgage broker in Mississauga call us at, 416-451-4158.

Ok, today we are going to talk about 5 advantages of making a 20% down payment… With houses being so expensive, coming up with a 20% down payment isn’t easy. Some buyers consider making a 20% or more down payment in order to avoid paying for mortgage insurance, which increases monthly payments. Here are 5 excellent reasons to pay 20% down (if possible)… If you are looking for a top-notch mortgage broker in Mississauga call us at, 416-451-4158.

Ok, today we are going to talk about the best way to refinance your home… Depending on your goals and financial situation, refinancing your mortgage can be a powerful tool. But it’s important to understand the benefits you’re looking for and what type of refinance is right for you. Here’s how to choose between two refinancing options… If you are looking for a top-notch mortgage broker in Mississauga call us at, 416-451-4158.

Ok, today we are going to talk about how to make a successful offer in a seller’s market… Buying a home in a seller’s market isn’t easy. Selection is limited, prices are high and competition is fierce. But it’s still possible to get the home you want at a price you can afford. Here are 5 tips for making a successful offer in a seller’s market… If you are looking for a top-notch mortgage broker in Mississauga call us at, 416-451-4158.

Ok, today we are going to talk about 4 ways to win acontract in a seller’s market…In a seller’s market, there are usually more buyers than homes, multiple offers, bidding wars, and generally rising prices. So if you’re

searching for your first home in this environment, it can be frustrating, but

don’t give up. If you are looking for a top-notch mortgage broker in Mississauga call us at, 416-451-4158.

Ok, today we are going to talk about what a “whisperlisting” is and when it makes sense…A whisper listing (also known as a pocket listing) is any

home that’s offered for sale but doesn’t get listed on MLS, the private

database Realtors use to share listings.Whisper listings are becoming more common, especially in a hot real estate market. In some cities where homes are selling so fast, it’s possible to get snatched up before the Realtor has time to put them on MLS. If you are looking for a top-notch mortgage broker in Mississauga call us at, 416-451-4158.

Ok, today we are going to talk about how your student loans can affect the home buying process…If you’re a first-time buyer, chances are you may have student loan debt. But that doesn’t mean you can’t qualify for a mortgage.

Student loans don’t affect your ability to get a mortgage any more than credit card debt or a car loan. If you are looking for a top-notch mortgage broker in Mississauga call us at, 416-451-4158.

Ok, today we are going to talk about how to make a long-distance move stress free… Major life changes are always stressful. And moving from one city or region to another is definitely a major change. Here are 5 steps you can take to help eliminate the stress of moving… If you are looking for a top-notch mortgage broker in Mississauga call us at, 416-451-4158.

Ok, today we are going to talk about what happens if a property gets damaged before the closing date…This is a nightmare scenario.You list your home, a buyer signs a sales contract, but before the deal closes, there’s a fire or other serious damage to the property. What happens then?The short answer is it’s complicated. Many factors affect how this situation plays out. If you are looking for a top-notch mortgage broker in Mississauga call us at, 416-451-4158.

Ok, today we are going to talk about a decade-by-decade retirement plan… Saving for retirement is a challenging but essential goal. Government pensions likely won’t be enough to live on, so it’s up to you to provide a comfortable retirement income. Here is a retirement plan broken down for you, decade by decade… If you are looking for a top-notch mortgage broker in Mississauga call us at, 416-451-4158.

Ok, today we are going to talk about 5 reasons you shouldconsider a pre-listing home inspection…Homebuyers often get a home inspection done during theclosing process. But from the seller’s perspective, that can be a little late.If the inspector finds issues, the deal may fall through or the seller may haveto rush around making last minute repairs.As a seller, you’re much better off paying for a homeinspection BEFORE you list your home. If you are looking for a top-notch mortgage broker in Mississauga call us at, 416-451-4158.

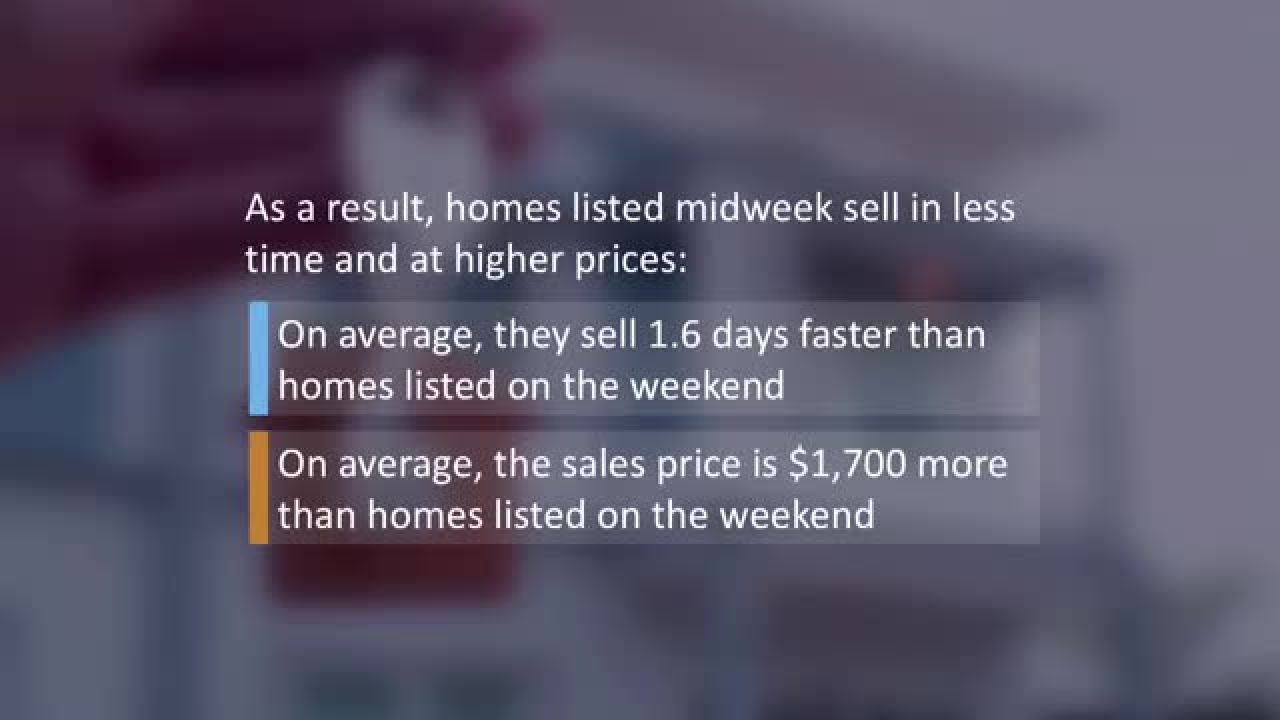

Ok, today we are going to talk about the benefits of listing your home midweek…When you list your home, you want it to sell as quickly as possibleat the highest possible price. Given that goal, a new survey of by Redfinsuggests the best time to list is midweek. If you are looking for a top-notch mortgage broker in Mississauga call us at, 416-451-4158.

Ok, today we are going to talk about how much home renovations can cost… Renovations can help make your home more comfortable and easier to sell. But depending on what you’re planning, they can also be expensive. To help you budget for your next project, the HomeAdvisor website has published a list of typical costs for renovation projects. Here’s a list of the most common renos and how much they cost… If you are looking for a top-notch mortgage broker in Mississauga call us at, 416-451-4158.

Ok, today we are going to talk about what a homeowner’s association is and why it can be beneficial…A homeowner’s association (HOA) sets and enforces neighborhood rules designed to maintain and enhance property values.As a result, HOA neighborhoods tend to be beautifully landscaped, architecturally consistent, and offer amenities like security, swimming pools and golf courses.But there are also a few cons to consider. If you are looking for a top-notch mortgage broker in Mississauga call us at, 416-451-4158.

Ok, today we are going to cover 5 steps for determining how much home you can afford to buy… Buying a home involves lots of decisions…

· condo or single family?

· big or small?

· inner city or suburban?

· new or old?

But the biggest and most important decision is: how much can I afford? If you are looking for a top-notch mortgage broker in Mississauga call us at, 416-451-4158.

Mississauga mortgage broker reveals 7 things you need to know about buying a new construction home….

Ok, today we are going to talk key things to know about buying a new construction home…Buying a new construction home offers many advantages customization, energy efficiency, no worn-out systems to replace.But sometimes it’s not as simple as buying an existing home. If you are looking for a top-notch mortgage broker in Mississauga call us at, 416-451-4158.

Ok, today we are going to talk about when the best days and months of the year are to list your home… If you’re thinking of selling your home, there’s never a bad time of year, but there certainly are perks to selling in the spring. Spring is usually the best time of year, and a recent survey gets even more specific, providing the best time to list, right down to time of day. Check it out to learn more… If you are looking for a top-notch mortgage broker in Mississauga call us at, 416-451-4158.

Ok, today we are going totalk about how to buy a house in a seller’s market…In a seller’s market—whenthere are more buyers than homes for sale—it’s not easy to get your offer accepted.Sellers may have so many options that they prefer to accept only unconditional offers that eliminate delays or possible hiccups.