Los mejores videos

Ok, today we are going to talk about 3 things you need to do before house hunting… Finding for your dream home is a lot easier if you get your finances in shape before you start looking. If you’re thinking about buying within the next year, now’s the perfect time to start preparing. Here are the first 3 steps to take before house hunting… If you are looking for a top-notch President in South Easton call us at, 508-274-8072

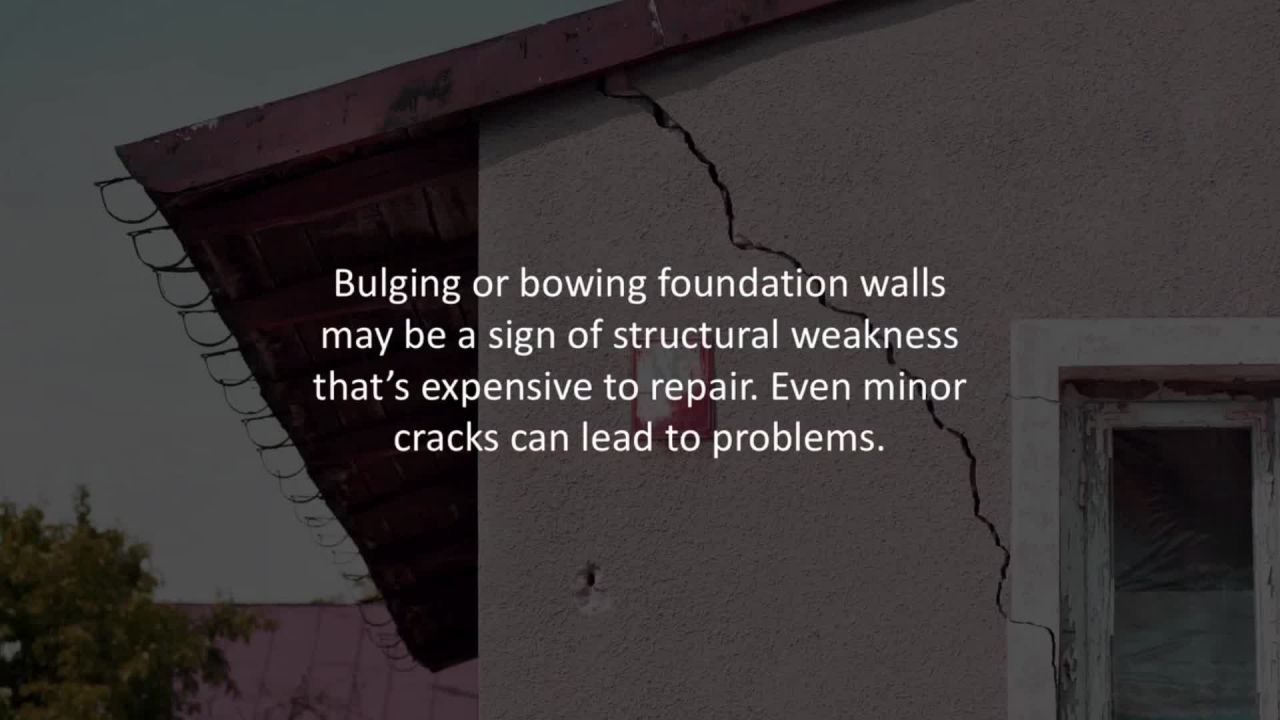

Ok, today we are going to talk about 5 things to look for and be aware of if they get noted in your home inspection… As any good Realtor will advise you, don’t even think about buying a house without a home inspection. Before you get emotionally attached to a home, invest a few hundred dollars in a thorough, professional home inspection. And if your report includes any of the following issues, consider walking away. Here are 5 home inspection red flags… If you are looking for a top-notch President in South Easton call us at, 508-274-8072

Welcome to Real Estate Marketing Sin #4. Most Realtors believe -- either consciously or unconsciously -- that once you "close the deal" and the client walks out the door, then the deed is done and you just move on to the next prospect. What they don't realize is that their next prospect might have just walked out the door! Most Realtors tend to be "hunters" instead of "harvesters". Top producers, on the hand, understand the importance of both. They understand that a new customer typically costs 5 to 10 times more than a repeat customer. That's why they focus on getting 60% to 70% of their business from their existing client database through referrals and repeat business -- and you should too! Here's how they do it... For more information call us at, 508-274-8072

Rocklin Mortgage Loan Originator reveals7 tips for using a budget tracking app to manage your financ

Today we are going to talk about how to use budget tracking apps but stay safe doing it… Budget tracking apps like Quicken and mint.com can be a great way to manage household finances. But considering all the personal financial information you enter into these apps, are they safe to use? Most experts agree the apps are generally safe; it’s the people using them who pose the greatest risk. Here are 7 tips for using a budget tracking app (while keeping your info safe)…If you are looking for a top-notch mortgage loan originator in Rocklin call us at, 916-316-2386

Ok, today we are going to talk about how to rebuild your finances if you’ve suffered from financial abuse… Being in an unhealthy relationship could be emotionally, physically, or even financially damaging. And according to recent statistics, 99% of domestic violence also includes financial abuse. Here’s what to do if you’re in a financially abusive situation, or if you’re recovering from one…If you are looking for a top-notch mortgage loan originator in Rocklin call us at, 916-316-2386

Ok, today we are going to talk about how to maximize the sale price of your home… Selling your home isn’t as simple as putting up a For Sale sign. There are many things to do in advance to prepare yourself financially and make sure your home sells for top dollar. Here are 5 ways to maximize the sale price of your home…If you are looking for a top-notch mortgage loan originator in Rocklin call us at, 916-316-2386

Ok, today we are going to talk about 4 risks of home equity loans… A home equity loan lets you borrow some of the equity you’ve built up in your home. For most people home equity loans are a convenient, affordable way to access extra cash. But they’re not without risk. Here are 4 things to consider before applying for a home equity loan…If you are looking for a top-notch mortgage loan originator in Rocklin call us at, 916-316-2386

Ok, today we are going to talk about how much home renovations can cost… Renovations can help make your home more comfortable and easier to sell. But depending on what you’re planning, they can also be expensive. To help you budget for your next project, the HomeAdvisor website has published a list of typical costs for renovation projects. Here’s a list of the most common renos and how much they cost…If you are looking for a top-notch mortgage loan advisor in Miami call us at, 786-338-3844

Ok, today we are going to talk about how to start investing… Obviously, there are several things to take care of before you can start investing. You need to cover rent or mortgage payments, monthly bills, groceries, etc., and you also need some money set aside for emergencies. But once you’ve accomplished that, it’s time to start investing for the future. Here are 5 steps to help you start investing…If you are looking for a top-notch mortgage loan advisor in Miami call us at, 786-338-3844

Ok, today we are going to talk about 5 things you need to know about foreclosures… Heaven forbid, you get several months late on mortgage payments, your lender’s last resort is to initiate foreclosure. This is a lengthy and expensive process for your lender, but its impact on you can be even more negative. Here’s 5 facts you need to know about the foreclosure process…If you are looking for a top-notch mortgage loan advisor in Miami call us at, 786-338-3844

Today we are going to talk about how to use budget tracking apps but stay safe doing it… Budget tracking apps like Quicken and mint.com can be a great way to manage household finances. But considering all the personal financial information you enter into these apps, are they safe to use? Most experts agree the apps are generally safe; it’s the people using them who pose the greatest risk. Here are 7 tips for using a budget tracking app (while keeping your info safe)…If you are looking for a top-notch mortgage advisor in Roseville call us at, 909-213-5909.

Ok, today we are going to talk about the 9 questions to ask your Realtor before you list your home with them… Finding and selecting a Realtor is an important step in the selling process. Recent data suggests that “For Sale by Owner” houses sell for about 25% less than houses sold by Realtors. To find the Realtor who’ll work best for you, interview two or three and ask them important things about their work experience, past sales, qualifications, etc. Here are 9 questions to ask your Realtor before you list…If you are looking for a top-notch mortgage advisor in Roseville call us at, 909-213-5909.

Here's an interesting question for you.... What’s the #1 factor that separates Top-Producers from the mediocre majority? Chances are you already intuitively know the answer. It's all about how they invest their time! You see, everyone has 24 hours per day. The difference between the top achievers and all the rest is how they use it. Here's how Top-Producers use their time... For more information call us at, 786-338-3844

Today we are going to talk about how to buy a house that’s not on the market… In a competitive real estate market, it may be difficult to find the house you’re looking for. And when you finally find it, you could be outbid by another buyer. That’s why many buyers are looking for homes BEFORE they’re listed. Here’s how to buy a house that’s not yet listed on the market…If you are looking for a top-notch mortgage advisor in Roseville call us at, 909-213-5909.

Ok, today we are going to talk about how to manage your finances during a recession… Nobody welcomes a recession. But if you’re among the fortunate majority that still has an income and a home, a recession can actually be a time of valuable learning and growth. Here are 5 ways to manage your finances during a recession…If you are looking for a top-notch mortgage advisor in Roseville call us at, 909-213-5909.

Ok, today we are going to talk about the expense of hiring a real estate agent and if it’s really worth it to you… When you’re selling a home, so much money is at stake, you can’t afford to make a mistake. That’s why over 90% of buyers and sellers work with a Realtor. But let’s face it, Real estate commissions are expensive. Are Realtors really worth it? Here’s what good Realtors do to earn every penny of their commissions…If you are looking for a top-notch mortgage advisor in Roseville call us at, 909-213-5909.

Ok, today we are going to talk about basic home maintenance you should be doing yearly, every 5-10 years and onward… Ongoing expenses like mortgage payments, property taxes and insurance are an expected part of homeownership. But there’s an additional ongoing expense you also need to budget for… And that is regular homeownership maintenance expenditures. On average, annual maintenance will cost 1% - 3% of your home’s purchase price. However, this can be reduced by maintaining regular preventative maintenance. Here’s your complete maintenance checklist…If you are looking for a top-notch mortgage advisor in Roseville call us at, 909-213-5909.

St. Augustine Mortgage Loan Officer reveals 5 simple things you can do to your home to instantly boo

Ok, today we are going to talk about 5 simple things you can do to your home to instantly boost the price when it hits the market… You don’t have to hire a professional stager to prepare sell your home. With a little guidance from a Realtor and a few simple touches, your home’s value can increase instantly. Here are 5 things you can do that can help you boost your asking price…If you are looking for a top-notch mortgage loan officer in St. Augustine call us at, 786-351-5051

St. Augustine Mortgage Loan Officer reveals 4 pitfalls to avoid when moving from the city to the sub

Ok, today we are going to talk about what to be aware of before moving from the city to the suburbs… For the young and single, the inner city has strong appeal. But as soon as there are kids, many couples are drawn to the suburbs. Less crowds and more open spaces become more enticing. If you don’t want to sacrifice quality of life, choose the suburb carefully. Here are 4 pitfalls to avoid when moving from the city to the suburbs…If you are looking for a top-notch mortgage loan officer in St. Augustine call us at, 786-351-5051

Have you ever wondered why some Realtors always seem to be in the right place at just the right time to win the listing or close the deal? In today's 7th secret of Superstar Realtors, you'll learn why it's no fluke. Here’s how they do it... For more information call us at, 786-351-5051