Latest videos

As any good real estate professional will tell you,setting the right price for a home is a mix of technical knowledge and intuition. Realtors have to rely on their experience, knowledge and feel for the market. But there’s more to it than that.Here are 4 factors that smart Realtors rely on to set the right listing price… If you're looking for a top-notch mortgage advisor in Houston, Call us at 830-313-5500

Ok, today we are going to talk about the pros and cons of house flipping.It’s possible to make a lot of money by flipping properties. But it’s not as easy as it sounds, and there are just as many pitfalls as there are rewards. Here are 4 pros and cons of house flipping… If you're looking for a top-notch mortgage advisor in Houston, Call us at 830-313-5500

Ok, today we are going to talk about 4 ways to get the lowest possible refinance rate…If you’re thinking about refinancing, there are ways to make your rate even lower than you think. Here are 4 ways to make sure you get the lowest possible refinance rate… If you're looking for a top-notch mortgage advisor in Houston, Call us at 830-313-5500

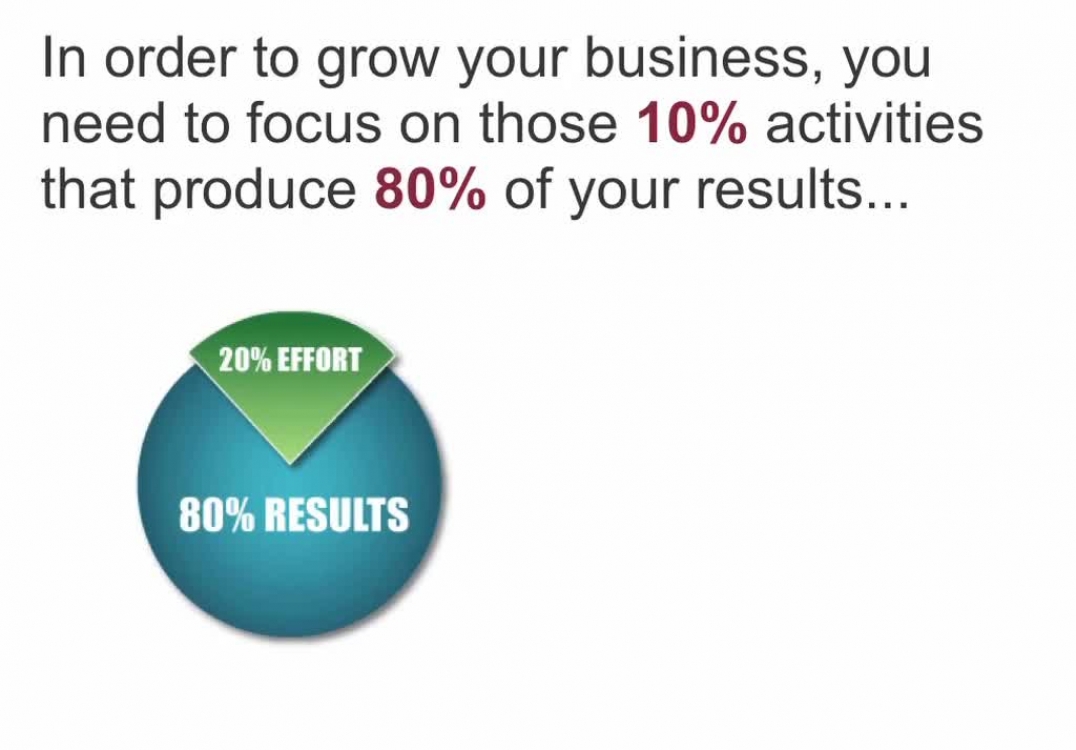

You've heard it before... In order to grow your business,

you need to focus on those 10% activities (like your marketing)

that produce 80% of your results...

But if all that "high leverage" stuff is so important...

How can you earn more of WITHOUT working more hours?

Here's the answer...

For more information, please call us at (503) 910-4976 or visit tracybellelends.com.

Everyone has 24hrs per day, 365 days per year. Some Realtors use that time to make $30k per year, others use it to make $300k per year. What's the difference? What do top producers know that the mediocre majority don't?

The secret to success is found in your daily agenda -- it comes down to how you use your TIME. Top producers INVEST it, low producers WASTE it. Show me your daily routine and I can predict your bank balance.

Sure, you may be “busy”, but are you productive? Are you achieving the results you want? Let’s not confuse ACTIVITY with PRODUCTIVITY.

With that in mind, I just loaded a new video that reveals...

How to cut the clutter and focus on what works…

I hope you find this helpful. Enjoy! :-)

For more information, please call us at (503) 910-4976 or visit tracybellelends.com.

According to recent surveys, there is ONE thing that homebuyers

are looking for more than anything else. In fact, this ONE thing

can make or break your online marketing success.

Here's the #1 thing every homebuyer wants to see...

For more information, please call us at (503) 910-4976 or visit tracybellelends.com.

Welcome to the final video in our brand new 5-part video

series titled, "TRUST: How to Earn it, Grow It and Use It

to Skyrocket Your Sales."

Today I’m giving you…

• 3 proven methods for driving traffic to your testimonial

capture page

• The anatomy of a killer-effective “testimonial magnet”

email campaign designed to get more of your clients to

send you rave reviews. And last but not least...

• 7 ways to profit from your testimonials once you get them

so you can milk them for all they’re worth.

Learn the 7 ways to profit from testimonials here...

For more information, please call us at (503) 910-4976 or visit tracybellelends.com.

Before you consider refinancing your existing mortgage, it's important for you to determine the break-even point, which represents how soon the cost of the refinance will be recaptured through lower monthly payments. The answer to this question depends on multiple factors. See the factors here. If you're looking for a top-notch loan officer in Salem, call us at (503) 910-4976.

Let’s face it, debt isn’t a financial problem, it’s a behavior problem. So becoming debt-free takes more than sound financial strategies, it takes a mindset shift that establishes new wealth-building habits. Here’s the fastest, easiest way to become debt free. If you're looking for a top-notch loan officer in Salem, call us at (503) 910-4976.

Ok, today we are going to talk about the most common questions homebuyers ask about mortgages. For most of us, shopping for our dream home is the fun part. So what’s the not-so-fun part? It’s usually when things get complicated trying to arrange financing. (After all, it can be confusing!) Here are answers to 5 of the most common mortgage questions. If you're looking for a top-notch loan officer in Salem, call us at (503) 910-4976.

Ok, today we are going to talk about 5 mistakes to avoid when buying a home. Buying a home can be exciting, stressful, easy or difficult depending on the market, time of year, etc. But no matter when or where you buy, you can still encounter challenges if you’re not prepared. Here are 5 common mistakes to avoid when buying a home. If you're looking for a top-notch loan officer in Salem, call us at (503) 910-4976.

Ok, today we are going to talk about 4 ways to sell your house quick, without compromising on a fair price… In most markets, spring is the #1 time of year for selling homes and fall comes in at #2. But no matter when you’re planning to sell your home, don’t despair! Here are 4 ways to sell your house quickly…If you're looking for a top-notch mortgage advisor in Houston, Call us at 830-313-5500

Welcome to Realtor Referral Mistake #4.

In today's video tip, you'll learn why most Realtors'

referrals are inconsistent, unreliable and unpredictable.

As a result, their income goes up and down like a Yo-Yo.

Can you relate? Welcome to the club.

It's not your fault. Chances are, no one ever took the time

to teach how to build a steady, consistent flow of referrals.

That is, until now. :)

Here's how Top Producers generate referrals at will...

For more information, please call us at (713) 961-5363 or visit www.thespiegelgroup.net.

Welcome to Realtor Referral Mistake #3.

In today's video tip, you'll discover the critical "X" factor that

has the power to instantly transform "happy clients" into

"raving fans" and "evangelists". It's a game-changer.

You'll also learn the the guarded secret Top Producers use to

stimulate referral frenzies, almost at will.

Here's why "happy clients" still don't send you referrals...

For more information, please call us at (713) 961-5363 or visit www.thespiegelgroup.net.

Welcome to Realtor Referral Mistake #2.

In today's video tip, you're going to learn why most

Realtors are unwittingly sabotaging their "referrability"

and therfore, leaving thousands of dollars on the table.

It also explains why most Realtors get WAY less referrals

than they'd like or even feel like they deserve.

HINT: It's not because of bad B.O. or halitosis. :)

Here's why "great service" doesn't get you referrals...

For more information, please call us at (713) 961-5363 or visit www.thespiegelgroup.net.

How would you like to attract more sizzling, red-hot

referrals from your past clients?

Well, you'll be glad to know I just put together a brand

new 6-part video series for you titled, "6 Deadly Mistakes

That Kill Your Referrals" that teaches how to do exactly

that -- become a referral magnet.

By avoiding these six costly mistakes and implementing

effective "referral systems" you can literally skyrocket

your referrals almost overnight.

OK, enough prelude already.

Here's the very first Referral Mistake to avoid...

For more information, please call us at (713) 961-5363 or visit www.thespiegelgroup.net.

Before you consider refinancing your existing mortgage, it’s important for you to determine the break-even point, which represents how soon the cost of the refinance will be recaptured through lower monthly payments. The answer to this question depends on multiple factors. Here's what you need to know before refinancing. If you're looking for a top-notch loan officer in Houston, call us at (713) 961-5363 or visit www.thespiegelgroup.net.

We’ve all heard about the wealth accumulation rule called “pay yourself first”. But billionaire Sir John Templeton had an even more powerful idea called the 50/50 rule. Here's the Billionaire Wealth Secret. If you're looking for a top-notch loan officer in Houston, call us at (713) 961-5363 or visit www.thespiegelgroup.net.

Get ready – today we’re about to shatter a few common refinancing myths that may shock you. Refinancing your mortgage can save you money, give you more flexibility and free up cash for other projects. But many people hesitate to even inquire about refinancing because they’ve bought into these common myths. Here are 6 common refinancing myths every homeowner needs to know. If you're looking for a top-notch loan officer in Houston, call us at (713) 961-5363 or visit www.thespiegelgroup.net.

Today we're going to talk about how to save for a down payment. Back in the day, you could buy a big house for $100,000. But now it seems like that’s just the price for the down payment. Most of the time, your down payment will be 20%. So on a $500,000 house, that’s $100,000 down! Even a $300,000 condo would require a $60,000 down payment. Here are 5 ways to save for a down payment. If you're looking for a top-notch loan officer in Houston, call us at (713) 961-5363 or visit www.thespiegelgroup.net.