Mortgage

Have you ever wondered how seemingly unknown

Realtors have positioned themselves as the #1 choice

in their niche in a short period of time?

Here is one of their secrets for making it happen...

In next week's 16th secret, you'll discover a powerful

marketing secret Superstar Realtors use to consistently

overcome their prospect's fear and skepticism.

This one strategy could at least DOUBLE your

prospect-to-closing conversion ratio.

Stay tuned...

For more information, please call us at ((813) 420-3887 or visit www.marketprime.com.

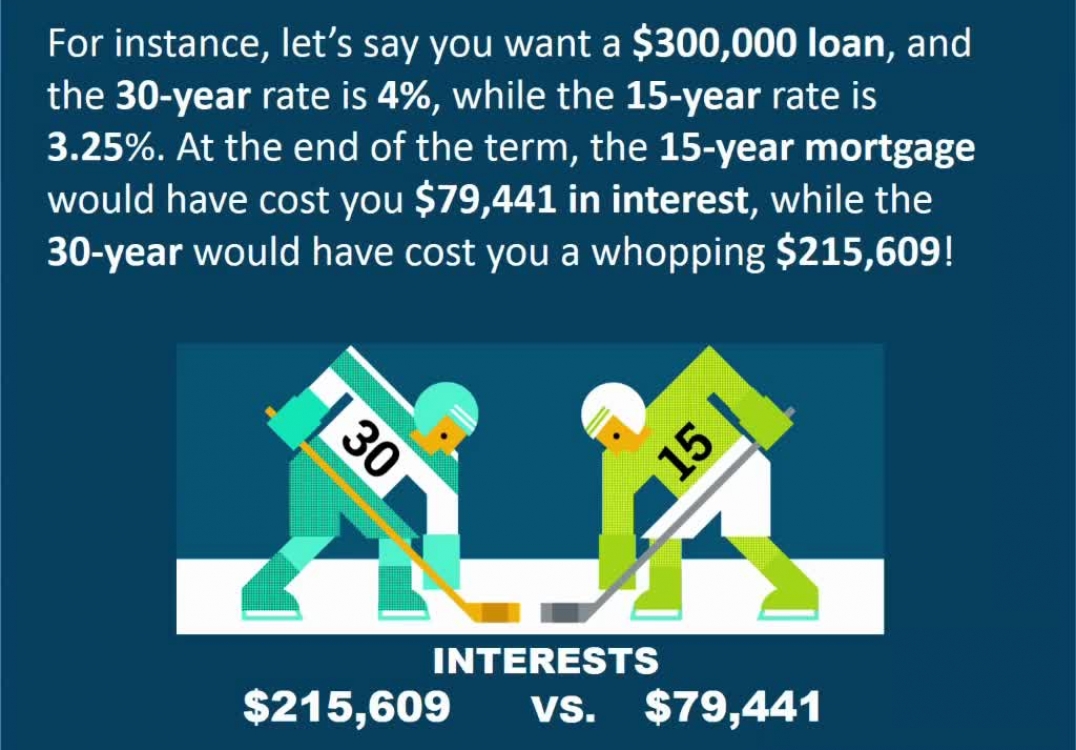

OK, today we’re going to talk about the BIG “A” word… AMORTIZATION that is! The length of time it takes you to pay off your entire mortgage is called the amortization. But don’t fall prey to the misconception that a longer amortization is better. In most cases, the opposite is true. Here’s what every homeowner needs to know. If you're looking for a top-notch mortgage lender in Tampa, call us at ((813) 420-3887.

Ok, today we are going to talk about when an all-cash offer is the right move. Surprisingly, lots of people make all-cash offers on houses.According to one study, up to 29% of single-family home and condo purchases in 2017 were all-cash. Here are the advantages and disadvantages to purchasing a home with all cash. If you're looking for a top-notch mortgage lender in Tampa, call us at ((813) 420-3887.

OK, let's talk about your retirement for a moment. It’s easy to assume there’s an endless list of things standing between you and a secure retirement,

including volatile stock markets, stagnant household income, adult children living at home, etc. But in reality, none of those things are as destructive

to your retirement savings as what I'm about to show you next. Here are 3 threats to a secure retirement. If you're looking for a top-notch mortgage lender in Tampa, call us at ((813) 420-3887.

Ok, today we are going to talk about 3 important steps every borrower should know (and take) before applying for a mortgage. Buying a home and applying for a mortgage—especially if you’ve never done it before—can be scary and complicated. There are so many things to consider. Here are 3 important steps to take when applying for a mortgage. If you're looking for a top-notch mortgage lender in Tampa, call us at ((813) 420-3887.

Ok, today we are going to talk about 5 mistakes to avoid when buying a home… Buying a home can be exciting, stressful, easy or difficult depending on the market, time of year, etc. But no matter when or where you buy, you can still encounter challenges if you’re not prepared. Here are 5 common mistakes to avoid when buying a home… If you are looking for a top-notch loan originator in Davie call us at, 954-907-8963.

Ok, today we are going to talk about how to throw the perfect backyard party this summer. Having the party in the backyard will simplify house cleaning and menu planning. Here’s how to pull it all together in 10 simple steps… If you are looking for a top-notch loan originator in Davie call us at, 954-907-8963.

Ok, today we’re going to talk about how to keep your kids’ out of debt… The last time I checked, the average student’s debt is currently almost $30,000, and it’ll be even higher by the time your kids graduate! The truth is most young people—and often their parents —can’t afford that kind of debt, so it ends up damaging their credit rating and ability to buy a house and raise a family. Of course, the best way to prevent such problems is to avoid massive student debt in the first place. Here are 5 tips to avoid student loan debt… If you are looking for a top-notch loan originator in Davie call us at, 954-907-8963.

Retirement may be years or decades away. But the only way to ensure a comfortable retirement is to start planning today. Here are 5 steps to a comfortable retirement… If you are looking for a top-notch loan originator in Davie call us at, 954-907-8963.

Ok, today we are going to talk about 4 ways to get the lowest possible refinance rate… If you’re thinking about refinancing, there are ways to make your rate even lower than you think. Here are 4 ways to make sure you get the lowest possible refinance rate… If you are looking for a top-notch loan originator in Davie call us at, 954-907-8963.

We’ve all heard the stories of massive cost overruns, missed deadlines, shoddy work. No wonder so many people are afraid of renovations. But avoiding such nightmares isn’t difficult. All you have to do is some upfront legwork. Here are 4 things you can do to avoid renovation nightmares… If you are looking for a top-notch loan originator in Davie call us at, 954-907-8963.

OK, we’re going to talk about a simple – yet profound – principle that can transform your health and your wealth over time… It’s called the “apple-a-day” principle. Here’s how it works… If you are looking for a top-notch loan originator in Davie call us at, 954-907-8963.

OK, let's talk about your retirement for a moment... It’s easy to assume there’s an endless list of things standing between you and a secure retirement, including volatile stock markets, stagnant household income, adult children living at home, etc. But in reality, none of those things are as destructive to your retirement savings as what I'm about to show you next... Here are 3 threats to a secure retirement... If you are looking for a top-notch loan originator in Davie call us at, 954-907-8963.

Let’s face it, debt isn’t a financial problem, it’s a behavior problem. So becoming debt-free takes more than sound financial strategies, it takes a mindset shift that establishes new wealth-building habits. Here’s the fastest, easiest way to become debt free. If you're looking for a top-notch mortgage advisor in San Juan Capistrano, call us at (949) 916-9608.

Ok, today we are going to talk about how Airbnb income will help you qualify for mortgage refinancing. Are you renting your home through Airbnb? Or ever thought about it? You might after you read about some of the perks you can get when it comes to refinancing or getting a second mortgage. Here are 6 tips for using Airbnb income when applying for a mortgage. If you're looking for a top-notch mortgage advisor in San Juan Capistrano, call us at (949) 916-9608.

OK, today we’re going to talk about how to get SMART with MONEY... If you’re like most people, you spend a lot of time worrying about money. But worry only makes things worse. Here are 4 common money challenges (and ways to take the worry out of them)… If you are looking for a top-notch loan originator in Davie call us at, 954-907-8963.

OK, today we’re going to talk about the BIG “A” word… AMORTIZATION that is! The length of time it takes you to pay off your entire mortgage is called the amortization. But don’t fall prey to the misconception that a longer amortization is better. In most cases, the opposite is true. Here’s what every homeowner needs to know…. If you are looking for a top-notch loan originator in Davie call us at, 954-907-8963.

Ok, today we are going to talk about when an all-cash offer is the right move… Surprisingly, lots of people make all-cash offers on houses. According to one study, up to 29% of single-family home and condo purchases in 2017 were all-cash. Here are the advantages and disadvantages to purchasing a home with all cash… If you are looking for a top-notch loan originator in Davie call us at, 954-907-8963.

Ok, today we are going to talk about 4 home improvement jobs that are difficult to do yourself. Doing home improvement projects yourself can save a lot of money and provide a sense of accomplishment. But some DIY projects can go terribly wrong, leading to wasted time, extra expenses, and friction between loved ones. Here are 4 home improvement projects that are risky to take on yourself. If you're looking for a top-notch mortgage advisor in San Juan Capistrano, call us at (949) 916-9608.

Buying your first home isn’t as simple as visiting a few realtor open houses. What you do before you start shopping can help ensure you make a decision you can comfortably live with for years! Here are 3 essential steps to take before going home shopping. If you're looking for a top-notch mortgage advisor in San Juan Capistrano, call us at (949) 916-9608.