Top videos

Ok, today we are going to talk about what a stratified market is and what it means to you… If you’re planning to buy or sell a house, you’re probably already familiar with the terms “buyer’s market” and “seller’s market.” In a buyer’s market, there are more homes than buyers, so prices drop and buyers get better deals. In a seller’s market there are more buyers than homes, so prices rise and sellers make more money. But there’s a third type of market, and it’s called a stratified market. Here’s what you need to know… If you are looking for a top-notch mortgage consultant in Eagan, call us at 651-271-4413.

Ok, today we are going to talk about when the best time to do certain updates on your home is… Timing renovations can be tricky. The sooner you remodel, the longer you have to enjoy your beautiful new home. But if you remodel too far in advance of selling, everything’s going to look outdated by the time you list your home. Here’s a yearly schedule broken down that will help you know when to update what… If you are looking for a top-notch mortgage consultant in Eagan, call us at 651-271-4413.

Ok, today we are going to talk about how to maximize the sale price of your home… Selling your home isn’t as simple as putting up a For Sale sign. There are many things to do in advance to prepare yourself financially and make sure your home sells for top dollar. Here are 5 ways to maximize the sale price of your home… If you are looking for a top-notch mortgage consultant in Eagan, call us at 651-271-4413.

Ok, today we are going to talk about 4 risks of home equity loans… A home equity loan lets you borrow some of the equity you’ve built up in your home. For most people home equity loans are a convenient, affordable way to access extra cash. But they’re not without risk. Here are 4 things to consider before applying for a home equity loan… If you are looking for a top-notch mortgage consultant in Eagan, call us at 651-271-4413.

Ok, today we are going to talk about how to pay off your credit card so you can live a stress-free future… If you’re like most people, emergencies, illnesses, job losses or more can put a dent in your credit cards. To make matters worse, most credit cards have high interest rates that make them difficult to pay off. But paying off your cards is exactly what you need to do to achieve a secure and stress-free financial future. Here are 6 tips for paying off your credit cards…If you are looking for a top-notch mortgage loan consultant in Pelham call us at, (205) 296-8802.

Ok, today we are going to talk about how to save money renovating your home… Renovating can add comfort, convenience and value to your home. But renovations are often pricey. Here are 5 tips for updating your home without blowing your budget…If you are looking for a top-notch mortgage loan consultant in Pelham call us at, (205) 296-8802.

Ok, today we are going to talk about how to build your savings up FAST! Have an unexpected financial need? Rather than borrowing or putting it on your credit card—which just makes your financial situation worse—consider accelerated saving. Here are 7 ways to accelerate your savings…If you are looking for a top-notch mortgage loan consultant in Pelham call us at, (205) 296-8802.

Ok, today we are going to talk about when the best time to do certain updates on your home is… Timing renovations can be tricky. The sooner you remodel, the longer you have to enjoy your beautiful new home. But if you remodel too far in advance of selling, everything’s going to look outdated by the time you list your home. Here’s a yearly schedule broken down that will help you know when to update what…If you are looking for a top-notch mortgage loan consultant in Pelham call us at, (205) 296-8802.

Ok, today we are going to talk about how to maximize the sale price of your home… Selling your home isn’t as simple as putting up a For Sale sign. There are many things to do in advance to prepare yourself financially and make sure your home sells for top dollar. Here are 5 ways to maximize the sale price of your home…If you are looking for a top-notch mortgage loan consultant in Pelham call us at, (205) 296-8802.

Ok, today we are going to talk about how to build your savings up FAST! Have an unexpected financial need? Rather than borrowing or putting it on your credit card—which just makes your financial situation worse—consider accelerated saving. Here are 7 ways to accelerate your savings…If you are looking for a top-notch mortgage agent in Haileybury call us at, (905) 809-9160.

Ok, today we are going to talk about how to finance a new home build… If you’re looking for a home that offers the latest energy efficiencies, low maintenance costs, and every amenity and convenience your family desires, maybe you should consider building new. Just keep in mind that financing new construction is a little more complicated. Here’s what you need to know…If you are looking for a top-notch mortgage agent in Haileybury call us at, (905) 809-9160.

With few exceptions, some of the first words we learn as kids are “Please” and “Thank you”. As parents, we're constantly reminding our kids to say these words because as a culture, we tend to be repelled by people who lack social graces. If showing appreciation is such an integral part of human interaction, how might you use appreciation to differentiate yourself and improve your marketing results? Here's how... For more information call us at, (205) 296-8802.

Here's an interesting question for you.... What’s the #1 factor that separates Top-Producers from the mediocre majority? Chances are you already intuitively know the answer. It's all about how they invest their time! You see, everyone has 24 hours per day. The difference between the top achievers and all the rest is how they use it. Here's how Top-Producers use their time... For more information call us at, (205) 296-8802.

Welcome to the final video in our brand new 5-part video series titled, "TRUST: How to Earn it, Grow It and Use It to Skyrocket Your Sales." Today I’m giving you… • 3 proven methods for driving traffic to your testimonial capture page • The anatomy of a killer-effective “testimonial magnet” email campaign designed to get more of your clients to send you rave reviews. And last but not least... • 7 ways to profit from your testimonials once you get them so you can milk them for all they’re worth. Learn the 7 ways to profit from testimonials here... For more information call us at, (205) 296-8802.

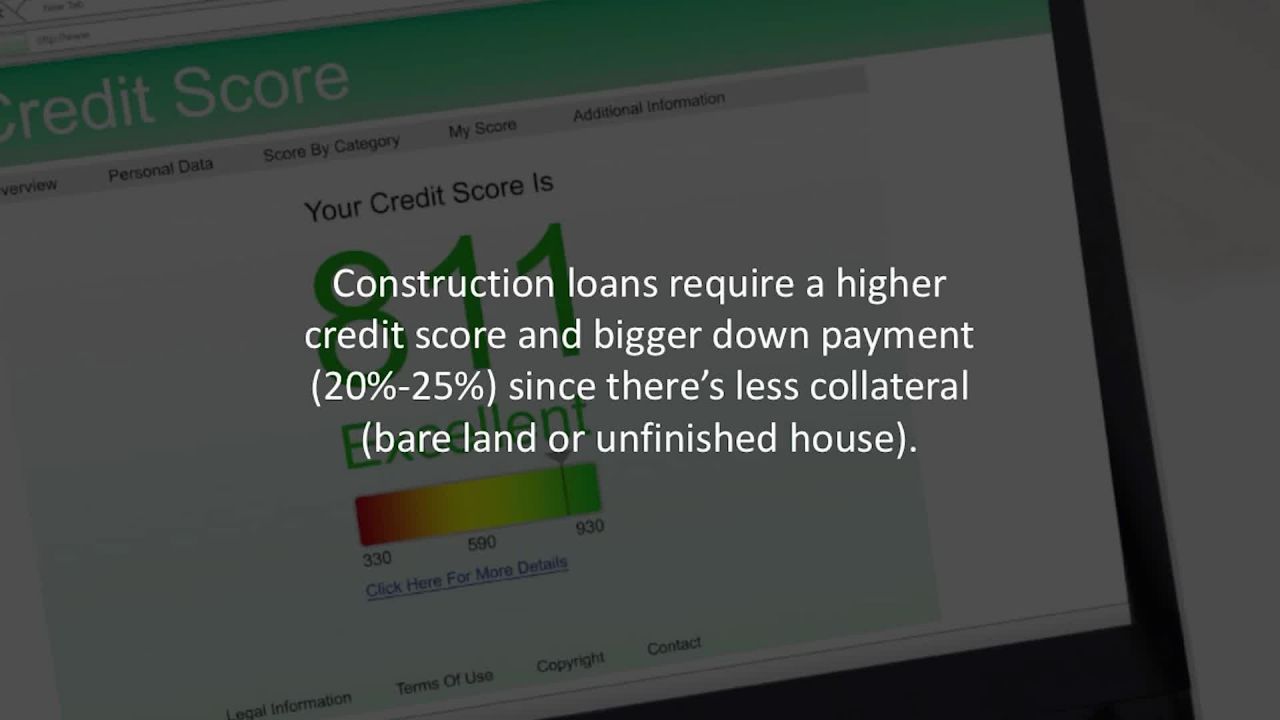

Ok, today we are going to talk about how to convert a construction loan into a traditional mortgage… If you’re planning to build a house or do a major renovation, you usually can’t qualify for a traditional mortgage because there’s no existing home to use as collateral. What you need is a construction loan, which is based on the projected future value of the completed property. Generally, construction loans are interest-only while the house is being built. Then when construction is complete, you refinance into a regular mortgage. Here’s how the process works…If you are looking for a top-notch mortgage agent in Haileybury call us at, (905) 809-9160.

Welcome to Real Estate Marketing Sin #7. When it comes to effective Realtor marketing, there are 3 keys to success: 1. The right market - the people who are most likely to need, want and pay for your services 2. The right message - that hits the hot buttons of your target market and elicits response 3. The right media - that delivers your message to the highest concentration of your target message If any one of these 3 critical components is missing from your marketing plan, your results will suffer. Here's how you can supercharge your results... For more information call us at, (905) 809-9160.

Welcome to the 2nd secret of Superstar Realtors. In today's secret, you'll learn how to market with the dignity and respect you deserve. Watch the 2nd secret here... Christine Walsh, Realtor Marketing, Hailebury, ON

Ok, today we are going to talk about 10 factors that determine your home’s value… Coming up with the right price for your home is a science. It’s not based on how much you love your home or how much money you need to get out of it. It’s based on what a potential buyer is willing to pay for a home like yours in the current market. Here are 10 factors that determine your home’s worth…If you are looking for a top-notch mortgage agent in Haileybury call us at, (905) 809-9160.

Have you ever heard someone say I run my business "By Referral ONLY"? Well, today's controversial message will reveal why that is the absolute worst strategy for building a stable business with a rock-solid income stream! Don't believe me? Take a moment and watch to today's video and you'll discover the key to consistently growing your income -- even in a down market... For more information call us at, (905) 809-9160.

In last week's video, we talked about the importance of building TRUST EQUITY with your prospects, clients and referral partners... ...and highlighted the Top 10 Ways People Know You're a Dangerous Salesman to Be Avoided. Now the pregnant question is... how do we build more TRUST EQUITY? Here are 7 “Trust Builders” Every Realtor Needs to Know... For more information call us at, (905) 809-9160.