Top Videos

Purchasing a house is a big step. Here are 7 Factors for Choosing the Right Home at the Right Price. If you're looking for top-notch Mortgage Advisor in Concord, call us at (416) 342-1480.

OK, today we are going to talk about the pros and cons of house flipping.It’s possible to make a lot of money by flipping properties. But it’s not as easy as it sounds, and there are just as many pitfalls as there are rewards. Here are 4 pros and cons of house flipping. If you're looking for top-notch Mortgage Advisor in Concord, call us at (416) 342-1480.

OK, today we’re going to talk about how you can change your life by getting comfortable with being uncomfortable…Imagine what would happen if you kept your workouts to the same easy exercises you’ve done a million times before. Your strength certainly wouldn’t increase much, would it?Which is why, if we want to get stronger, we have to push ourselves beyond our comfort level with new exercises and more reps.It’s the same in the rest of your life. Here’s how to create your breakthrough. If you're looking for a top-notch Loan Officer in Watsonville, Call us at (831) 535-3954

Ok, today we are going to talk about 4 home improvement jobs that are difficult to do yourself…Doing home improvement projects yourself can save a lot of money and provide a sense of accomplishment. But some DIY projects can go terribly wrong, leading to wasted time, extra expenses, and friction between loved ones. Here are 4 home improvement projects that are risky to take on yourself…If you're looking for a top-notch Loan Officer in Watsonville, Call us at (831) 535-3954

Ok, today we are going to talk about how to throw the perfect backyard party this summer. Having the party in the backyard will simplify house cleaning and menu planning.If you're looking for a top-notch Loan Officer in Watsonville, Call us at (831) 535-3954

Ok, today we are going to talk about everything you need to know about closing costs. Buying a hom.e involves more expenses than just the price of the property itself. One category of expenses that most people forget to budget for is closing costs. Here are 8 closing costs every homebuyer needs to know. If you're looking for a top-notch Loan Officer in Watsonville, Call us at (831) 535-3954

Ok, today we are going to talk about the pros and cons of house flipping.It’s possible to make a lot of money by flipping properties. But it’s not as easy as it sounds, and there are just as many pitfalls as there are rewards. If you're looking for a top-notch Loan Officer in Watsonville, Call us at (831) 535-3954

Ok, today we are going to talk about three easy, but crucial repairs you must make before selling your home.Making your house as presentable as possible is the best way to achieve a quick and profitable sale. However, you don’t have to make expensive repairs that will force you to raise your asking price.Often, inexpensive but highly-noticeable improvements—combined with good staging—will get you the buyers and sale you want.If you're looking for a top-notch Loan Officer in Watsonville, Call us at (831) 535-3954

Ok, today we are going to talk about how you can spice up and add value to your kitchen without doing a complete renovation.If you're looking for a top-notch Loan Officer in Watsonville, Call us at (831) 535-3954

Ok, today we’re going to talk about what you need to know BEFORE you break out of your mortgage.If you're looking for a top-notch Loan Officer in Watsonville, Call us at (831) 535-3954

Retirement may be years or decades away. But the only way to ensure a comfortable retirement is to start planning today.If you're looking for a top-notch Loan Officer in Watsonville, Call us at (831) 535-3954

It’s no coincidence that most wealthy people got rich by owning real estate. After all, real estate is the #1 millionaire-maker in the world! Here are 7 ways to create wealth with real estate. If you're looking for top-notch Mortgage Advisor in Concord, call us at (416) 342-1480.

Ok, today we are going to talk about a few ways to save money in under 30 minutes. After all, saving money doesn’t have to be time-consuming. Here are 5 quick and easy ways to start saving right now. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

Ok, today we are going to talk about the added costs that most homebuyers don’t realize when purchasing a home. Your home is probably the biggest purchase you’ll ever make. But the expenses don’t stop with the price. Here are some additional costs you need to budget for. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

Ok, today we are going to talk about saving for a down payment and how to know when you can afford to buy a home. Experts say the cheapest, most efficient way to buy a house is to make a 20% down payment. But today, that’s a huge amount of money! Here are 4 factors to consider when determining if you can afford to buy. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

OK, today we’re going to do something a little different. Regardless of what you want to accomplish in life, there is ONE critical ingredient to your success that you can’t ignore. In fact, it’s the “secret sauce” that separates the world’s GREAT ACHIEVERS from all the rest.If you're looking for a top-notch Loan Officer in Watsonville, Call us at (831) 535-3954

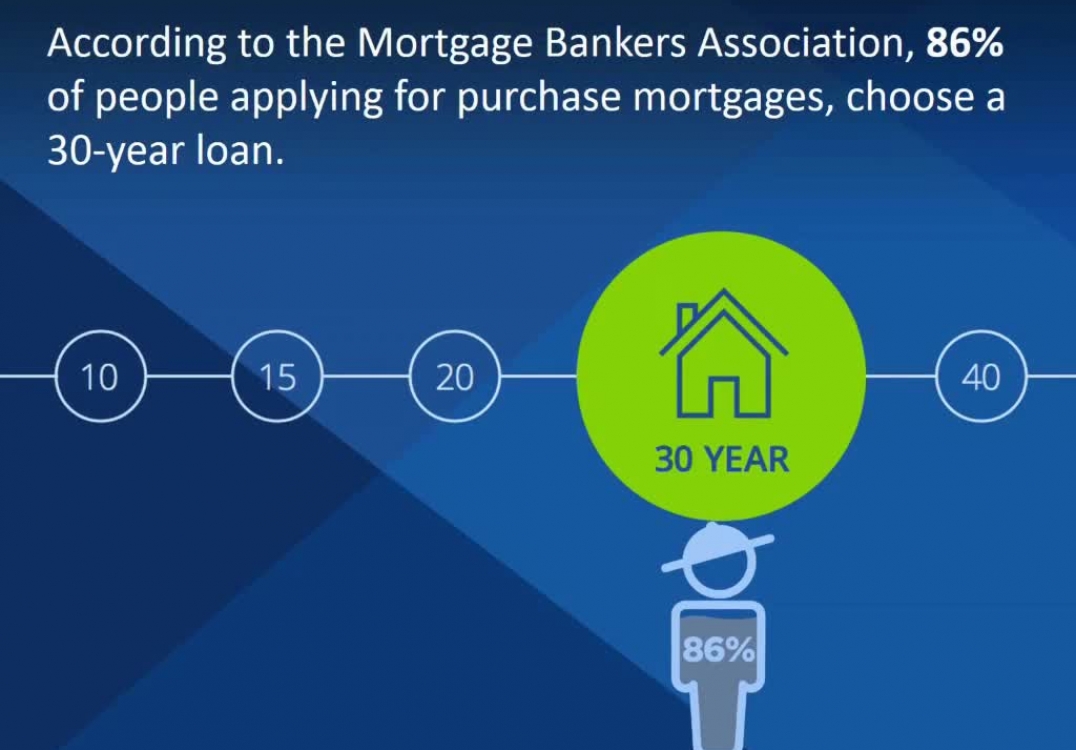

OK, today we’re going to talk about the BIG “A” word… AMORTIZATION that is! The length of time it takes you to pay off your entire mortgage is called the amortization. But don’t fall prey to the misconception that a longer amortization is better. In most cases, the opposite is true. Here’s what every homeowner needs to know. If you're looking for a top-notch mortgage banker in Henderson, call us at (702) 612-0822.

Have you ever heard someone say I run my business

"By Referral ONLY"? Well, today's controversial message

will reveal why that is the absolute worst strategy for

building a stable business with a rock-solid income stream!

Don't believe me? Take a moment and watch to today's

video and you'll discover the key to consistently

growing your income -- even in a down market...

In next week's 14th secret, you'll learn why most

real estate advertising doesn't work and how superstar

Realtors get 200-1000% higher response rates than

average Realtors.

Tune in to this upcoming video and learn the secrets

to improving your return on your ad dollars.

Stay tuned...

For more information, please call us at (702) 612-0822 or visit https://mikebrines.leader1.com.

Before you consider refinancing your existing mortgage, it's important for you to determine the break-even point, which represents how soon the cost of the refinance will be recaptured through lower monthly payments. The answer to this question depends on multiple factors. See the factors here. If you're looking for a top-notch mortgage advisor in New Jersey, call us at (732) 722-5819.

In last week's video, we talked about the importance of building TRUST EQUITY with your prospects, clients and referral partners......and highlighted the Top 10 Ways People Know You're a Dangerous Salesman to Be Avoided.Now the pregnant question is... how do we build more TRUST EQUITY? For more information, Please call us at (416) 342-1480 or visit www.suppafinancial.com