Top videos

Ok, today we are going to talk about some important things to consider before downsizing your home… In 1950, the average single-family home in the US was 1,000 square feet, and today it’s 2,600 square feet. The difference is even more dramatic when you consider how much larger families were in the 1950s! Some find themselves living in unnecessarily large homes, which leaves room for downsizing and saving. But before you rush in to selling and buying small, here are 5 things to consider before downsizing… If you are looking for top-notch mortgage agent in Whitby call us at, 289-314-8786.

I once heard a statistic that 90% of all failure comes from quitting. Thomas Edison affirmed this when he said, “Many of life's failures are people who did not realize how close they were to success when they gave up.” If it weren't for Mr. Edison's dogged determination to keep going, after thousands of failed attempts, at creating the incandescent light bulb, who knows we might still be lighting our homes with candles! In other words, persistence beats resistance. Quitters never win and winners never quit. If you want to increase your chances of success you must have a dream worth fighting for and then resolve to never, never, never give up! Here's How to Activate the Power of Persistence... For more information call us at, 603-637-4110

Ok, today we are going to talk about how you can save time and money paying your utility bills on your home… Monthly bills are inevitable and predictable. But for some people, bills come as a surprise just when they can least afford them. Here’s 6 tips to save you time and money paying your utility bills……If you are looking for a top-notch mortgage advisor in Monroe call us at, 646-251-5746

With few exceptions, some of the first words we learn as kids are “Please” and “Thank you”. As parents, we're constantly reminding our kids to say these words because as a culture, we tend to be repelled by people who lack social graces. If showing appreciation is such an integral part of human interaction, how might you use appreciation to differentiate yourself and improve your marketing results? Here's how... For more information call us at, 309-453-2234

Ok, today we are going to talk about 6 things to do before you list your house… If you’re thinking of selling soon, you’ve probably already started working on enhancements like painting, replacing appliances, installing new flooring or re-grouting bathrooms. But there are lots of little maintenance items you need to take care of too. Here are 6 things to do before you list your house…If you are looking for a top-notch mortgage advisor in Roseville call us at, 909-213-5909.

Today we are going to talk about how to buy a house that’s not on the market… In a competitive real estate market, it may be difficult to find the house you’re looking for. And when you finally find it, you could be outbid by another buyer. That’s why many buyers are looking for homes BEFORE they’re listed. Here’s how to buy a house that’s not yet listed on the market…If you are looking for a top-notch President in South Easton call us at, 508-274-8072

Ok, today we are going to talk about 5 smart ways to use your home equity… Home equity is the difference between the value of your home and the unpaid balance of your mortgage. You can often access a percentage of that amount through a home equity loan or home equity line of credit (HELOC). Here are 5 of the best ways to use your home equity… If you are looking for top-notch mortgage agent in Whitby call us at, 289-314-8786.

I’m curious to know your thoughts on this… What would you say is the #1 biggest challenge every real estate agent faces? Is it the economy, home values, mortgage rates, inventory? Well, after extensive research, we discovered that the single most important factor to your success in any market is shockingly different than what most agents think. Here’s what we discovered… For more information call us at, 603-637-4110

Welcome to the 3rd secret of Superstar Realtors. In today's secret, you'll learn a very different approach to marketing your real estate services. This one approach has more power to build your real estate business than any other strategy available. Click here to listen to the third secret...For more information call us at, (704)746-2541

Here's an interesting question for you.... What’s the #1 factor that separates Top-Producers from the mediocre majority? Chances are you already intuitively know the answer. It's all about how they invest their time! You see, everyone has 24 hours per day. The difference between the top achievers and all the rest is how they use it. Here's how Top-Producers use their time... For more information call us at, 309-453-2234

I once heard a statistic that 90% of all failure comes from quitting. Thomas Edison affirmed this when he said, “Many of life's failures are people who did not realize how close they were to success when they gave up.” If it weren't for Mr. Edison's dogged determination to keep going, after thousands of failed attempts, at creating the incandescent light bulb, who knows we might still be lighting our homes with candles! In other words, persistence beats resistance. Quitters never win and winners never quit. If you want to increase your chances of success you must have a dream worth fighting for and then resolve to never, never, never give up! Here's How to Activate the Power of Persistence... For more information call us at, 916-316-2386

Ok, today we are going to talk about how to manage your finances during a recession… Nobody welcomes a recession. But if you’re among the fortunate majority that still has an income and a home, a recession can actually be a time of valuable learning and growth. Here are 5 ways to manage your finances during a recession…If you are looking for a top-notch mortgage loan officer in St. Augustine call us at, 786-351-5051

Ok, today we are going to talk about how to make a long-distance move stress free… Major life changes are always stressful. And moving from one city or region to another is definitely a major change. Here are 5 steps you can take to help eliminate the stress of moving…If you are looking for a top-notch mortgage expert in Midland call us at, 432-203-5941

As you know, BUYER LEADS are the critical ingredient necessary for selling your listings FAST and for TOP DOLLAR... Now, the question is, HOW can you attract MORE of 'em, with the least amount of time, energy and money? Well, to help you in this, here are two proven strategies for ATTRACTING more quality buyer leads and gaining an UNFAIR ADVANTAGE over your competitors... For more information call us at, 801-577-9231

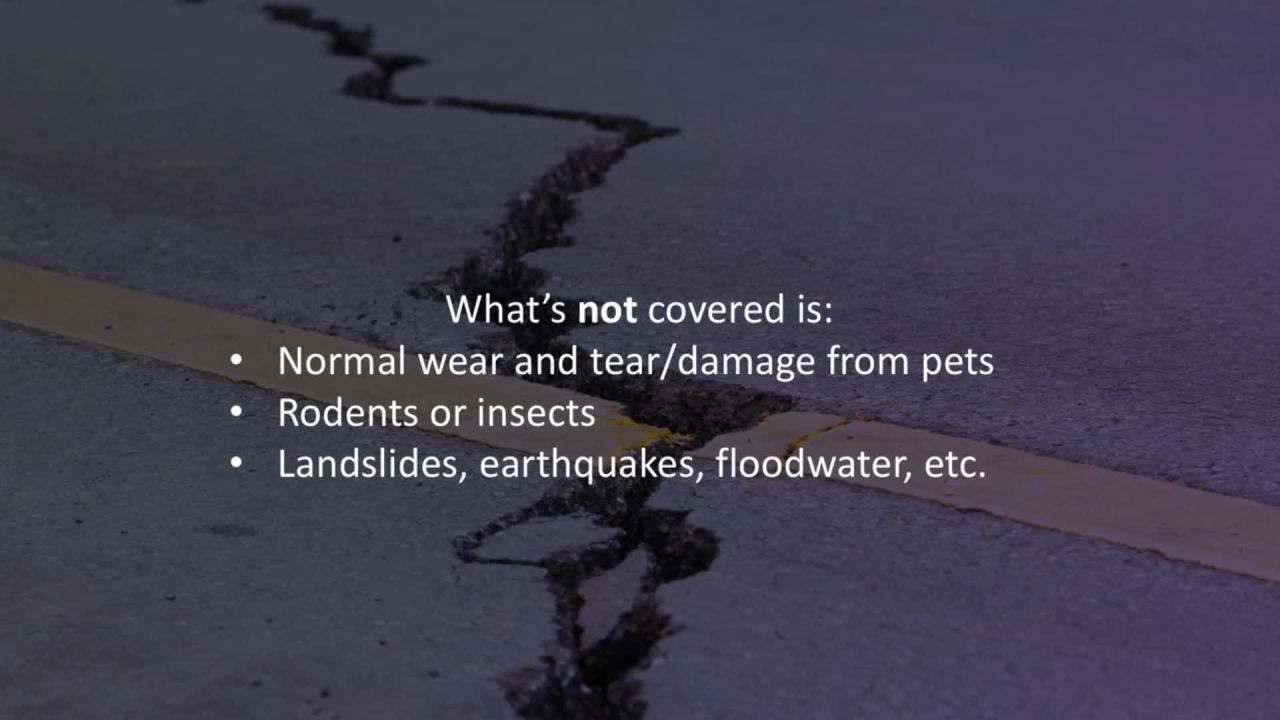

Ok, today we are going to talk about why you need homeowner’s insurance and how it keeps you protected… Homeowner’s insurance is an important and required part of home ownership. Here are the 3 main reasons why you need homeowner’s insurance…If you are looking for a top-notch President in South Easton call us at, 508-274-8072

Ok, today we are going to cover 5 steps for determining how much home you can afford to buy… Buying a home involves lots of decisions… • condo or single family? • big or small? • inner city or suburban? • new or old? But the biggest and most important decision is: how much can I afford? Here are 5 steps to figure out home much home you can afford… If you are looking for top-notch mortgage agent in Whitby call us at, 289-314-8786.

How would you like to attract more sizzling, red-hot referrals from your past clients? Well, you'll be glad to know I just put together a brand new 6-part video series for you titled, "6 Deadly Mistakes That Kill Your Referrals" that teaches how to do exactly that -- become a referral magnet. By avoiding these six costly mistakes and implementing effective "referral systems" you can literally skyrocket your referrals almost overnight. OK, enough prelude already. Here's the very first Referral Mistake to avoid... For more information call us at, 603-637-4110

Have you ever wondered why some Realtors always seem to be in the right place at just the right time to win the listing or close the deal? In today's 7th secret of Superstar Realtors, you'll learn why it's no fluke. Here’s how they do it...For more information call us at, (704)746-2541

With few exceptions, some of the first words we learn as kids are “Please” and “Thank you”. As parents, we're constantly reminding our kids to say these words because as a culture, we tend to be repelled by people who lack social graces. If showing appreciation is such an integral part of human interaction, how might you use appreciation to differentiate yourself and improve your marketing results? Here's how... For more information call us at, 916-316-2386