Top videos

Ok, today we are going to review everything you need to know about second mortgages… What is a second mortgage? A second mortgage is an additional loan taken out on a property that’s already mortgaged. Second mortgages are riskier for lenders than first mortgages because they’re in second position on your property's title. As a result, the interest rate on second mortgages is higher. Here’s what you need to know about second mortgages…If you are looking for a top-notch mortgage advisor in Durham call us at, 919-985-3076.

In last week's video, we talked about the importance

of building TRUST EQUITY with your prospects, clients

and referral partners...

...and highlighted the Top 10 Ways People Know You're

a Dangerous Salesman to Be Avoided.

Now the pregnant question is... how do we build

more TRUST EQUITY?

Here are 7 “Trust Builders” Every Realtor Needs to Know...

For more information, Please call us at 647.830.7150 or Visit https://www.centum.ca/sites/arezou_yaghmori

Ok, today we are going to talk about how you can save time and money paying your utility bills on your home… Monthly bills are inevitable and predictable. But for some people, bills come as a surprise just when they can least afford them. Here’s 6 tips to save you time and money paying your utility bills… If you're looking for a top-notch loan officer in Kennesaw, call us at (404) 379-8754.

Have you ever wondered how seemingly unknown

Realtors have positioned themselves as the #1 choice

in their niche in a short period of time?

Here is one of their secrets for making it happen...

In next week's 16th secret, you'll discover a powerful

marketing secret Superstar Realtors use to consistently

overcome their prospect's fear and skepticism.

This one strategy could at least DOUBLE your

prospect-to-closing conversion ratio.

Stay tuned...

For more information, please call us at (604) 273-2002 or visit https://www.AdvancedEquity.ca.

Thanks to aging Baby Boomers, the market for vacation properties is hotter than ever. But before you start shopping, here are some things to consider... If you are looking for a mortgage advisor in Houston, call us at 830-313-5500

Ralph Waldo Emerson wrote that each person is compensated in like manner for that which he or she has contributed. This is often referred to as the Law of Compensation or the Law of Cause and Effect. Basically, it's saying that you get back what you give, whether that's a lot or a little. If you want to increase how much you earn, watch this video: If you're looking for a top-notch Senior Loan Officer in Las Vegas, Call us at 702.708.4666

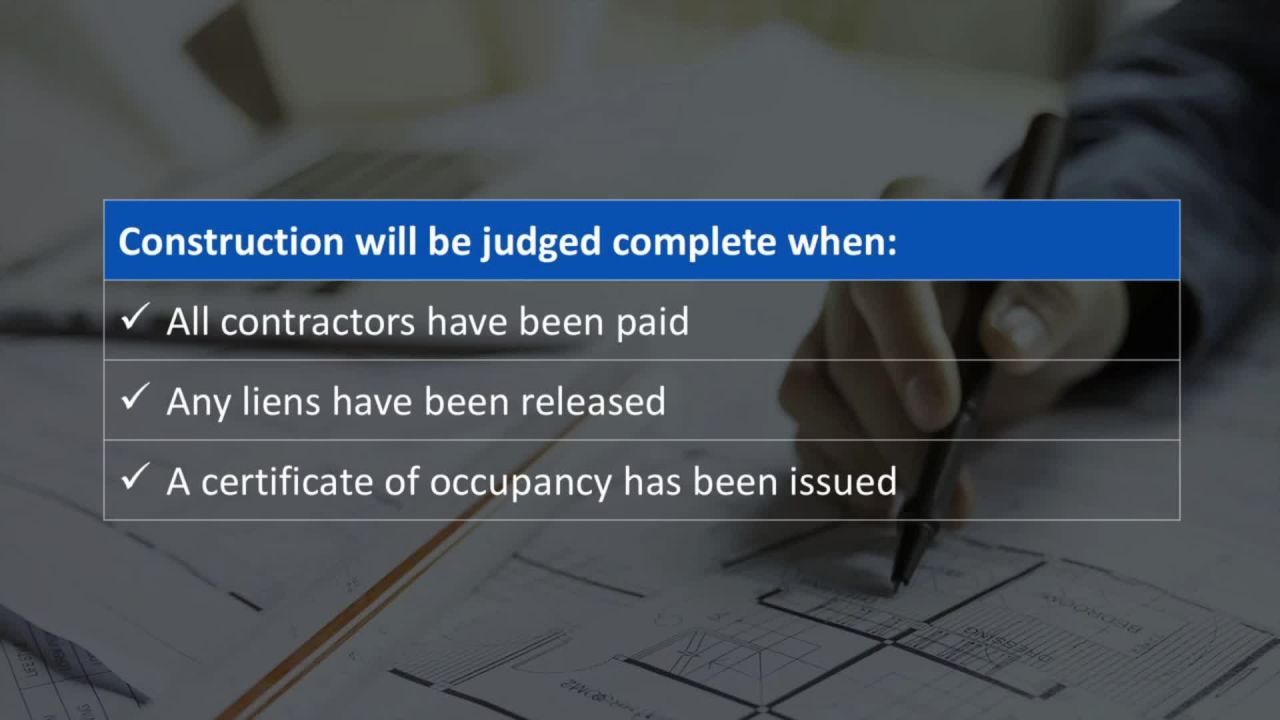

Ok, today we are going to talk about how to convert a construction loan into a traditional mortgage… If you’re planning to build a house or do a major renovation, you usually can’t qualify for a traditional mortgage because there’s no existing home to use as collateral. What you need is a construction loan, which is based on the projected future value of the completed property. Generally, construction loans are interest-only while the house is being built. Then when construction is complete, you refinance into a regular mortgage. Here’s how the process works…If you are looking for a top-notch mortgage broker in Georgia call us at, 770-530-9111

As you know, BUYER LEADS are the critical ingredient necessary for selling your listings FAST and for TOP DOLLAR... Now, the question is, HOW can you attract MORE of 'em, with the least amount of time, energy and money? Well, to help you in this, here are two proven strategies for ATTRACTING more quality buyer leads and gaining an UNFAIR ADVANTAGE over your competitors...For more

information call us at, 808-479-8546

Here's an interesting question for you....

What’s the #1 factor that separates Top-Producers from

the mediocre majority?

Chances are you already intuitively know the answer.

It's all about how they invest their time!

You see, everyone has 24 hours per day. The difference between

the top achievers and all the rest is how they use it.

Here's how Top-Producers use their time...

For more information please call us at (657) 254-5300 or visit TheHomeLoanPlanner.com.

Ok, today we are going to talk about the pros and cons of house flipping. It’s possible to make a lot of money by flipping properties. But it’s not as easy as it sounds, and there are just as many pitfalls as there are rewards. Here are 4 pros and cons of house flipping… If you're looking for a top-notch Senior Loan Officer in Plainville, Call us at 860.995.3513

Ok, today we are going to talk about how millennials are changing the real estate landscape… As millennials become the largest adult generation, it’s no surprise that they’re becoming a major force in home buying. According to Zillow, a US-based online real estate marketplace, millennials now make up 42% of all homebuyers. Here’s how millennial buyers and sellers differ from previous generations… If you are looking for a top-notch producing branch manager in Mt Pleasant call us at 843-478-8459

Welcome to Realtor Referral Mistake #5. In today's tip, you'll learn how to focus your marketing efforts on the your highest-profit activities so you can make earn more, while working less. It all comes down to working smarter, not harder. Here's a 12-month marketing calendar for massive success...For more information call us at, 720-365-2018

Did you know there's a way to do home renovations that actually pays for itself - even turns a profit... without having to pay out of pocket? Here's how… If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

OK, let's say you're planning on buying a house... Most homebuyers have a rough idea how much they can afford to pay each month on their mortgage... But to translate that monthly payment into a maximum mortgage amount, it's important to consider several important factors. Don't buy a home until you watch this video.... If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

Have you ever wondered why some Realtors® quickly skyrocket to success while the majority continues to struggle just to eke out a meager existence? We all know everyone has access to the same MLS marketing tools, so why such a disparity in results? Is the difference found in their education, intelligence, skills, timing, work habits, contacts or luck? The answer to this mystery is actually no mystery at all. If you dig down to the root cause of their success, you’ll invariably find that the common denominator of success in each and every Top Producer lies in their MINDSET or their UNIQUE WAY OF THINKING. Here are ten ways Top-Producers think differently than all the rest… For more information call us at, 801-6474600

Hello THis is testing video

Welcome to Realtor Referral Mistake #4. In today's video tip, you'll learn why most Realtors' referrals are inconsistent, unreliable and unpredictable. As a result, their income goes up and down like a Yo-Yo. Can you relate? Welcome to the club. It's not your fault. Chances are, no one ever took the time to teach how to build a steady, consistent flow of referrals. That is, until now. :) Here's how Top Producers generate referrals at will... For more information call us at, 760-217-0820

Ok, today we are going to talk about 6 things to do before you list your house… If you’re thinking of selling soon, you’ve probably already started working on enhancements like painting, replacing appliances, installing new flooring or re-grouting bathrooms. But there are lots of little maintenance items you need to take care of too. Here are 6 things to do before you list your house… If you are looking for a top-notch mortgage advisor in Huntsville call us at 256-975-8039

Here's an interesting question for you.... What’s the #1 factor that separates Top-Producers from the mediocre majority? Chances are you already intuitively know the answer. It's all about how they invest their time! You see, everyone has 24 hours per day. The difference between the top achievers and all the rest is how they use it. Here's how Top-Producers use their time...For more infomation call us at 808-283-1640

Ok, today we are going to talk about how to convert a construction loan into a traditional mortgage… If you’re planning to build a house or do a major renovation, you usually can’t qualify for a traditional mortgage because there’s no existing home to use as collateral. What you need is a construction loan, which is based on the projected future value of the completed property. Generally, construction loans are interest-only while the house is being built. Then when construction is complete, you refinance into a regular mortgage. Here’s how the process works… If you are looking for a top-notch mortgage loan originator in Wailuku call us at, 808-283-1640