Top videos

Ok, today we are going to talk about real estate planning and why it’s necessary… You don’t have to be wealthy to have an estate plan. No matter who you are, you probably have possessions you’d like your children to have once you’re gone. And you definitely want to have a say in who will take care of your kids if you die before your time. Here are 4 reasons why you should start thinking about estate planning today… If you are looking for a top-notch mortgage broker in New Westminster call us at, 778-278-1811

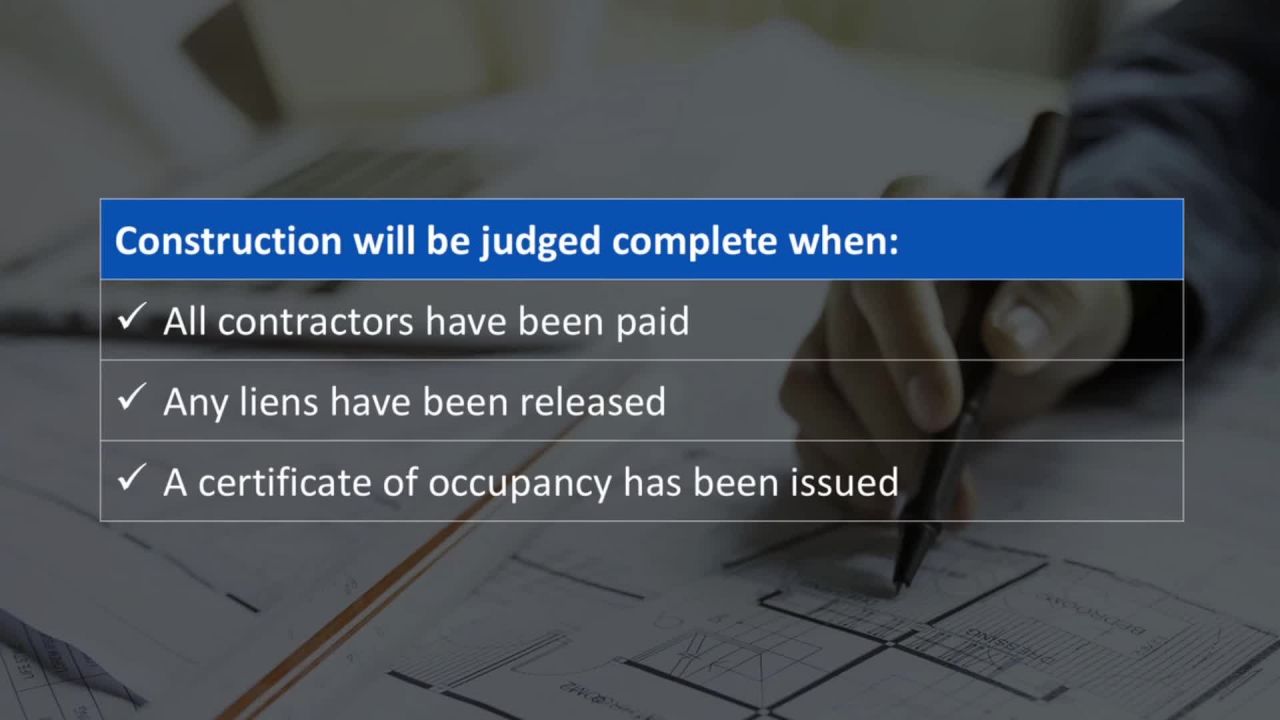

Ok, today we are going to talk about how to convert a construction loan into a traditional mortgage… If you’re planning to build a house or do a major renovation, you usually can’t qualify for a traditional mortgage because there’s no existing home to use as collateral. What you need is a construction loan, which is based on the projected future value of the completed property. Generally, construction loans are interest-only while the house is being built. Then when construction is complete, you refinance into a regular mortgage. Here’s how the process works… If you are looking for a top-notch mortgage broker in New Westminster call us at, 778-278-1811

Ok, today we are going to review everything you need to know about second mortgages… What is a second mortgage? A second mortgage is an additional loan taken out on a property that’s already mortgaged. Second mortgages are riskier for lenders than first mortgages because they’re in second position on your property's title. As a result, the interest rate on second mortgages is higher. Here’s what you need to know about second mortgages… If you are looking for a top-notch mortgage broker in New Westminster call us at, 778-278-1811

Ok, today we are going to talk about what a stratified market is and what it means to you… If you’re planning to buy or sell a house, you’re probably already familiar with the terms “buyer’s market” and “seller’s market.” In a buyer’s market, there are more homes than buyers, so prices drop and buyers get better deals. In a seller’s market there are more buyers than homes, so prices rise and sellers make more money. But there’s a third type of market, and it’s called a stratified market. Here’s what you need to know… If you are looking for a top-notch mortgage broker in New Westminster call us at, 778-278-1811

Ok, today we are going to cover 5 tips for buying a condo… Millions of people have either decided that condo living suits their budget and lifestyle better than single-family homeownership, or they purchase condos as an investment, second home, or vacation property. There are important differences between buying a home and buying a condo. So, before you make an offer… Here are 5 tips for buying a condo… If you are looking for a top-notch mortgage expert in Midland call us at, 432-203-5941

Ok, today we are going to talk about how you can buy a home without visiting it in person… Today, more buyers are making offers on homes sight unseen. Reasons for this could include: • Being too busy for physical shopping • Living on the other side of the country • Feeling totally comfortable with online purchases • Preferring the safety of physical distance Here are 6 tips for buying a house sight unseen… If you are looking for a top-notch mortgage expert in Midland call us at, 432-203-5941

Ok, today we are going to talk about the pros and cons for buying a house verses building new… Deciding whether to buy an existing house or build a brand new one can be complicated. There are so many factors to consider. Here’s a list of pros and cons for both building new and buying an existing home… If you are looking for a top-notch mortgage expert in Midland call us at, 432-203-5941

Welcome to Real Estate Marketing Sin #8. Did you know that your prospect receives, on average, over 3,000 marketing impressions a day? With all the "marketing clutter" bombarding your prospects' on a daily basis, it's becoming more and more difficult to capture people's attention, let alone get a response! So, how do you differentiate your business in a way that separates you from the competition and makes you STAND OUT? Here's exactly how you do it... For more information call us at, 432-203-5941

With few exceptions, some of the first words we learn as kids are “Please” and “Thank you”. As parents, we're constantly reminding our kids to say these words because as a culture, we tend to be repelled by people who lack social graces. If showing appreciation is such an integral part of human interaction, how might you use appreciation to differentiate yourself and improve your marketing results? Here's how... For more information call us at, 432-203-5941

Welcome to Real Estate Marketing Sin #8. Did you know that your prospect receives, on average, over 3,000 marketing impressions a day? With all the "marketing clutter" bombarding your prospects' on a daily basis, it's becoming more and more difficult to capture people's attention, let alone get a response! So, how do you differentiate your business in a way that separates you from the competition and makes you STAND OUT? Here's exactly how you do it... For more information call us at, 630-853-6456

Why do some Realtors® have all the clients they can handle, while others seem to struggle? Is it because they are smarter than all the other Realtors® or is it because they simply work harder? Perhaps neither. After analyzing the habits, attributes and character traits of hundreds of real estate professionals over the years, we've identified the "secrets" that separate the Top 1% highest-income-earning Realtors® from all the rest. And for your benefit, we've decided to distill all these traits down into 21 specific things that create superstar Realtors® and allow them to pick and choose who they work with, and have all the clients they can handle. Are you ready for the 1st secret of Superstar Realtors®? Here it is... For more information call us at, 630-853-6456

Ok, today we are going to talk about how much home renovations can cost… Renovations can help make your home more comfortable and easier to sell. But depending on what you’re planning, they can also be expensive. To help you budget for your next project, the HomeAdvisor website has published a list of typical costs for renovation projects. Here’s a list of the most common renos and how much they cost… If you are looking for a top-notch mortgage broker in St George call us at, 801-577-9231

Ok, today we are going to talk about how to pay off your credit card so you can live a stress-free future… If you’re like most people, emergencies, illnesses, job losses or more can put a dent in your credit cards. To make matters worse, most credit cards have high interest rates that make them difficult to pay off. But paying off your cards is exactly what you need to do to achieve a secure and stress-free financial future. Here are 6 tips for paying off your credit cards… If you are looking for a top-notch mortgage broker in St George call us at, 801-577-9231

Welcome to the 3rd secret of Superstar Realtors. In today's secret, you'll learn a very different approach to marketing your real estate services. This one approach has more power to build your real estate business than any other strategy available. Click here to listen to the third secret... For more information call us at, 801-577-9231

Welcome to the 4th secret of Superstar Realtors. In today's secret I unlock the mystery to creating a constant stream of qualified leads that come to you instead of the other way around. All the Superstar Realtors I know use this tactic and you should too. Click here to listen to the fourth secret... For more information call us at, 801-577-9231

Today's video will unveil the secret to commanding high commissions, have people begging for your services, and be perceived as the ONLY viable solution by your prospective clients. Click here to watch the sixth secret... For more information call us at, 801-577-9231

Have you ever wondered why some Realtors always seem to be in the right place at just the right time to win the listing or close the deal? In today's 7th secret of Superstar Realtors, you'll learn why it's no fluke. Here’s how they do it... For more information call us at, 801-577-9231

Are you tired of spending your hard earned money on advertising that doesn't work? Discover how SUPERSTAR Realtors get other people to do their advertising for them... for FREE! Here’s how they do it... For more information call us at, 801-577-9231

Have you ever wondered why you see the names of Superstar Realtors everywhere? It seems every time you turn around, their name is staring at you. Click here to find out how they do it... For more information call us at, 801-577-9231

Today you'll learn the importance of "YOU" and why that is critically important to your career as a Realtor. This might sound dull but you're about to learn an important lesson that only the Superstar Realtors really understand. Here's what I'm talking about... For more information call us at, 801-577-9231