Top videos

Ok, today we are going to talk about how you can buy a home without visiting it in person… Today, more buyers are making offers on homes sight unseen. Reasons for this could include: • Being too busy for physical shopping • Living on the other side of the country • Feeling totally comfortable with online purchases • Preferring the safety of physical distance Here are 6 tips for buying a house sight unseen… If you are looking for a top-notch mortgage loan originator in Rocklin call us at, 916-316-2386

Rancho Cucamonga Mortgage Broker reveals6 tips to save you time and money paying your utility bills…

Ok, today we are going to talk about how you can save time and money paying your utility bills on your home… Monthly bills are inevitable and predictable. But for some people, bills come as a surprise just when they can least afford them. Here’s 6 tips to save you time and money paying your utility bills…If you are looking for a top-notch Mortgage Broker at Rancho Cucamonga call us at, 951-235-2752

Today we're going to talk about buyer lead CONVERSION. This is one of the easiest ways to increase your income without putting in more hours. The pregnant question is... HOW can you boost your conversion ratio? Here are a few tips to get you started...For more information call us at, 727-247-2215

Ok, today we are going to talk about why you need homeowner’s insurance and how it keeps you protected… Homeowner’s insurance is an important and required part of home ownership. Here are the 3 main reasons why you need homeowner’s insurance… If you are looking for a top-notch mortgage broker in St George call us at, 801-577-9231

Welcome to Realtor Referral Mistake #2. In today's video tip, you're going to learn why most Realtors are unwittingly sabotaging their "referrability" and therfore, leaving thousands of dollars on the table. It also explains why most Realtors get WAY less referrals than they'd like or even feel like they deserve. HINT: It's not because of bad B.O. or halitosis. :) Here's why "great service" doesn't get you referrals... For more information call us at, 432-203-5941

Ok, today we are going to talk about how to build your savings up FAST! Have an unexpected financial need? Rather than borrowing or putting it on your credit card—which just makes your financial situation worse—consider accelerated saving. Here are 7 ways to accelerate your savings…If you are looking for a top-notch producing branch manager in Dallas call us at, 972-922-3742

Ok, today we are going to talk about some important things to consider before downsizing your home… In 1950, the average single-family home in the US was 1,000 square feet, and today it’s 2,600 square feet. The difference is even more dramatic when you consider how much larger families were in the 1950s! Some find themselves living in unnecessarily large homes, which leaves room for downsizing and saving. But before you rush in to selling and buying small, here are 5 things to consider before downsizing… If you are looking for top-notch mortgage agent in Whitby call us at, 289-314-8786.

Ok, today we are going to talk about 6 ways your family can save money, but still have fun. Making the most of time as a family doesn’t have to mean spending a bunch of money. In fact, you could be earning some! Here are 6 ways to save money and stay social… If you are looking for top-notch mortgage agent in Whitby call us at, 289-314-8786.

OK, today we’re going shatter a few MONEY MYTHS… Ever since we were children, we’ve heard and repeated familiar sayings about money. One favorite of parents everywhere is, “Money doesn’t grow on trees.” But what if it turned out that most of the conventional wisdom about money wasn’t true, or at least wasn’t helpful? For instance, while it’s literally true that money doesn’t grow on trees, that saying can lead us to believe in scarcity rather than abundance—so scarcity is what we end up with! Here are 3 three other equally destructive money myths to avoid… If you are looking for top-notch mortgage agent in Whitby call us at, 289-314-8786.

Welcome to Realtor Referral Mistake #5. In today's tip, you'll learn how to focus your marketing efforts on the your highest-profit activities so you can make earn more, while working less. It all comes down to working smarter, not harder. Here's a 12-month marketing calendar for massive success...For more information call us at, 508-274-8072

Today we're going to talk about buyer lead CONVERSION. This is one of the easiest ways to increase your income without putting in more hours. The pregnant question is... HOW can you boost your conversion ratio? Here are a few tips to get you started...For more information call us at, 508-274-8072

Ok, today we are going to talk about how to finance a new home build… If you’re looking for a home that offers the latest energy efficiencies, low maintenance costs, and every amenity and convenience your family desires, maybe you should consider building new. Just keep in mind that financing new construction is a little more complicated. Here’s what you need to know… If you are looking for a top-notch mortgage advisor in Katy call us at, 432-425-9497

Ok, today we are going to talk about how to save money on home insurance… Insurance is absolutely essential to home ownership. You have to be confident that your investment and your family are adequately protected. However, there’s no reason to pay more for home insurance than you have to. Here are 7 ways to save money on home insurance… If you are looking for a top-notch mortgage advisor in Katy call us at, 432-425-9497

Today you'll learn how Superstar Realtors have the uncanny ability to get things done, open new doors, and create profitable referral alliances. This message will be very important to your career so click the link below and watch to today's message. Here's how Top Dog Realtors make it happen:For More Information call us at, 513-238-0999

As you know, BUYER LEADS are the critical ingredient necessary for selling your listings FAST and for TOP DOLLAR... Now, the question is, HOW can you attract MORE of 'em, with the least amount of time, energy and money? Well, to help you in this, here are two proven strategies for ATTRACTING more quality buyer leads and gaining an UNFAIR ADVANTAGE over your competitors...For More Information call us at, 513-238-0999

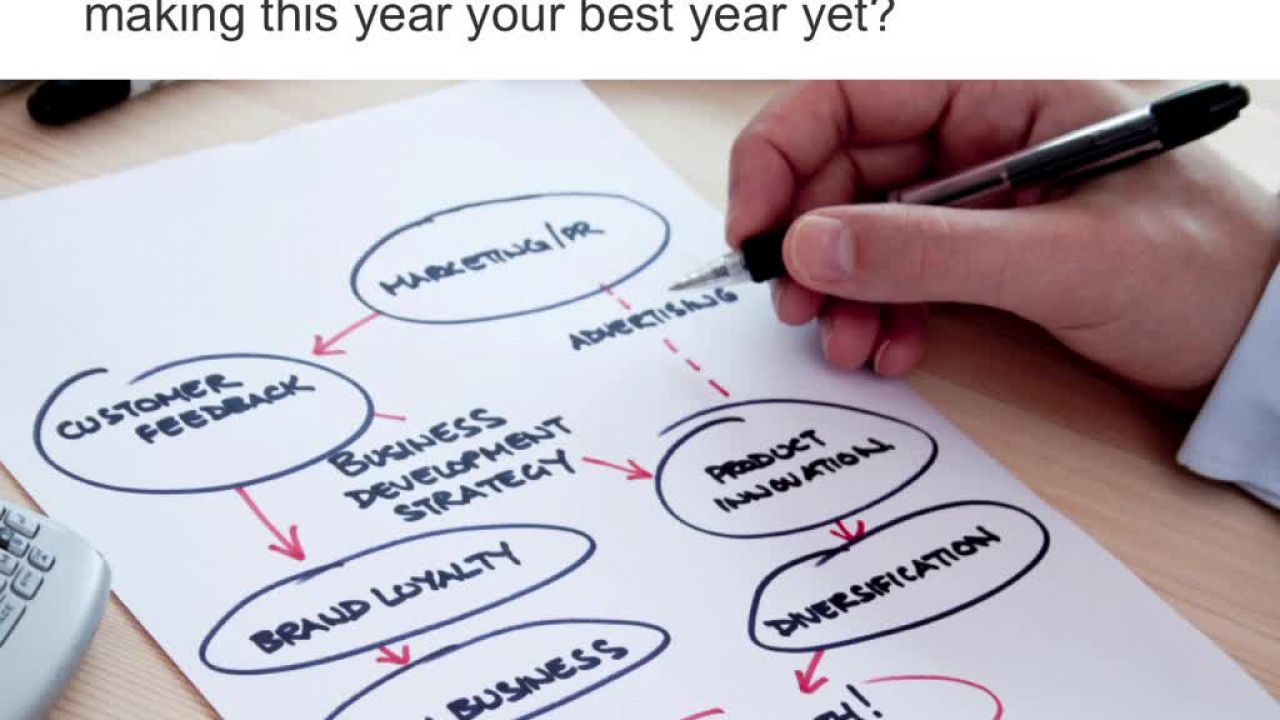

Quick question for you... Do you have a clear, concise marketing plan for making this year your best year yet? Chances are, if you're like most Realtors®, you have room for improvement. Here are a few powerful questions to help you take your business to the next level... For More Information call us at, 513-238-0999

Welcome to video #4 in our brand new 5-part video series titled, "TRUST: How to Earn it, Grow It and Use It to Skyrocket Your Sales." Last week, I revealed the #1 secret for boosting your sales. Today I’m going to show you how to create your own testimonial capture page, so you can automate the entire process of collecting testimonials. Remember: more trust = more sales! Here's how to capture testimonials on autopilot... For more information call us at, 508-274-8072

Ok, today we are going to talk about 4 ways to become mortgage-free sooner… One of the pillars of achieving financial security is reducing debt. And the biggest debt you’ll ever have is your mortgage. Imagine how much more money you’d have for retirement, kids’ education, travel, etc., if you were mortgage-free! Here are 4 ways to become mortgage-free fast… If you are looking for a top-notch mortgage professional in Toronto call us at, (866) 492-4024.

Ok, today we are going to talk about real estate planning and why it’s necessary… You don’t have to be wealthy to have an estate plan. No matter who you are, you probably have possessions you’d like your children to have once you’re gone. And you definitely want to have a say in who will take care of your kids if you die before your time. Here are 4 reasons why you should start thinking about estate planning today…If you are looking for a top-notch mortgage loan advisor in Granite Bay call us at, (510) 303-5464

Ok, today we are going to talk about how to create or update your home office space… The COVID pandemic introduced many of us to working from home. And regardless of being in a pandemic or not, many of us will continue to and have been working from home already. So now’s the time to make your home office as efficient, comfortable and uplifting as possible. Here are 6 ways to make your home office work better…If you are looking for a top-notch mortgage loan advisor in Granite Bay call us at, (510) 303-5464