Top videos

Welcome to the 4th secret of Superstar Realtors. In today's secret I unlock the mystery to creating a constant stream of qualified leads that come to you instead of the other way around. All the Superstar Realtors I know use this tactic and you should too. Click here to listen to the fourth secret...In the upcoming 5th secret you'll learn why Superstar Realtors can charge higher fees than all their competitors and still have clients lined up around the block to use their services .Stay tuned. For more information call us at,905.392.6595 Or visit https://www.citadelmortgages.ca

Today you'll learn how Superstar Realtors have the uncanny ability to get things done, open new doors, and create profitable referral alliances. This message will be very important to your career so click the link below and watch to today's message. Here's how Top Dog Realtors make it happen: In next week's 12th secret, you'll discover how Superstar Realtors set themselves apart from their competition and position themselves as the only logical choice in their prospect's mind. Stay tuned.. For more information call us at,905.392.6595 Or visit https://www.citadelmortgages.ca

Did you know that there are literally thousands of people every month in your market area who are searching for real estate information online? In today's video tip, you'll discover how you can attract a steady stream of qualified prospects using a LEAD GENERATION WEBSITE (even if you don't have time, money or technical know-how).Here's how you do it...In next week's tip, you'll learn a little-known secret that unlocks the mystery about how Superstar Realtor scan consistently increase their productivity while decreasing their work-load. For more information call us at,905.392.6595 Or visit https://www.citadelmortgages.ca

Welcome to Realtor Referral Mistake #5. In today's tip, you'll learn how to focus your marketing efforts on the your highest-profit activities so you can make earn more, while working less. It all comes down to working smarter, not harder. Here's a 12-month marketing calendar for massive success. For more information call us at,905.392.6595 Or visit https://www.citadelmortgages.ca

Ok, today we are going to talk about what cash reserves are and why you need them to buy a home… When buying a house, most people only think about saving enough to cover a down payment and closing costs. But lenders like to see more than that. Borrowers who have additional “cash reserves” are considered lower risk and are more likely to be approved for financing at the lowest possible rate. So, what are “cash reserves” and how can they benefit you? Take a look… If you are looking

for a top-notch mortgage agent in Toronto call us at, 905-392-6595

Ok, today we are going to review everything you need to know about second mortgages… What is a second mortgage? A second mortgage is an additional loan taken out on a property that’s already mortgaged. Second mortgages are riskier for lenders than first mortgages because they’re in second position on your property's title. As a result, the interest rate on second mortgages is higher. Here’s what you need to know about second mortgages… If you are looking

for a top-notch mortgage agent in Toronto call us at, 905-392-6595

Welcome to Real Estate Marketing Sin #3. Ever wondered how fast food franchises like McDonalds or Wendy's run like finely-oiled cash machines? Notice how they do the same things, the same way, every single time. Unfortunately, most Realtors never take the time to "systematize" their business, which results in duplication, waste, chaos and ultimately, lost sales. Here are 4 types of "systems" to implement in your biz. In next week's tip, you'll learn the secret for maximizing your repeat and referral business. Stay tuned. For more information, call us at (571) 264-7716.

Welcome to Realtor Referral Mistake #6. This is our final installment in this series. In today's video tip, you'll learn how Top-Producing Realtors engineer their business to consistently cultivate "raving fan" clients who send them loads of red-hot referrals... without begging or asking. You see, they understand a key pychological trigger, that hardly anyone utilizes, that can literally DOUBLE the number of referrals you generate. For more information call us at,416.474.7466 Or visit https://www.shellyknowsmortgages.com

Ok, today we are going to talk about how to pay off your credit card so you can live a stress-free future… If you’re like most people, emergencies, illnesses, job losses or more can put a dent in your credit cards. To make matters worse, most credit cards have high interest rates that make them difficult to pay off. But paying off your cards is exactly what you need to do to achieve a secure and stress-free financial future. Here are 6 tips for paying off your credit cards… If you are looking for a top-notch mortgage broker in Vaughan call us at, 416-474-7466

Ok, today we are going to talk about when the best days and months of the year are to list your home… If you’re thinking of selling your home, there’s never a bad time of year, but there certainly are perks to selling in the spring. Spring is usually the best time of year, and a recent survey gets even more specific, providing the best time to list, right down to time of day. Check it out to learn more… If you are looking for a top-notch mortgage broker in Vaughan call us at, 416-474-7466

Ok, today we are going to talk about how to save money on home insurance… Insurance is absolutely essential to home ownership. You have to be confident that your investment and your family are adequately protected. However, there’s no reason to pay more for home insurance than you have to. Here are 7 ways to save money on home insurance… If you are looking for a top-notch mortgage broker in Vaughan call us at, 416-474-7466

Ok, today we are going to talk about three things you need to know before you borrow from your home equity… Accessing your home equity through a home equity line of credit (HELOC) or cash-out refinance can be an affordable way to pay for renovations or education. Here are 3 things you need to know before applying for a HELOC… If you are looking for a top-notch mortgage broker in Vaughan call us at, 416-474-7466

Ok, today we are going to talk about what cash reserves are and why you need them to buy a home… When buying a house, most people only think about saving enough to cover a down payment and closing costs. But lenders like to see more than that. Borrowers who have additional “cash reserves” are considered lower risk and are more likely to be approved for financing at the lowest possible rate. So, what are “cash reserves” and how can they benefit you? Take a look… If you are looking for a top-notch mortgage broker in Vaughan call us at, 416-474-7466

Ok, today we are going to talk about how to manage your finances during a recession… Nobody welcomes a recession. But if you’re among the fortunate majority that still has an income and a home, a recession can actually be a time of valuable learning and growth. Here are 5 ways to manage your finances during a recession… If you are looking for a top-notch mortgage broker in Vaughan call us at, 416-474-7466

Ok, today we are going to talk about when it is smart to pay off your mortgage early… Being mortgage-free sounds wonderful. But as with most financial choices, there are pros and cons. Before using an inheritance, a raise or savings to pay off your mortgage early, there are some important things to consider. Here’s 7 things to consider if you want to pay your mortgage off early… If you are looking for a top-notch mortgage broker in Vaughan call us at, 416-474-7466

Ok, today we are going to talk about the expense of hiring a real estate agent and if it’s really worth it to you… When you’re selling a home, so much money is at stake, you can’t afford to make a mistake. That’s why over 90% of buyers and sellers work with a Realtor. But let’s face it, Real estate commissions are expensive. Are Realtors really worth it? Here’s what good Realtors do to earn every penny of their commissions… If you are looking for a top-notch mortgage broker in Vaughan call us at, 416-474-7466

Ok, today we are going to review everything you need to know about second mortgages… What is a second mortgage? A second mortgage is an additional loan taken out on a property that’s already mortgaged. Second mortgages are riskier for lenders than first mortgages because they’re in second position on your property's title. As a result, the interest rate on second mortgages is higher. Here’s what you need to know about second mortgages… If you are looking for a top-notch mortgage broker in Vaughan call us at, 416-474-7466

Ok, today we are going to talk about what a stratified market is and what it means to you… If you’re planning to buy or sell a house, you’re probably already familiar with the terms “buyer’s market” and “seller’s market.” In a buyer’s market, there are more homes than buyers, so prices drop and buyers get better deals. In a seller’s market there are more buyers than homes, so prices rise and sellers make more money. But there’s a third type of market, and it’s called a stratified market. Here’s what you need to know… If you are looking for a top-notch mortgage broker in Vaughan call us at, 416-474-7466

Ok, today we are going to talk about basic home maintenance you should be doing yearly, every 5-10 years and onward… Ongoing expenses like mortgage payments, property taxes and insurance are an expected part of homeownership. But there’s an additional ongoing expense you also need to budget for… And that is regular homeownership maintenance expenditures. On average, annual maintenance will cost 1% - 3% of your home’s purchase price. However, this can be reduced by maintaining regular preventative maintenance. Here’s your complete maintenance checklist… If you are looking for a top-notch mortgage broker in Vaughan call us at, 416-474-7466

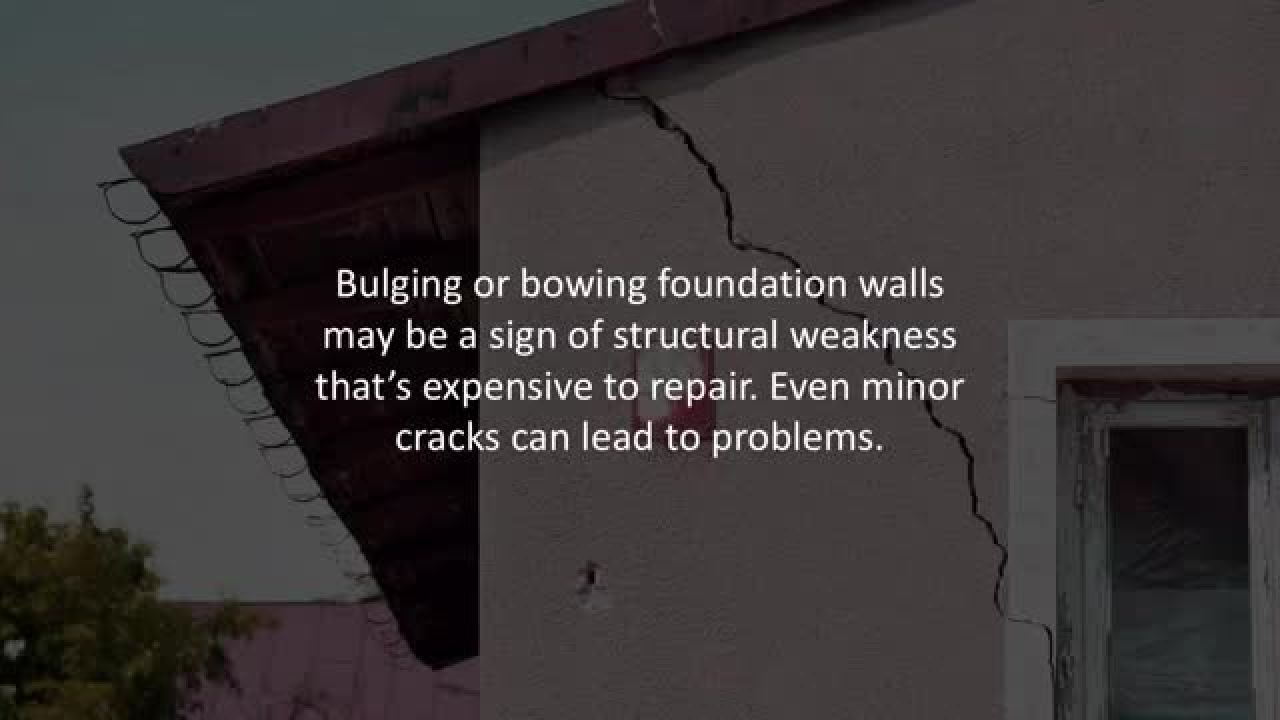

Ok, today we are going to talk about 5 things to look for and be aware of if they get noted in your home inspection… As any good Realtor will advise you, don’t even think about buying a house without a home inspection. Before you get emotionally attached to a home, invest a few hundred dollars in a thorough, professional home inspection. And if your report includes any of the following issues, consider walking away. Here are 5 home inspection red flags… If you're looking for a top-notch mortgage professional in Toronto, call us at (866) 492-4024.