Mortgage

Ok, today we are going to talk about 3 important steps every borrower should know (and take) before applying for a mortgage… Buying a home and applying for a mortgage—especially if you’ve never done it before—can be scary and complicated. There are so many things to consider. Here are 3 important steps to take when applying for a mortgage… If you are looking for a top-notch loan originator in Ardmore, call us at 580-579-9952.

Ok, today we are going to talk about when an all-cash offer is the right move… Surprisingly, lots of people make all-cash offers on houses. According to one study, up to 29% of single-family home and condo purchases in 2017 were all-cash. Here are the advantages and disadvantages to purchasing a home with all cash… If you are looking for a top-notch loan originator in Ardmore, call us at 580-579-9952.

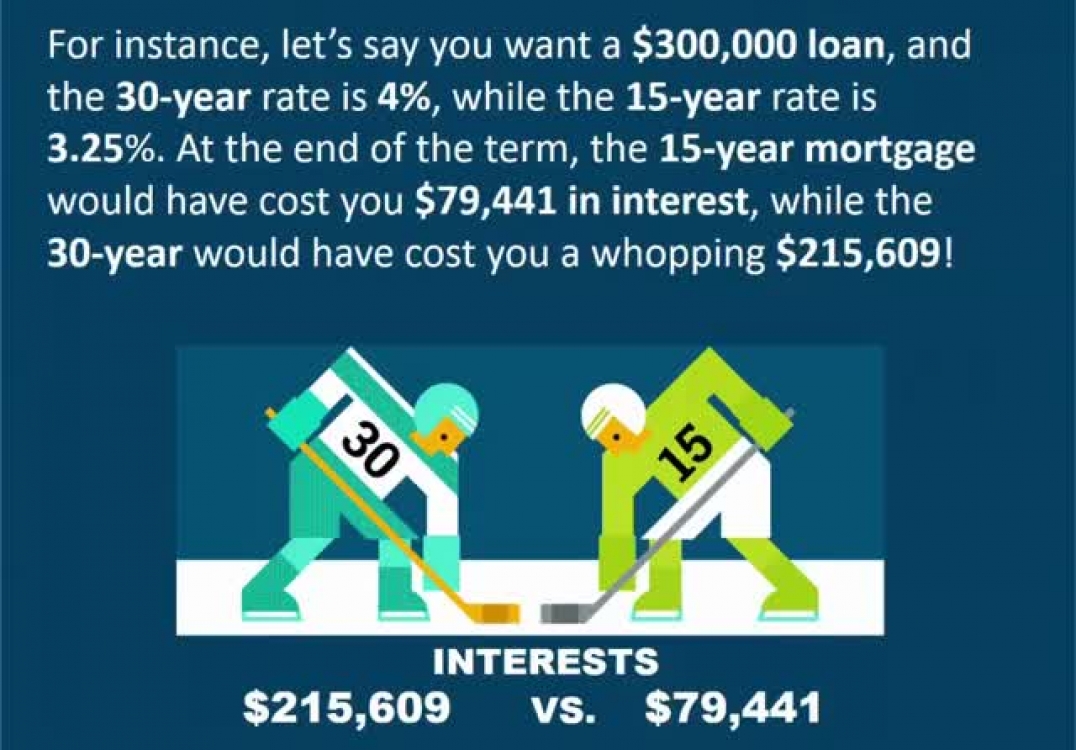

OK, today we’re going to talk about the BIG “A” word… AMORTIZATION that is! The length of time it takes you to pay off your entire mortgage is called the amortization. But don’t fall prey to the misconception that a longer amortization is better. In most cases, the opposite is true. Here’s what every homeowner needs to know…. If you are looking for a top-notch loan originator in Ardmore, call us at 580-579-9952.

OK, let's talk about your retirement for a moment... It’s easy to assume there’s an endless list of things standing between you and a secure retirement, including volatile stock markets, stagnant household income, adult children living at home, etc. But in reality, none of those things are as destructive to your retirement savings as what I'm about to show you next... Here are 3 threats to a secure retirement... If you are looking for a top-notch loan originator in Ardmore, call us at 580-579-9952.

Ok, today we are going to talk about 4 home improvement jobs that are difficult to do yourself. Doing home improvement projects yourself can save a lot of money and provide a sense of accomplishment. But some DIY projects can go terribly wrong, leading to wasted time, extra expenses, and friction between loved ones. Here are 4 home improvement projects that are risky to take on yourself. If you're looking for a top-notch mortgage advisor in Valparaiso, call us at (219) 286-2211.

Please forward this to anyone you care about who has filed for bankruptcy... Many Canadians find themselves bogged down with a bad credit rating for the wrong reason -- illness, losing a job, or simply not understanding consumer credit. Sometimes bad financial situations happen to good people and bankruptcy is the only way out. But it's not all doom and gloom -- there are a number of strategies for putting your credit back on track and getting approved for a mortgage, even after bankruptcy. Going from one financial institution to the next, only to be declined again and again can be very frustrating, which is where an experienced mortgage consultant on your side can make all the difference. Here are 10 factors to consider... If you are looking for a top-notch loan originator in Ardmore, call us at 580-579-9952.

Buying your first home isn’t as simple as visiting a few realtor open houses. What you do before you start shopping can help ensure you make a decision you can comfortably live with for years! Here are 3 essential steps to take before going home shopping… If you are looking for a top-notch loan originator in Ardmore, call us at 580-579-9952.

Ok, today we are going to talk about how Airbnb income will help you qualify for mortgage refinancing… Are you renting your home through Airbnb? Or ever thought about it? You might after you read about some of the perks you can get when it comes to refinancing or qualifying for a second mortgage. Here are 7 tips for using Airbnb income when applying for a mortgage… If you are looking for a top-notch loan originator in Ardmore, call us at 580-579-9952.

Ok, today we are going to talk about three easy, but crucial repairs you must make before selling your home. Making your house as presentable as possible is the best way to achieve a quick and profitable sale. However, you don’t have to make expensive repairs that will force you to raise your asking price. Often, inexpensive but highly-noticeable improvements—combined with good staging—will get you the buyers and sale you want. Here are the 3 most important things to fix before listing your home… If you are looking for a top-notch loan originator in Ardmore, call us at 580-579-9952.

To ensure your long-term financial security, it's essential to develop an effective financial plan, retirement strategy and investment portfolio. Since most people don't have the skills required to do this, here are 7 tips for choosing the right financial planner... If you are looking for a mortgage advisor in Houston, call us at 830-313-5500

Have you ever wondered when the best time of the year is to do home renovations? Deciding when to start a remodeling project may simply depend on when you need it finished. But if you have a little leeway, here are some considerations that can make the process easier and more affordable… If you are looking for a mortgage advisor in Houston, call us at 830-313-5500

Ok, today we are going to talk about 5 ways you can win the bidding war… If you’re house shopping in a competitive market, you’re likely to encounter a bidding war. Unfortunately, bidding wars can be frustrating, expensive and time consuming. However, it’s still possible to get the house you want. Here are 5 ways to win a bidding war… If you are looking for a mortgage advisor in Houston, call us at 830-313-5500

OK, today we’re going to talk about the amazing philosophy of ants… Yeah, that’s right ants. Ants are amazing creatures. For instance, some ants can carry 50 times their own weight! Even more amazing: ants are experts in philosophy. While the great ant philosophers didn’t write any books, we can still learn about their wisdom by observing their actions. Here are 4 ant philosophies that can help us succeed in life… If you are looking for a mortgage advisor in Houston, call us at 830-313-5500

Have you ever wondered when the best time of the year, month and week is, to list and sell your home – FAST! – for top dollar? Watch this short video to find out… If you are looking for a mortgage advisor in Houston, call us at 830-313-5500

If and when you decide to sell your home, pricing it right is always a key factor to selling it fast for top dollar. Today we’re going to talk about when it might make sense to lower your listing price. Here are 3 factors to consider before you drop your asking price… If you are looking for a mortgage advisor in Houston, call us at 830-313-5500

Question for you... Are you curious what your home is worth in today’s market? Here’s the most accurate way to find out… If you are looking for a mortgage advisor in Houston, call us at 830-313-5500

OK, today we’re going to talk about why most people stay stuck in debt… Being deep in debt can make your life a nightmare, put your family at risk and make your future look hopeless. So why do so many people stay in debt when there are proven ways to put yourself back on a firm financial footing? Here are the Top 5 reasons… If you are looking for a mortgage advisor in Houston, call us at 830-313-5500

Thanks to aging Baby Boomers, the market for vacation properties is hotter than ever. But before you start shopping, here are some things to consider... If you are looking for a mortgage advisor in Houston, call us at 830-313-5500

OK, today we’re going to have some REAL TALK about credit cards… Yes, they’re convenient. Yes, they’re sometimes necessary. However, with the average household debt growing year after year (with no end in sight), it’s mission critical that we manage our credit cards effectively. Easier said than done. Here’s the truth about credit cards every homeowner needs to know… If you are looking for a mortgage advisor in Houston, call us at 830-313-5500

Ok, today we are going to talk about how to profit the most from your tax refund… Like millions of other taxpayers, you may have received a refund this year. So what now? How will you spend that money? Here are a few SMART ways to use your tax refund… If you are looking for a mortgage advisor in Houston, call us at 830-313-5500