Hipoteca

Ok, today we are going to talk about when and how it might make sense to responsibly charge your home renovation project to your credit card According to a recent report, about one third of homeowners charge at least part of their home renovations to a credit card. In some instances, this can be a good option.Here are a few important tips to consider before using your credit card to pay for a home reno… If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

When choosing a mortgage, most Canadians choose a 5-year fixed-rate.But just because fixed-rate mortgages are most popular, doesn’t mean they’re necessarily a good fit for you.Here are a few things you need to know about fixed-rate mortgages…If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

How can you to have a happy and fulfilled retirement? If you believe the ads, you might think all you need is money. A big retirement account and you’ll be set!Sure, having enough money to live comfortably is important, but there are so many other things that are just as important. Here are 5 steps to a happy retirement… If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

Ok, today we are going to talk about flood insurance and how this could protect your home…As climate change progresses, flooding is becoming more common in all parts of Canada.Historically, overland flood insurance, as opposed to water damage coverage, hasn’t been available. But after some very expensive major floods, insurance companies are now offering policies that cover flooding caused by rainfall and overflowing bodies of water. Here are 5 things you need to know about flood insurance… If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

As you know, there are loads of credit card options out there. Credit cards that let you earn travel miles, merchandise or cash back can be a good deal. However, to get the most out of a rewards credit card, you have to be strategic. Here are 5 ways to make your rewards credit cards more rewarding… If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

Ok, today we are going to talk about how to rebuild your finances if you’ve suffered from financial abuse… Being in an unhealthy relationship could be emotionally, physically, or even financially damaging.And according to recent statistics, 99% of domestic violence also includes financial abuse. Here’s what to do if you’re in a financially abusive situation, or if you’re recovering from one… If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

Ok, today we are going to talk about what you should and should not fight the buyer on after your home inspection… Buying a home involves a lot of give and take. Sometimes, though, buyers are tempted to insist that minor inspection findings be addressed. Unfortunately, this can be a bad idea both for the deal and your future satisfaction. Here’s what NOT to fight for after your home inspection… If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

Ok, today we are going to talk about how to finance a new home build…If you’re looking for a home that offers the latest energy efficiencies, low maintenance costs, and every amenity and convenience your family desires, maybe you should consider building new. Just keep in mind that financing new construction is a little more complicated. Here’s what you need to know… If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

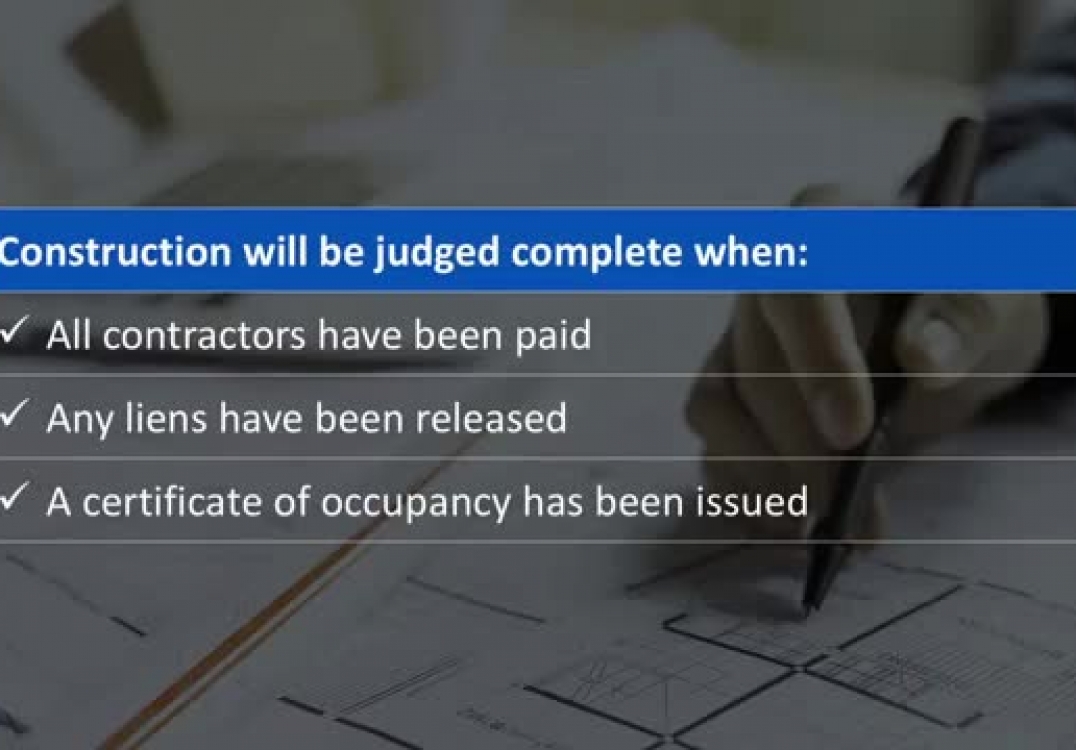

Ok, today we are going to talk about how to convert a construction loan into a traditional mortgage…If you’re planning to build a house or do a major renovation, you usually can’t qualify for a traditional mortgage because there’s no existing home to use as collateral. What you need is a construction loan, which is based on the projected future value of the completed property. Generally, construction loans are interest-only while the house is being built. Then when construction is complete, you refinance into a regular mortgage.Here’s how the process works… If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

Ok, today we are going to talk about how to throw the perfect backyard party this summer.Having the party in the backyard will simplify house cleaning and menu planning.Here’s how to pull it all together in 10 simple steps… If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

Did you know there are ways you can cut down the cost of your mortgage when buying your next home? Here are 3 ways to cut mortgage costs… If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

Ok, today we are going to talk about how you can use your cell phone bill to increase your credit score.As with most credit contracts, your monthly cellphone bill can show up on your credit report. Here are 3 steps to using your cell phone bill to get a higher credit score… If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

Ok, today we are going to talk about what cash reserves are and why you need them to buy a home…When buying a house, most people only think about saving enough to cover a down payment and closing costs. But lenders like to see more than that. Borrowers who have additional “cash reserves” are considered lower risk and are more likely to be approved for financing at the lowest possible rate.So, what are “cash reserves” and how can they benefit you? Take a look… If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

British Columbia Mortgage Broker reveals Pros and cons for buying an existing house vs building new…

Ok, today we are going to talk about the pros and cons for buying a house verses building new…Deciding whether to buy an existing house or build a brand new one can be complicated. There are so many factors to consider. Here’s a list of pros and cons for both building new and buying an existing home… If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

Ok, today we are going to talk about 4 ways to avoid becoming “house-rich” and “cash-poor”…Being “house-rich, cash-poor" means you have all your money tied up in your house, with little left over for day-to-day expenses. You may be living in a nice home, but it feels like you’re living in poverty! Either way, you’re left with significant mortgage expenses and little cash to cover them.Here are 4 ways to avoid becoming “house-rich, cash-poor”… If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

Ok, today we are going to talk about three things you need to know before you borrow from your home equity…Accessing your home equity through a home equity line of credit (HELOC) or cash-out refinance can be an affordable way to pay for renovations or education. Here are 3 things you need to know before applying for a HELOC…If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

We’ve all heard the stories of massive cost overruns, missed deadlines, shoddy work. No wonder so many people are afraid of renovations. But avoiding such nightmares isn’t difficult. All you have to do is some upfront legwork.Here are 4 things you can do to avoid renovation nightmares… If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

Buying a home in a new real estate development can be exciting! However, there are important things to be aware of before you sign the contract. There’s nothing like turning the key on a brand-new home that’s never been lived in. But buying in new a real estate development isn’t the same as buying an existing house. Here are 5 tips for buying in new real estate development…If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

Ok, today we are going to talk about when an all-cash offer is the right move…Surprisingly, lots of people make all-cash offers on houses.According to one study, up to 29% of single-family home and condo purchases in 2017 were all-cash. Here are the advantages and disadvantages to purchasing a home with all cash… If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.

Ok, today we are going to talk about the important questions you need to consider before refinancing your mortgage…When interest rates drop, it makes refinancing your mortgage a tempting proposition. But is it worth it? Here are 4 critical questions to ask before you refinance… If you're looking for a top-notch Mortgage Broker in Greater Vancouver, Fraser Valley and Whistler, BC/Canada, call us at (778) 878-5350.