Mortgage

Ok, today we are going to talk about how you can buy a home without visiting it in person… Today, more buyers are making offers on homes sight unseen. Reasons for this could include: • Being too busy for physical shopping • Living on the other side of the country • Feeling totally comfortable with online purchases • Preferring the safety of physical distance Here are 6 tips for buying a house sight unseen… If you are looking for a top-notch mortgage consultant in Plymouth call us at, 612-799-1909

Ok, today we are going to cover 5 tips for buying a condo… Millions of people have either decided that condo living suits their budget and lifestyle better than single-family homeownership, or they purchase condos as an investment, second home, or vacation property. There are important differences between buying a home and buying a condo. So, before you make an offer… Here are 5 tips for buying a condo… If you are looking for a top-notch mortgage consultant in Plymouth call us at, 612-799-1909

Ok, today we are going to talk about the pros and cons for buying a house verses building new… Deciding whether to buy an existing house or build a brand new one can be complicated. There are so many factors to consider. Here’s a list of pros and cons for both building new and buying an existing home… If you are looking for a top-notch mortgage consultant in Plymouth call us at, 612-799-1909

Ok, today we are going to talk about why you need homeowner’s insurance and how it keeps you protected… Homeowner’s insurance is an important and required part of home ownership. Here are the 3 main reasons why you need homeowner’s insurance… If you are looking for a top-notch mortgage consultant in Plymouth call us at, 612-799-1909

Ok, today we are going to talk about how to save money renovating your home… Renovating can add comfort, convenience and value to your home. But renovations are often pricey. Here are 5 tips for updating your home without blowing your budget…If you are looking for a top-notch mortgage consultant in Plymouth call us at, 612-799-1909

Ok, today we are going to talk about how to save money on home insurance… Insurance is absolutely essential to home ownership. You have to be confident that your investment and your family are adequately protected. However, there’s no reason to pay more for home insurance than you have to. Here are 7 ways to save money on home insurance…If you are looking for a top-notch mortgage consultant in Plymouth call us at, 612-799-1909

Ok, today we are going to talk about what to be aware of before moving from the city to the suburbs… For the young and single, the inner city has strong appeal. But as soon as there are kids, many couples are drawn to the suburbs. Less crowds and more open spaces become more enticing. If you don’t want to sacrifice quality of life, choose the suburb carefully. Here are 4 pitfalls to avoid when moving from the city to the suburbs… If you are looking for a top-notch mortgage consultant in Plymouth call us at, 612-799-1909

Ok, today we are going to talk about 5 things you need to know about foreclosures… Heaven forbid, you get several months late on mortgage payments, your lender’s last resort is to initiate foreclosure. This is a lengthy and expensive process for your lender, but its impact on you can be even more negative. Here’s 5 facts you need to know about the foreclosure process… If you are looking for a top-notch mortgage consultant in Plymouth call us at, 612-799-1909

Ok, today we are going to talk about 5 simple things you can do to your home to instantly boost the price when it hits the market… You don’t have to hire a professional stager to prepare sell your home. With a little guidance from a Realtor and a few simple touches, your home’s value can increase instantly. Here are 5 things you can do that can help you boost your asking price… If you are looking for a top-notch mortgage consultant in Plymouth call us at, 612-799-1909

Ok, today we are going to talk about 4 ways to improve technology throughout your home… With growing numbers of us working and learning from home, it’s more essential now than ever before that our homes can accommodate modern technologies. Whether you’re looking to update your home, or on the market for a new home, there are a few things to do and look for to update your home. Here are 4 ways to give your home a tech tune up… If you are looking for a top-notch mortgage consultant in Plymouth call us at, 612-799-1909

Ok, today we are going to talk about how to start investing… Obviously, there are several things to take care of before you can start investing. You need to cover rent or mortgage payments, monthly bills, groceries, etc., and you also need some money set aside for emergencies. But once you’ve accomplished that, it’s time to start investing for the future. Here are 5 steps to help you start investing…If you are looking for a top-notch mortgage consultant in Plymouth call us at, 612-799-1909

Ok, today we are going to talk about how much home renovations can cost… Renovations can help make your home more comfortable and easier to sell. But depending on what you’re planning, they can also be expensive. To help you budget for your next project, the HomeAdvisor website has published a list of typical costs for renovation projects. Here’s a list of the most common renos and how much they cost…If you are looking for a top-notch mortgage consultant in Plymouth call us at, 612-799-1909

Ok, today we are going to talk about how to pay off your credit card so you can live a stress-free future… If you’re like most people, emergencies, illnesses, job losses or more can put a dent in your credit cards. To make matters worse, most credit cards have high interest rates that make them difficult to pay off. But paying off your cards is exactly what you need to do to achieve a secure and stress-free financial future. Here are 6 tips for paying off your credit cards…If you are looking for a top-notch mortgage consultant in Plymouth call us at, 612-799-1909

Ok, today we are going to talk about an important thing you should do before you buy in an area… test drive the neighbourhood! You wouldn’t think of buying a car without driving it first. And buying new shoes usually involves wearing them around the store a couple of times. So how do you know you’ll actually like the neighbourhood you’re considering, unless you try it out? Here are 4 ways to test drive a neighbourhood…If you are looking for a top-notch mortgage broker in St George call us at, 801-577-9231

Ok, today we are going to talk about 5 things to look for and be aware of if they get noted in your home inspection… As any good Realtor will advise you, don’t even think about buying a house without a home inspection. Before you get emotionally attached to a home, invest a few hundred dollars in a thorough, professional home inspection. And if your report includes any of the following issues, consider walking away. Here are 5 home inspection red flags…If you are looking for a top-notch mortgage broker in St George call us at, 801-577-9231

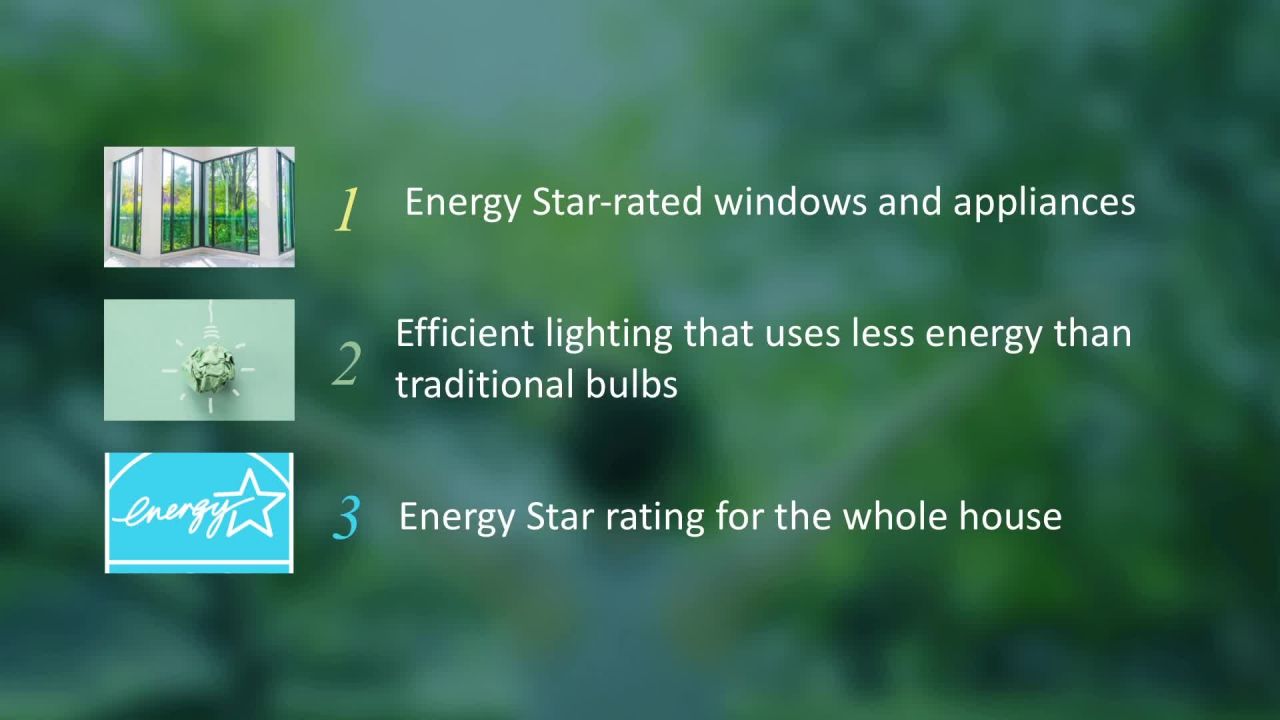

Ok, today we are going to talk about the top three green features buyers look for in a house… Are you looking to make upgrades to your home to make it more energy efficient? Wondering what to invest in that will help with resale? As concern for the environment continues to grow, today’s homebuyers are increasingly looking for green options. Here are the top 3 green features buyers are looking for…If you are looking for a top-notch mortgage broker in St George call us at, 801-577-9231

Ok, today we are going to talk about 3 things you need to do before house hunting… Finding for your dream home is a lot easier if you get your finances in shape before you start looking. If you’re thinking about buying within the next year, now’s the perfect time to start preparing. Here are the first 3 steps to take before house hunting…If you are looking for a top-notch mortgage broker in St George call us at, 801-577-9231

Ok, today we are going to talk about an important thing you should do before you buy in an area… test drive the neighbourhood! You wouldn’t think of buying a car without driving it first. And buying new shoes usually involves wearing them around the store a couple of times. So how do you know you’ll actually like the neighbourhood you’re considering, unless you try it out? Here are 4 ways to test drive a neighbourhood… If you are looking for a top-notch mortgage expert in Midland call us at, 432-203-5941

Ok, today we are going to talk about 5 things to look for and be aware of if they get noted in your home inspection… As any good Realtor will advise you, don’t even think about buying a house without a home inspection. Before you get emotionally attached to a home, invest a few hundred dollars in a thorough, professional home inspection. And if your report includes any of the following issues, consider walking away. Here are 5 home inspection red flags… If you are looking for a top-notch mortgage expert in Midland call us at, 432-203-5941

Ok, today we are going to talk about the top three green features buyers look for in a house… Are you looking to make upgrades to your home to make it more energy efficient? Wondering what to invest in that will help with resale? As concern for the environment continues to grow, today’s homebuyers are increasingly looking for green options. Here are the top 3 green features buyers are looking for… If you are looking for a top-notch mortgage expert in Midland call us at, 432-203-5941