Concept Mortgage

|Подписчики

Последние видео

I have a question for you. How would you like it if your company could provide you with an exclusive Employee Mortgage Benefits Program that allowed you to $AVE BIG when buying, selling and refinancing your home? Here's a short video that explains how the program works. If you're looking for a top-notch Loan Officer in Watsonville, call us at (831) 535-3954.

Ok, today we are going to talk about some important things to consider before downsizing your home. In 1950, the average single-family home in the US was 1,000 square feet, and today it’s 2,600 square feet. The difference is even more dramatic when you consider how much larger families were in the 1950s! Some find themselves living in unnecessarily large homes, which leaves room for downsizing and saving. But before you rush in to selling and buying small, here are5 things to consider before downsizing. If you're looking for a top-notch Loan Officer in Watsonville, call us at (831) 535-3954.

Are you considering buying a new home or investment property in the near future? If so, saving a down payment can be a challenge. But think of it this way: if you can discipline yourself to regularly set aside funds until you have a down payment, you’ll probably have no trouble making your mortgage payments. Here’s how to get started. If you're looking for a top-notch Loan Officer in Watsonville, call us at (831) 535-3954.

OK, here's what you need to know about dividend stocks. When a corporation earns a profit, that money can either be re-invested in the business or paid to shareholders as a dividend. Many corporations keep a portion of their earnings and pay the rest as a dividend. Since dividend stocks offer regular dividends as well as long-term equity growth, are they a better investment? Like so many questions related to investing, the answer is "yes" and "no". Here are some factors to consider. If you're looking for a top-notch Loan Officer in Watsonville, call us at (831) 535-3954.

Do you or anyone you know have mounting high-interest debt? There are few things in life that can cause more stress and strife than debt -- especially if you don't see a way out! In today's video, you'll learn how to escape debt prison... FAST. If you have $10K+ in consumer debt, this video is for you. If you're looking for a top-notch Loan Officer in Watsonville, call us at (831) 535-3954.

How's this for a new perspective. Rather than seeing your debts as a problem, what if they could be an opportunity? With a little knowledge, ingenuity and discipline you can transform those debts into wealth! Here are 6 Tips to Shift from Debt to Financial Freedom. If you're looking for a top-notch Loan Officer in Watsonville, call us at (831) 535-3954.

Ok, today let's talk about debt and, more importantly, how to get out of it. Nobody sets out to get deep in debt. It just seems to happen to some people and not to others. Here are 7 traits of debt-free people that set them apart from everyone else. If you're looking for a top-notch Loan Officer in Watsonville, call us at (831) 535-3954.

Ok, today we are going to talk about how you can use your cell phone bill to increase your credit score. Experian started adding cellphone and utility payments to credit reports. While this may sound insignificant, the new data could boost credit scores and increase loan approvals for millions of people. Here are 4 steps to using your cell phone bill to get a higher credit score. If you're looking for a top-notch Loan Officer in Watsonville, call us at (831) 535-3954.

Ok, today we are going to talk about when and how it might make sense to responsibly charge your home renovation project to your credit card. According to a recent report, about one third of homeowners charge at least part of their home renovations to a credit card. In some instances, this can be a good option. Here are a few important tips to consider before using your credit card to pay for a home reno. If you're looking for a top-notch Loan Officer in Watsonville, call us at (831) 535-3954.

It’s easy for some people to be pessimistic about retirement. With kids to put through school, a mortgage to pay off, the rising cost of everything and growing credit card debt, many people ignore retirement planning and hope for the best. Even if you’ve already started saving, it’s hard to be confident when stock markets are volatile and interest rates are low. But believe it or not, there’s a large group of retirees who are feeling fine about retirement. Here are 5 habits of confident retirees. If you're looking for a top-notch Loan Officer in Watsonville, call us at (831) 535-3954.

If you have kids and/or nephews or nieces, today's video is especially for you. According to SavingForCollege.com, the cost of a four-year public university education (for in-state residents, excluding housing and supplies), is projected to be $95,000 by the time today's newborns graduate from high school. But if you start planning while your kids are young, the costs can still be affordable. Plus, you'll save them from being burdened with thousands of dollars in student loan debt! Here are a few ways to start saving. If you're looking for a top-notch Loan Officer in Watsonville, call us at (831) 535-3954.

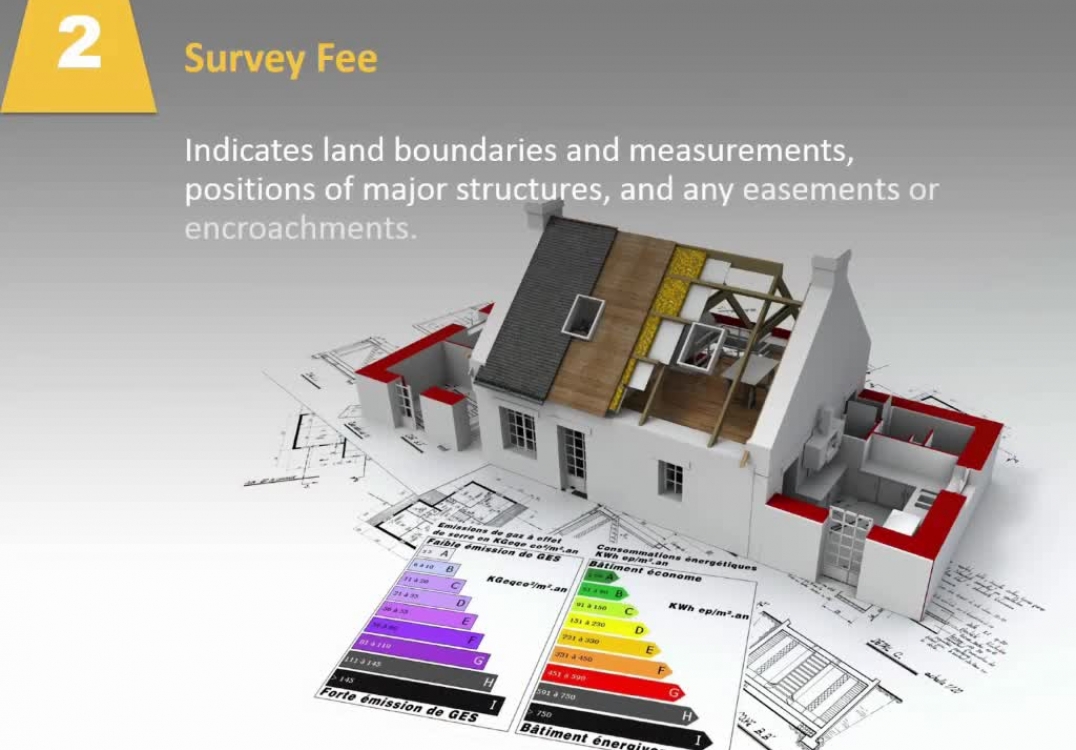

Thinking about buying a property any time soon? If so, here are the closing costs to be aware of before you buy (so you don’t have any unwanted surprises). If you're looking for a top-notch Loan Officer in Watsonville, call us at (831) 535-3954.

I'm not a financial advisor, nor am I an expert in investing, but in these turbulent economic times it's more important than ever to discuss this important and controversial topic. Even today, both mutual funds and real estate still offer investment potential. Wondering which is better? Here are a few things to consider. If you're looking for a top-notch Loan Officer in Watsonville, call us at (831) 535-3954.

As you may know, credit reporting agencies collect all the data on your loans, lines of credit and credit cards to create your credit report and calculate your credit score. This information is then used by lenders—including mortgage lenders—to determine whether you’re a good credit risk. What many people don’t realize is that cellphone bill payments can also have an effect on credit rating. Here's how your cell phone impacts your credit. If you're looking for a top-notch Loan Officer in Watsonville, call us at (831) 535-3954.

Are you considering buying a new home or investment property in the near future? Buying a home is a major investment no matter how you look at it. But for many homebuyers, it's even more complicated and costly than it needs to be because of blind spots where they are lacking critical information--information that can literally make or break their chances of buying their dream home or add tens of thousands of dollars in unnecessary costs or countless hours wasted in fruitless activity. It's crazy! Homebuyers are, in many cases, making the biggest investment of their lives without any step-by-step roadmap for success. In response to this obvious need, we've decided to create a brand new homebuyer guide titled, "15 Homebuyer Mistakes And How To Avoid Them". We don't have time to get into all fifteen of them now, but here's one BIG mistake you MUST avoid. If you're looking for a top-notch Loan Officer in Watsonville, call us at (831) 535-3954.

Have you ever wondered how some people can have big incomes but they still stay stuck in the rat race with little money left over at the end of the month? Yes, chances are they have a spending problem. But there's something even deeper at play that most people don't realize. Here's one of the many important financial lessons we should be taught in school but aren't. If you're looking for a top-notch Loan Officer in Watsonville, call us at (831) 535-3954.

Before you consider refinancing your existing mortgage, it’s important for you to determine the break-even point, which represents how soon the cost of the refinance will

be recaptured through lower monthly payments. The answer to this question depends on multiple factors. Here's what you need to know before refinancing. If you're looking for a top-notch Loan Officer in Watsonville, call us at (831) 535-3954.

We’ve all heard about the wealth accumulation rule called “pay yourself first”. But billionaire Sir John Templeton had an even more powerful idea called the 50/50 rule. Here's the Billionaire Wealth Secret. If you're looking for a top-notch Loan Officer in Watsonville, call us at (831) 535-3954.

Before you consider refinancing your existing mortgage, it's important for you to determine the break-even point, which represents how soon the cost of the refinance will

be recaptured through lower monthly payments. The answer to this question depends on multiple factors. See the factors here. If you're looking for a top-notch Loan Officer in Watsonville, call us at (831) 535-3954.

Choosing the best mortgage from all the available lenders out there can be complicated. There are so many terms, features, restrictions and potential penalties to keep in mind. But at least mortgage rates are easy to compare—all you have to do is choose the lowest one, right? Think again! Choosing the lowest rate is only straightforward if all the rates are stated the same way and include the same things. Here are a few "insider secrets" you need to be aware of. If you're looking for a top-notch Loan Officer in Watsonville, call us at (831) 535-3954.