Eni O'Donnell Mortgage

|Abonnenten

Neueste Videos

Choosing the best mortgage from all the available lenders out there can be complicated. There are so many terms, features, restrictions and potential penalties to keep in mind. But at least mortgage rates are easy to compare—all you have to do is choose the lowest one, right? Think again! Choosing the lowest rate is only straightforward if all the rates are stated the same way and include the same things. Here are a few "insider secrets" you need to be aware of. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

San Diego Mortgage Advisor reveals 5 ways to qualify for a mortgage (even if you have less than perf

Ok, today we are going to talk about how to buy a home, even if you have bad credit. Obviously, if you have good credit, it’s easier to qualify for a mortgage. But that doesn’t mean home ownership is out of reach if you have bruised credit. Here are 5 ways to qualify for a mortgage (even if you have less than perfect credit). If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

Ok, today we are going to talk about 4 ways to sell your house quick, without compromising on a fair price. In most markets, spring is the #1 time of year for selling homes and fall comes in at #2. But no matter when you’re planning to sell your home, don’t despair! Here are 4 ways to sell your house quickly. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

Ok, today we are going to talk about 4 ways to get the lowest possible refinance rate. If you’re thinking about refinancing, there are ways to make your rate even lower than you think. Here are 4 ways to make sure you get the lowest possible refinance rate. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

Ok, today we are going to talk about how to throw the perfect backyard party this summer. Having the party in the backyard will simplify house cleaning and menu planning. Here’s how to pull it all together in 10 simple steps. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

Ok, today we’re going to talk about how to keep your kids’ out of debt. The last time I checked, the average student’s debt is currently almost $30,000, and it’ll be even higher by the time your kids graduate! The truth is most young people—and often their parents—can’t afford that kind of debt, so it ends up damaging their credit rating and ability to buy a house and raise a family. Of course, the best way to prevent such problems is to avoid massive student debt in the first place. Here are 5 tips to avoid student loan debt. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

Ok, today we are going to talk about the pros and cons of house flipping. It’s possible to make a lot of money by flipping properties. But it’s not as easy as it sounds, and there are just as many pitfalls as there are rewards. Here are 4 pros and cons of house flipping. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

Ok, today we are going to talk about 4 home improvement jobs that are difficult to do yourself. Doing home improvement projects yourself can save a lot of money and provide a sense of accomplishment. But some DIY projects can go terribly wrong, leading to wasted time, extra expenses, and friction between loved ones. Here are 4 home improvement projects that are risky to take on yourself. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

We’ve all heard the stories of massive cost overruns, missed deadlines, shoddy work. No wonder so many people are afraid of renovations. But avoiding such nightmares isn’t difficult. All you have to do is some upfront legwork. Here are 4 things you can do to avoid renovation nightmares. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

OK, we’re going to talk about a simple – yet profound – principle that can transform your health and your wealth over time. It’s called the “apple-a-day” principle. Here’s how it works. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

Ok, today we are going to talk about the pros and cons of house flipping. It’s possible to make a lot of money by flipping properties. But it’s not as easy as it sounds, and there are just as many pitfalls as there are rewards. Here are 4 pros and cons of house flipping. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

OK, today we’re going to talk about how to get SMART with MONEY. If you’re like most people, you spend a lot of time worrying about money. But worry only makes things worse. Here are 4 common money challenges (and ways to take the worry out of them). If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

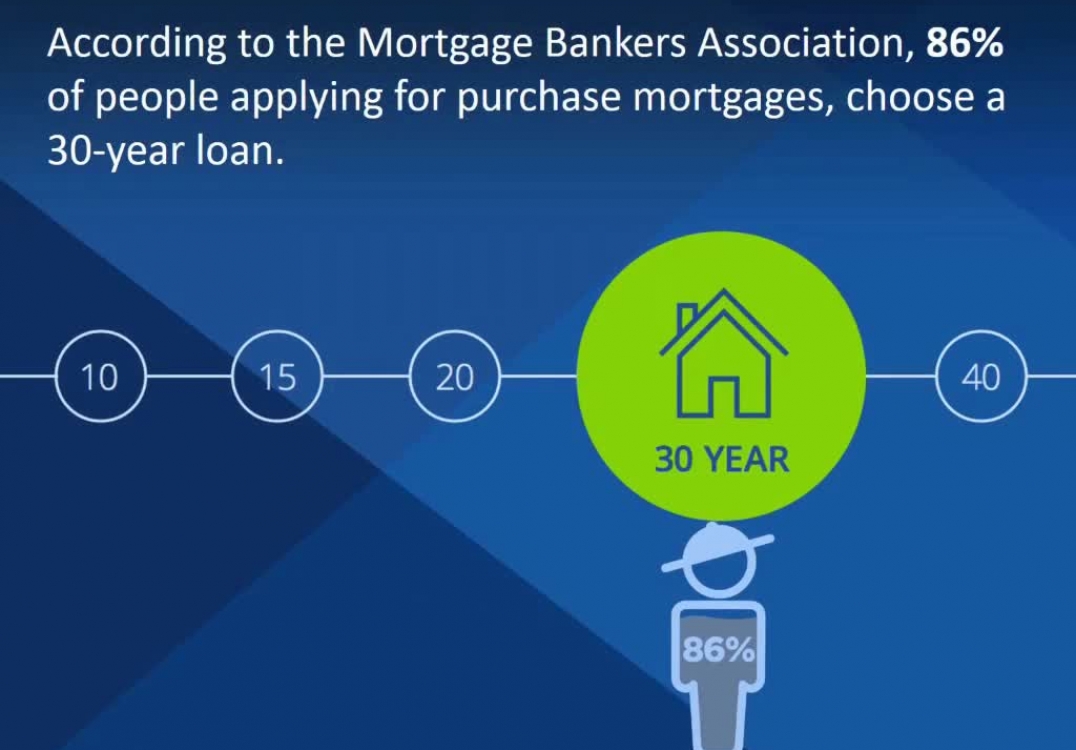

OK, today we’re going to talk about the BIG “A” word… AMORTIZATION that is! The length of time it takes you to pay off your entire mortgage is called the amortization. But don’t fall prey to the misconception that a longer amortization is better. In most cases, the opposite is true. Here’s what every homeowner needs to know. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

Ok, today we are going to talk about when an all-cash offer is the right move. Surprisingly, lots of people make all-cash offers on houses.According to one study, up to 29% of single-family home and condo purchases in 2017 were all-cash. Here are the advantages and disadvantages to purchasing a home with all cash. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

OK, let's talk about your retirement for a moment. It’s easy to assume there’s an endless list of things standing between you and a secure retirement, including volatile stock markets, stagnant household income, adult children living at home, etc. But in reality, none of those things are as destructive to your retirement savings as what I'm about to show you next. Here are 3 threats to a secure retirement. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

Ok, today we are going to talk about 3 important steps every borrower should know (and take) before applying for a mortgage. Buying a home and applying for a mortgage—especially if you’ve never done it before—can be scary and complicated. There are so many things to consider. Here are 3 important steps to take when applying for a mortgage. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

Ok, today we are going to talk about how Airbnb income will help you qualify for mortgage refinancing. Are you renting your home through Airbnb? Or ever thought about it? You might after you read about some of the perks you can get when it comes to refinancing or getting a second mortgage. Here are 6 tips for using Airbnb income when applying for a mortgage. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

Please forward this to anyone you care about who has filed for bankruptcy. Many Americans find themselves bogged down with a bad credit rating for the wrong reason -- illness, losing a job, or simply not understanding consumer credit. Sometimes bad financial situations happen to good people and bankruptcy is the only way out. But it's not all doom and gloom -- there are a number of strategies for putting your credit back on track and getting approved for a mortgage, even after bankruptcy. Going from one financial institution to the next, only to be declined again and again can be very frustrating, which is where an experienced mortgage consultant on your side can make all the difference. Here are 10 factors to consider. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

Buying your first home isn’t as simple as visiting a few realtor open houses. What you do before you start shopping can help ensure you make a decision you can comfortably live with for years! Here are 3 essential steps to take before going home shopping. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.

Ok, today we are going to talk about three easy, but crucial repairs you must make before selling your home. Making your house as presentable as possible is the best way to achieve a quick and profitable sale. However, you don’t have to make expensive repairs that will force you to raise your asking price. Often, inexpensive but highly-noticeable improvements—combined with good staging—will get you the buyers and sale you want. Here are the 3 most important things to fix before listing your home. If you're looking for a top-notch mortgage advisor in San Diego, call us at (619) 797-6555.